Major EU and US stock indices were a sea of green yesterday, with NASDAQ being the main gainer as tech stocks were bought again. The Bank of Canada held its policy untouched as was expected and kept its statement language largely unchanged. As for today, the main event may be the ECB policy decision, with investors locking their gaze on any comments related to the euro’s latest rally to a two-year high.

Equities Rebound As Investors Buy Back Tech Stocks

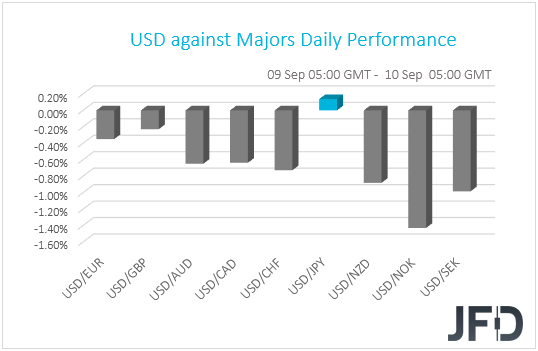

The US dollar traded lower against all but one of the other G10 currencies on Wednesday and during the Asian morning Thursday. It underperformed the most versus NOK, SEK, and NZD in that order, while it eked out some gains only against JPY.

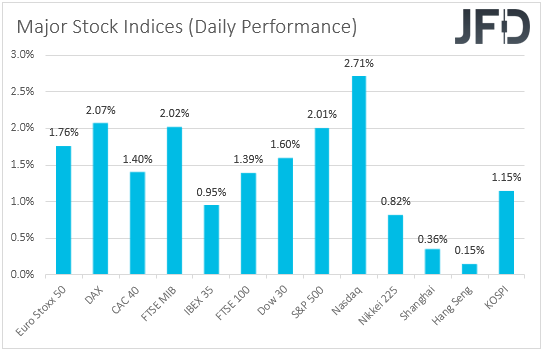

The weakening of the US dollar and the Japanese yen suggests that risk appetite returned into the markets yesterday. Indeed, shifting our attention to the equity world, we see that major EU and US indices were a sea of green, with Nasdaq being the main gainer as tech-related stocks were bought again.

Tesla (NASDAQ:TSLA) jumped 7.7%, while Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), and Amazon (NASDAQ:AMZN) rose by at least 4%.

Reports that AstraZeneca (NYSE:AZN) may resume its coronavirus vaccine trials next week may have also helped. The company had to pause trials after they identified side effects in a participant.

The upbeat morale, although softer, rolled over into the Asian session today as well. Japan’s Nikkei 225 gained 0.82%.

Although we saw decent chances for the latest correction to continue for a while more, yesterday’s rebound adds more credence to our view that another crash seemed unlikely. Remember, we noted that with major central banks and governments willing to do whatever it takes to support the global economy, we saw decent chances for equities to resume their uptrends in the not-too-distant future.

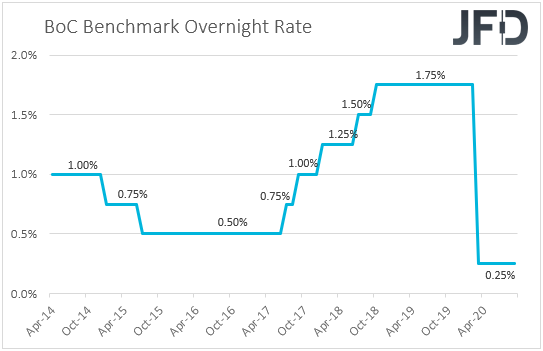

Apart from developments surrounding the broader market sentiment, we also had a Bank of Canada interest rate decision yesterday. As we expected, the Bank kept interest rates unchanged at +0.25%, repeating that they will stay there until the 2% inflation target is sustainably achieved.

