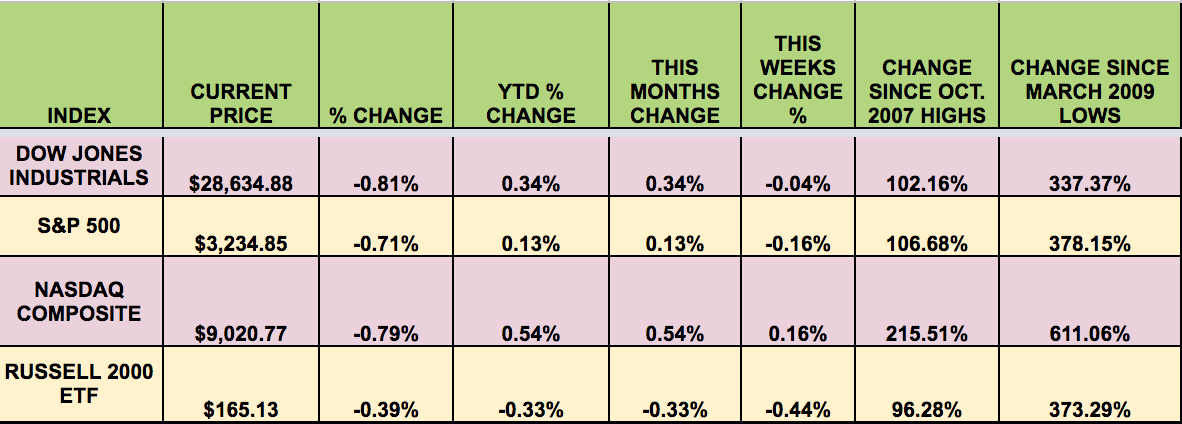

Market Indexes: It was a mixed week for the market, with the DOW and S&P down slightly, and the Russell small caps lagging. The 1st 2 days of 2020 were up on Thursday, with a pullback on Friday, due to the heightened tensions in the Middle East. So far, the tech-heavy NASDAQ is leading the way in 2020.

Volatility: The VIX rose 4..39% this week, ending the week at $14.02, its 2nd straight week of gains.

High Dividend Stocks: These high yield stocks go ex-dividend next week: GPS, KIO, T, WDR, UVV.

Market Breadth: 15 out of 30 DOW stocks rose this week, vs. 25 last week. 41% of the S&P 500 rose, vs. 74% last week.

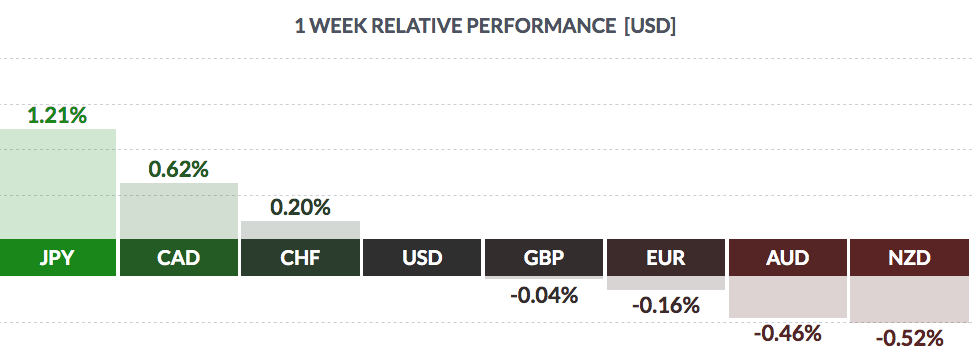

FOREX: The USD fell vs. the yen, Loonie, and Swiss franc this week, and rose vs. pound, euro, and Aussie/NZ dollars.

