- Equities remain on the back foot as key US data on the menu today

- ADP, jobless claims and ISM Services could prove market moving

- Dollar’s mixed performance continues, yen benefits

- OPEC+ production rumours fail to push oil prices higher

US Data Releases in the Spotlight

Equity markets continue to exhibit a rather unexpected fragility as second-tier data like Wednesday’s JOLTs job openings resulted in another negative session in most stock indices around the globe. This market behaviour is a product of Fed Chairman Powell’s decision to put more focus on the US labour market developments ahead of the September 18 Fed meeting.

The Nasdaq 100 index continues to lead the correction with Nvidia’s (NASDAQ:NVDA) woes overshadowing the overall AI frenzy. Interestingly, seasonality for September is rather negative for US stock markets, predominantly for the S&P 500 index, which means that the recent bearish pressure could persist further.

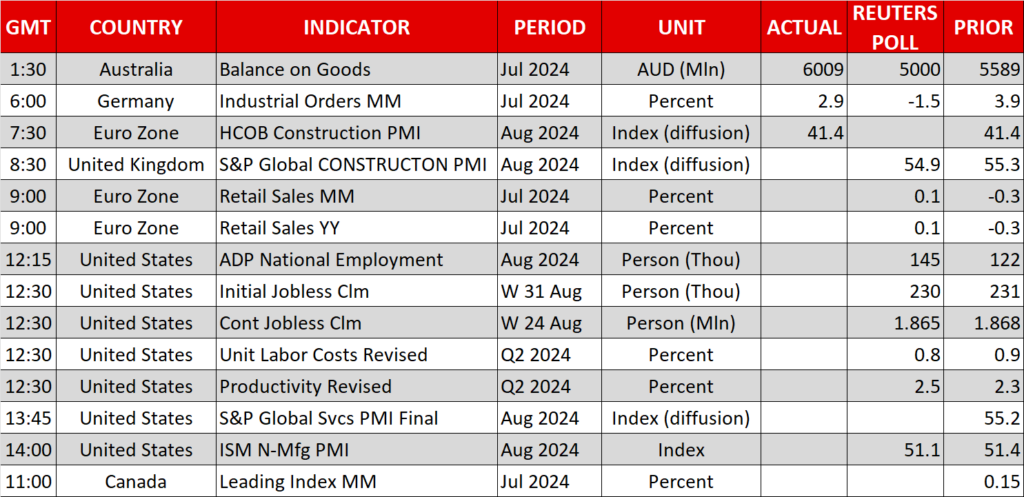

The focus today will remain on the US data calendar and particularly the labour market. The ADP employment report is expected to show a 145k increase with the market clearly paying extra attention to the weekly jobless claims and the Challenger job cuts print. In addition, the ISM Services survey could confirm expectations for a slowdown in the US economy despite the fact the tone of the latest Fed Beige Book was mostly positive.

However, the ISM Services employment subcomponent probably holds the stronger market-moving potential of today’s session as another strong print, matching the past months’ performance, could put a sizeable dent on market expectations for a 50bps rate cut on September 18. The crucial test though will be Friday’s non-farm payrolls figure.

Interestingly, most Fed easing cycles since 2000 started with a 50bps rate move. This could be seen as a signal that the Fed is ready to do whatever it takes to help the economy, with back-to-back rate cuts also high on the Fed’s action list.

Dollar has Mixed Performance this Week

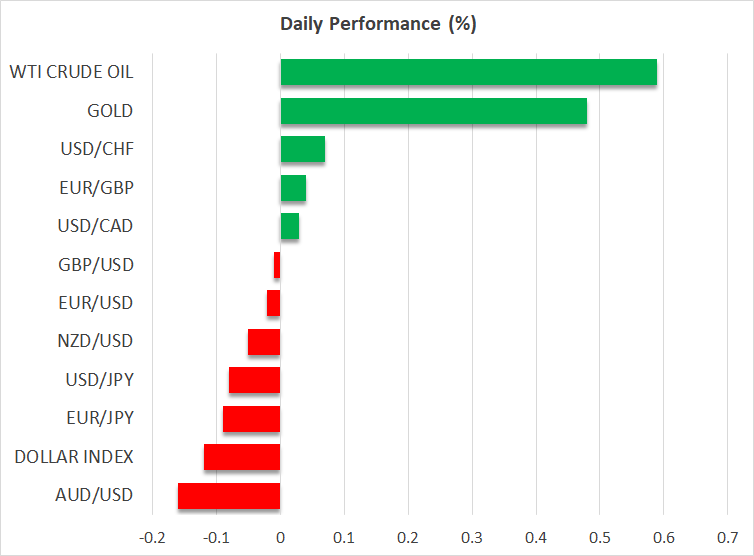

Amidst these developments, the US dollar’s performance has been mixed this week. It has been losing ground against both the euro and the pound but gaining versus risk-on currencies like the Aussie and the Kiwi. The former has failed to materially benefit from the hawkish RBA commentary with Governor Bullock’s comments earlier today confirming the August meeting’s message of very low appetite for rate cuts at this juncture.

On the flip side, the Japanese yen has been enjoying decent gains this week following a positive set of economic data releases that started last week with the stronger Tokyo inflation report for August and continued earlier today with the July labour cash earnings showing consistently strong growth. As a result, at the time of writing, dollar/yen is hovering a tad above the early August low of 141.67.

Oil has Been a Key Market Mover this Week

The continued underperformance of oil on the back of expectations for a larger-than-discussed production increase in October and fears for a global economic slowdown especially as China’s economic performance continues to disappoint, has alarmed the OPEC+ alliance.

There are reports that OPEC+ is considering postponing any decisions regarding production quotas until December at the ministerial meeting to be held in Vienna.

Oil prices remain under pressure with the crucial $70 level potentially attracting some buying interest.