They also reiterated the view that they will continue with their QE program until the economic recovery is well underway, and that they stand ready to adjust their programs if market conditions change. They said that both the global and Canadian economies are evolving broadly in line with the scenario outlined in July, but added that the bounce-back in activity in the third quarter looks to be faster than anticipated in July.

Although there were no major changes compared to the prior gathering, the last part may have helped the Canadian dollar to finish its day higher against its US counterpart. The rebound in oil prices may have also helped. Moving ahead, we expect the currency to be driven mainly by oil prices, as well as by any headlines surrounding the broader market sentiment. If oil reverses back south on demand concerns, the Loonie may turn back south as well, especially if this happens in the midst of another selloff in equities. The opposite may be true if investors around the globe continue to increase their risk exposures.

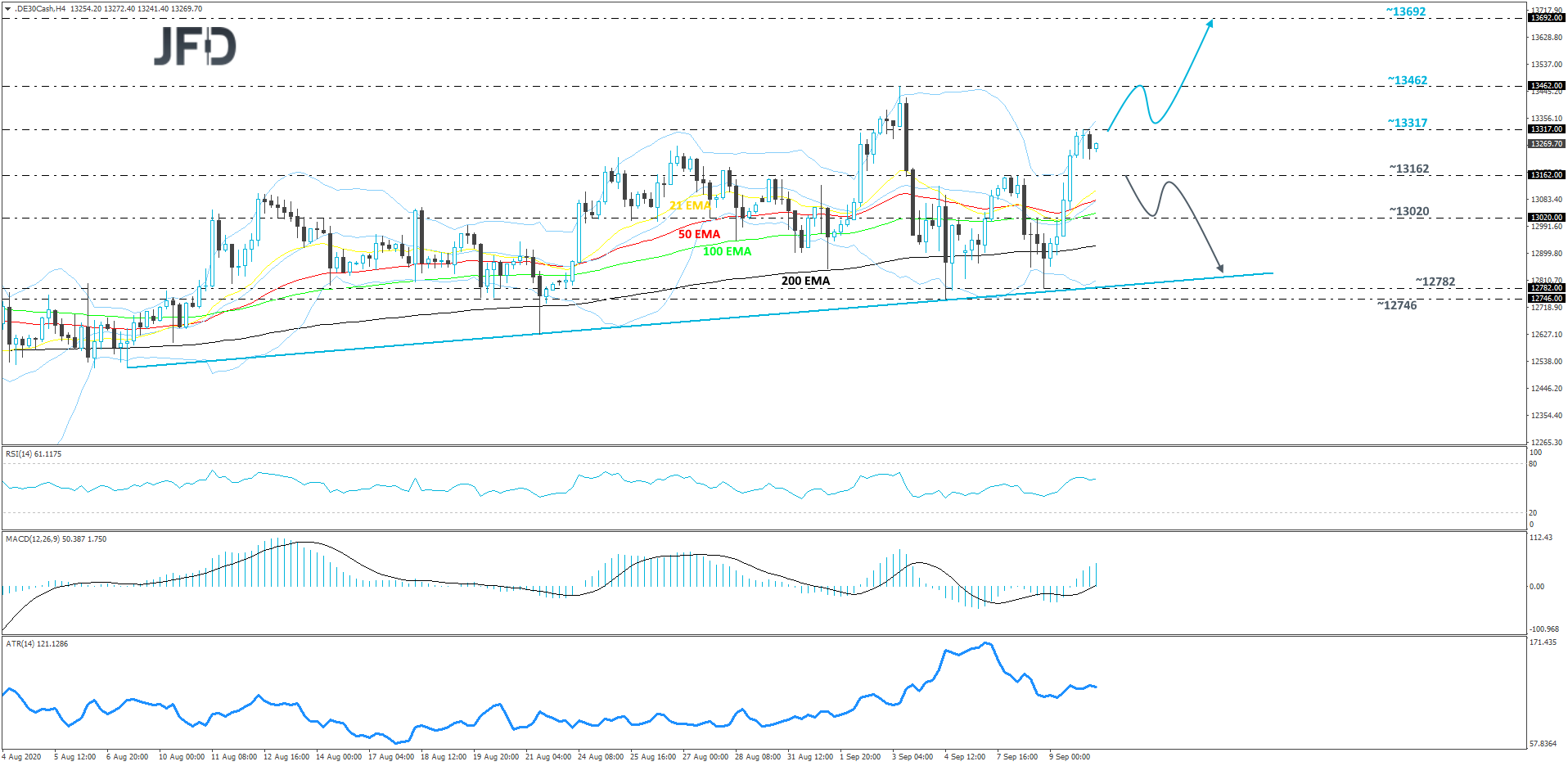

DAX – Technical Outlook

On Tuesday, DAX 30 had a strong rebound from its short-term upside support line taken from the low of August 7th. Yesterday, the German index continued accelerating, breaking above key resistance, at 13162, marked near the highs of August 7th and 8th.

We can see that the cash index is currently finding another resistance near the 13317 hurdle. If that hurdle gets broken, we will get a bit more comfortable with examining higher areas, hence why we will stay somewhat positive, for now.

A break above that 13317 barrier would confirm a forthcoming higher high and may attract a few extra buyers into the arena. That could lift the price to the 13462 area, marked by the current highest point of September, which might halt the uprise. If so, the index may correct slightly lower, but if it remains above the 13317 territory, the bulls might take charge again and lift DAX back to the 13462 zone. If this time that zone fails to withstand the bulls, its break could clear the way to the 13692 level, marked by the high of February 21st.