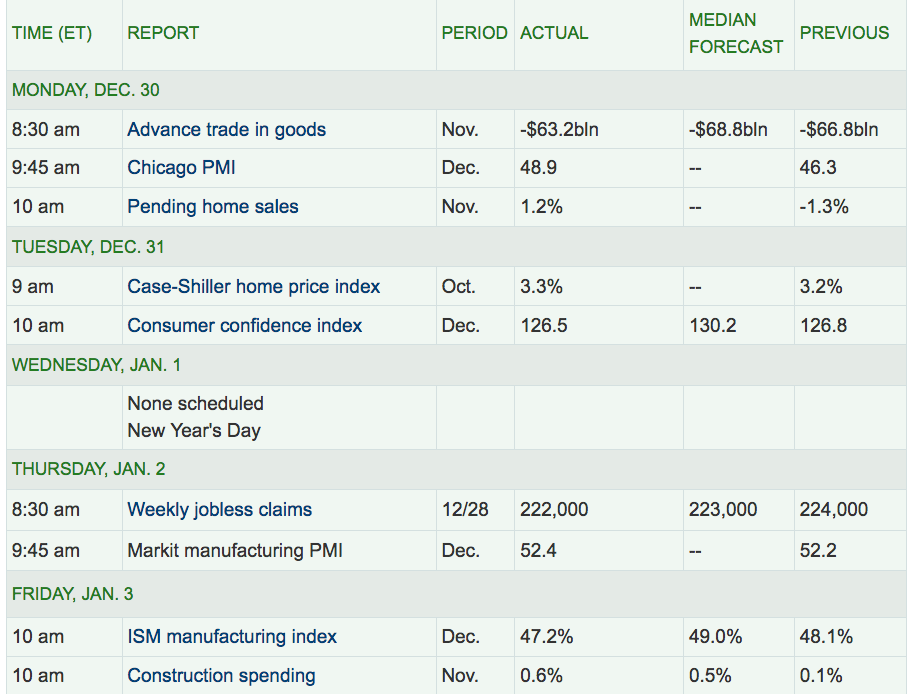

Economic News:

“U.S. automakers on Friday reported another year of stable sales of pick-up trucks, as discounts during the crucial holiday season and lower interest rates on vehicle loans attracted buyers while demand for passenger cars retreated further. Passenger cars have fallen out of favor with buyers amid lower oil prices and automakers have focused on selling larger sport utility vehicles (SUVs) and pick-ups that are also more profitable.” (Reuters)

Pending Home sales rose 1.2% in November, and the Case-Shiller Home Price Index rose 3.2% in October. Construction Spending rose 126.5, below forecasts.