On the downside, a drop back below the 13162 hurdle, marked near the highs of September 7th and 8th, could temporarily spook the bulls from the field. This might lead the German index back to the 13020 obstacle, a break of which might set the stage for a re-test of the aforementioned upside line, which could help stop the fall. If DAX rebounds from that line, then this whole move lower might have been seen as a temporary correction, before another leg of buying.

Will the ECB Talk Down The Euro? Or Not?

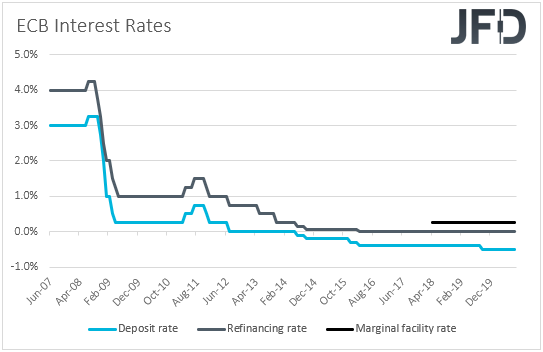

As for today, the main event on the agenda is the ECB monetary policy decision. The last time they met, ECB officials refrained from altering their monetary policy, but stayed ready to adjust all their instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner. At the press conference following the decision, President Lagarde urged EU governments to take action in battling the coronavirus pandemic, with EU leaders eventually agreeing on a EUR 750bn rescue fund.

The euro entered a rally mode against its US counterpart, perhaps on hopes that with a fiscal aid, the Eurozone was likely to recovery faster. What may have also helped EUR/USD to march higher was the Fed’s decision to adjust its inflation approach, noting that they will now aim a 2% average inflation, which means extra loose policy for longer.

Having said all that though, after hitting 1.20, EUR/USD came under some selling interest as inflation in the Euro area turned negative in August for the first time since 2018. On top of that, ECB chief Economist Philip Lane said that the EUR/USD exchange rate “does matter” for monetary policy, comments which combined with the negative inflation rate may have raised speculation for additional easing by the ECB.

That said, yesterday, a Bloomberg report hit the wires, noting that ECB policymakers are growing more confident on the Euro-area economic outlook, which suggests that they are unlikely to introduce new simulative measures at this gathering. The euro gained following the report.