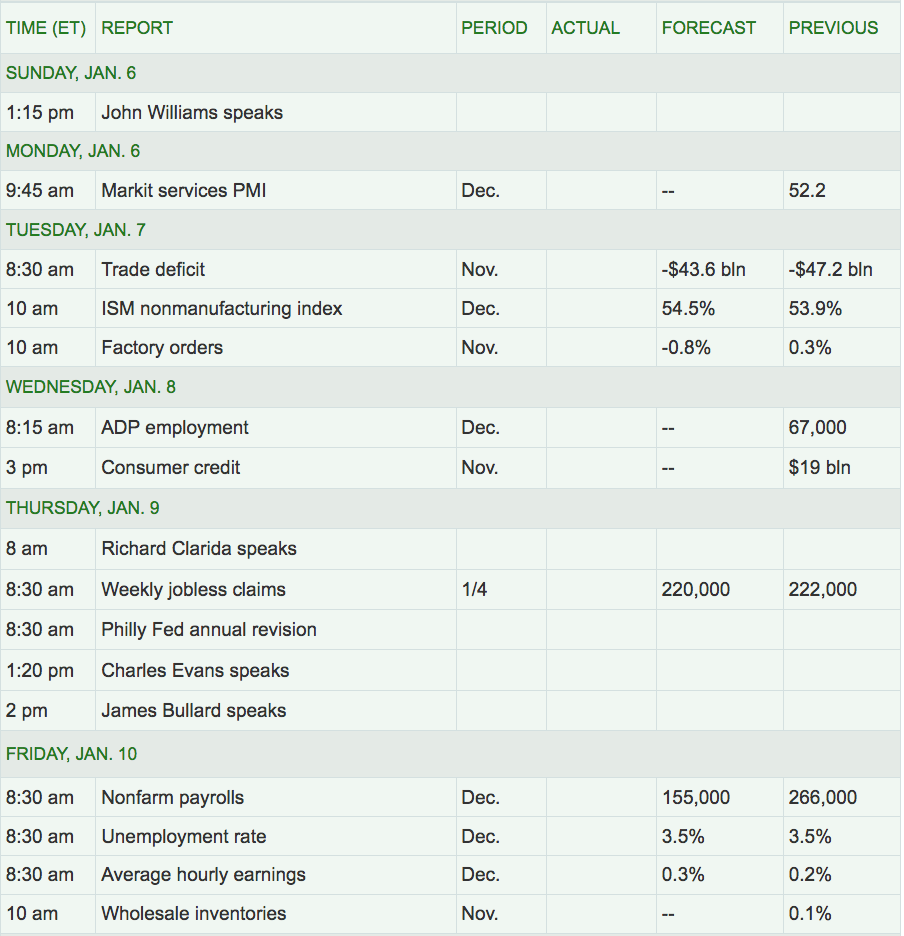

Week Ahead Highlights: The non-farm Payrolls report for December will come out on Friday. Economists are forecasting a much lower number, 158K, than the November 258K figure.

Next Week’s US Economic Reports:

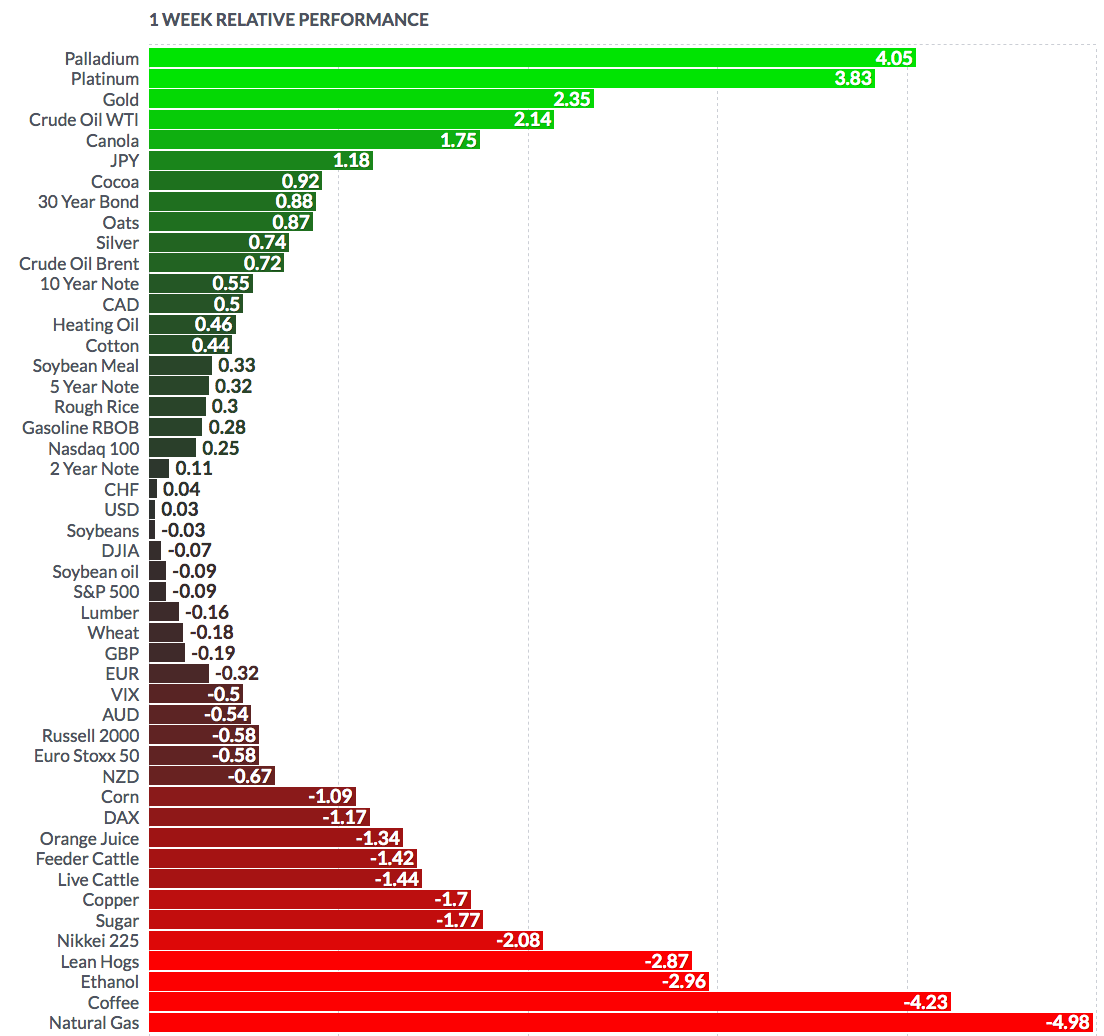

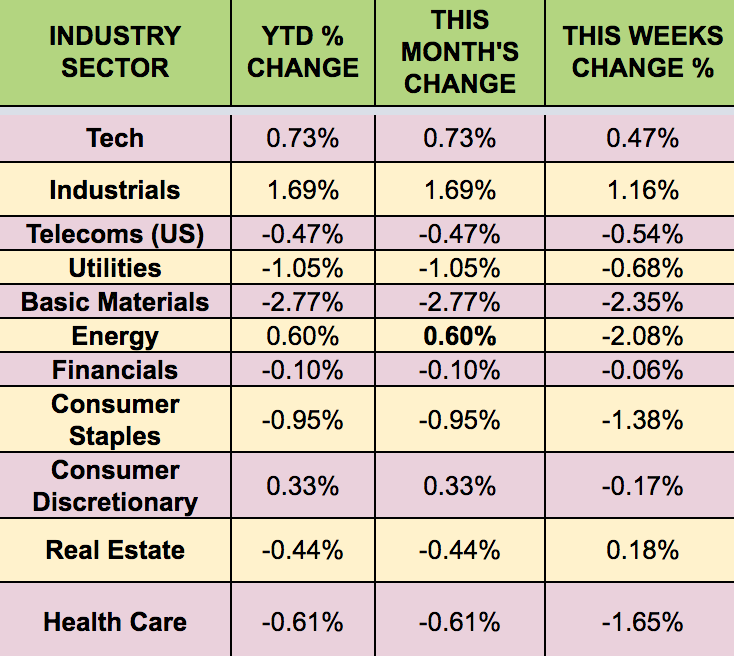

Sectors: Industrials and Tech led this week; Basic Materials lagged.

Futures: WTI Crude rose 2.03% this week, finishing at $62.97, another high weekly close, on the heels of inflamed Middle East tensions.

“Oil stocks were in the spotlight on Friday after a targeted military strike killed Iranian General Qassem Soleimani, considered the architect of the Islamic Republic’s military expansion in the Middle East.

The attack has sent crude-oil prices soaring, with West Texas Intermediate crude for February delivery on the New York Mercantile Exchange up $1.41, or 2.3%, at $62.59 a barrel after trading as high as $64.09 — the highest intraday level for the U.S. benchmark since late April. The expectation is that an Iranian response to the killing of one of its most revered generals will hurt global energy supplies, at least in the short term.

The ensuing surge in crude-oil prices could be beneficial to those companies that produce crude and its byproducts, with that view giving some buoyancy to energy stocks. However, gains aren’t as powerful as they have been in the most recent Middle East drama, when a drone attack briefly knocked out major facilities in Saudi Arabia back in mid September.” (MarketWatch)

“Oil posted the longest run of weekly gains since April as prices followed equities higher and a government report showed U.S. crude inventories falling to the lowest in two months.” (Reuters)