Thus, all the attention may fall on any comments over the euro’s latest appreciation, and how this could affect the outlook for inflation. It they appear as confident as yesterday’s report suggested and show little concern over the euro’s strength, EUR-bulls may decide to stay in the driver’s seat for a while more. Now, in case they ring alarm bells over the euro’s rally, and also appear concerned with regards to the economic outlook – in contrast to yesterday’s report –, the common currency may come under new selling interest.

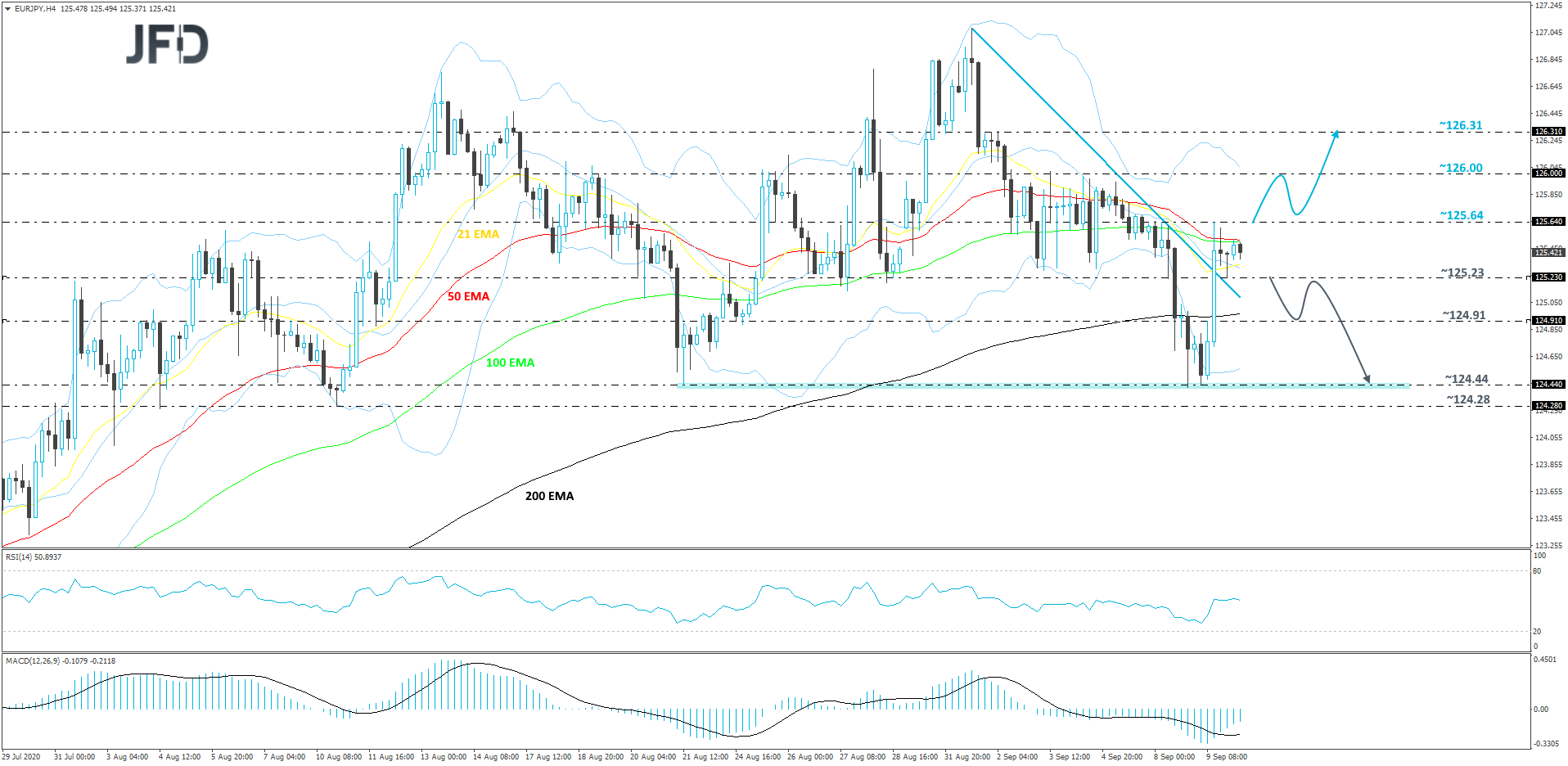

EUR/JPY – Technical Outlook

Yesterday, EUR/JPY popped above its short-term tentative downside resistance line drawn from the high of September 1st. After reaching the 125.64 barrier, the rate slowed down its acceleration. Now the pair seems to be forming a possible bullish pennant, which might attract more buyers into the game. In order to get comfortable with higher areas, at least for the near term, a break of the 125.64 hurdle would be needed. Until then we will take a cautiously-bullish approach.

A push above the aforementioned 125.64 zone would confirm a forthcoming higher high, possibly opening the door towards higher areas, like the 126.00 hurdle. That hurdle is marked near the highs of September 3rd and 4th, where the rate could get a temporary hold-up. That said, if the bulls are still feeling comfortable, a break of that hurdle might set the stage for a move to the 126.31 level, marked by the high of September 2nd.

Alternatively, if the pair drops back below the 125.23 area, marked by yesterday’s intraday swing low, that could open the way back to some lower levels. The bears may then target the 124.91 obstacle, a break of which might open the door for a re-test of the 124.44 zone, which is marked near the lows of August 21st and September 9th.

As For The Rest of Today's Events

During the European morning, we already got Norway’s CPIs for August. The headline rate rose to +1.7% yoy from +1.3% as expected, while the core one inched up to +3.7% yoy from +3.5%, instead of staying unchanged as the forecast suggested. This, combined with the fact that GDP for mainland Norway contracted at a pace very close to the Bank’s own estimate, may allow Norges Bank officials to continue sitting comfortably on the sidelines.

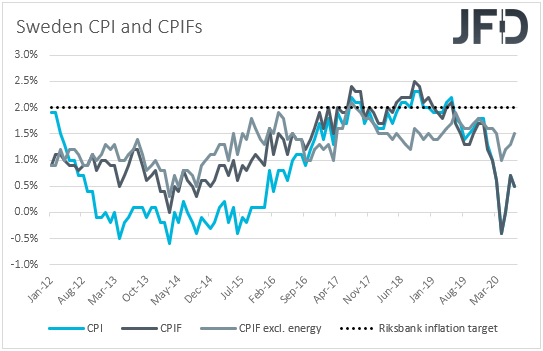

We get inflation data for August from Sweden as well. Both the CPI and CPIF rates are forecast to have increased to +0.9% yoy and +0.8% yoy from +0.5%. That said, as it is always the case, we will pay more attention to the core CPIF rate, which excludes the volatile items of energy. That rate rose to +1.5% yoy in July, from +1.3%.

At its latest gathering, the Riksbank decided to extend its framework for its asset purchases from SEK 300bn to SEK 500bn, up to the end of June 2021, while it announced that in September, it will start purchasing corporate bonds. The Board also decided to cut interest rates and extend maturities on lending to banks, despite keeping the repo rate unchanged at 0%.

We believe that after acting at its last gathering, even if inflation misses somewhat its forecasts, the Riksbank is unlikely to proceed with changes at its upcoming gathering.

Later in the day, from the US, we get the initial jobless claims for last week. Expectations are for a small decline to 846k from 881k the week before. The EIA (Energy Information Administration) weekly report on crude oil inventories is also coming out and the forecast points to a 1.335mn barrels slide after a 9.362mn tumble the week before.

As for the speakers, apart from ECB’s Chief Christine Lagarde, we also have BoC Governor Tiff Macklem.