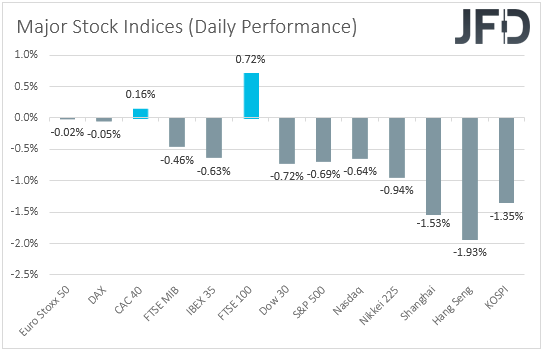

European equities traded mixed yesterday, but Wall Street and Asian ones finished their sessions in the red, as higher energy prices heightened concerns over accelerating inflation, which could lead to faster tightening by major central banks.

The fact that Evergrande (OTC:EGRNY) missed another payment to offshore bondholders may have also weighed on the broader appetite.

Heightened Inflation Fears Trigger Risk Aversion

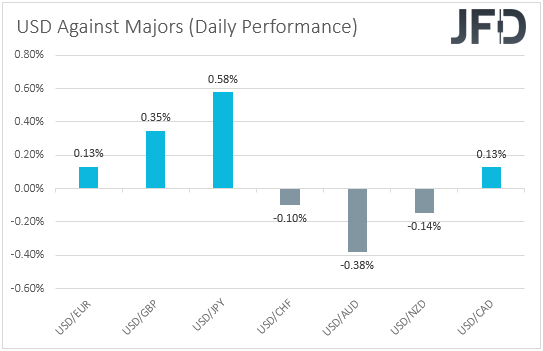

The US dollar traded mixed against the other major currencies on Monday and during the Asian session Tuesday. It gained versus JPY, GBP, EUR, and CAD in that order, while it lost some ground against AUD, NZD, and CHF.

The weakening of the yen and the strengthening of the risk-linked Aussie and Kiwi suggest that markets may have traded in a risk-on manner yesterday and today in Asia.

However, the little strength of the Swiss Franc and the weakening of the Loonie and the pound point otherwise. Thus, with the performance in the FX world painting a blurry picture with regards to the broader market sentiment, we prefer to turn our gaze to the equity world.

EU indices traded mixed, with FTSE 100 and CAC 40 recording gains, but FTSE MIB and IBEX 35 sliding. Euro Stoxx 50 and DAX finished virtually unchanged. Market sentiment softened during the US session, with all three of Wall Street's leading indices ending their session in the red, and deteriorated even more in Asia today.

With no new major events to drive the markets, we believe that further reducing investors' risk exposure results from the cocktail of developments we had last week.

Yes, on Wednesday, Russia indicated that energy supply to Europe is likely to increase, but yesterday, oil prices kept drifting north, with WTI conquering highs last seen back in 2014.

Therefore, with only talks and no concrete action yet, we believe that market participants could stay concerned over high energy prices, translating into a further acceleration in inflation and faster tightening by major central banks.

China's Evergrande missed the third deadline yesterday to pay interest to offshore bondholders, adding to fears over a potential default, which could leave its mark on the nation's financial system, and perhaps have a spillover effect to the rest of the world.

As for the US funding saga, Senate lawmakers agreed to raise the nation's debt ceiling until December, but that doesn't mean that the probability of a potential government shutdown then is zero.

A fresh standoff between Democrats and Republicans suggesting a shutdown in a couple of months could further weigh investors' morale.

Therefore, we see the path of least resistance towards the downside for now. At the same time, we expect the US dollar to stay in uptrend mode.

Now, looking at the economic calendar, we got the UK employment report for August during the early European session today.

The unemployment rate ticked down to 4.5% from 4.6% as expected, but the net change in employment revealed fewer jobs than the forecast suggested.

In any case, they still were more than in July. As for wages, they slowed more or less in line with expectations. Although a decent report, the pound barely reacted at the time of the release.

As we noted yesterday, with the latest supply chain problems in the UK, we saw it unlikely for data concerning the period of August to be able to drive the pound, even if this means a greater likelihood for earlier rate hikes by the Bank of England (BoE).

After all, BoE policymaker Michael Saunders told households to get ready for "significantly earlier" interest rate hikes over the weekend as inflation pressure mounts.

And yet, the pound was the second loser in line yesterday among the major currencies, confirming our view that it remains more linked to developments surrounding the broader market sentiment.

DJIA – Technical View

The Dow Jones Industrial Average cash index traded sharply lower yesterday after it hit resistance slightly below 34985. Overall, the index remains below the downside resistance line taken from the high of Sept. 3 and above the upside support one drawn from the low of Oct. 1.

Therefore, although we see the downside scenario as more likely than the upside one inequities, we prefer to stand pat for now regarding this index.

We would like to see an apparent dip below the 34260 barrier to get confident on more declines.

This could signal the break below the upside line drawn from the low of Oct. 1 and may initially target the 33845 zone, which provided strong support between Oct. 4 and 6.

If the bears are unwilling to stop there, then a break lower may pave the way towards the low of Oct. 1, at 33525. On the upside, we would like to see a clear recovery above 34985 before we start considering the bullish case again.

This could confirm the break above the downside line taken from the high of Sept. 3 and could initially challenge the peak of Sept. 10 at 35110.

If the bulls do not stop there, we could see advances towards the 35280 zone, which provided strong support between Aug. 31 and Sept. 5, the break of which could aim for the 35520 area, which acted as a ceiling between Aug. 25 and Sept. 6.

GBP/CAD – Technical Outlook

GBP/CAD traded in a consolidated manner yesterday, staying between the key zone of 1.7055 and the support of 1.6950. On Friday, the pair fell below the 1.7055 hurdle, thereby confirming a lower low.

Combined with the fact that it remains below the downside resistance line taken from the high of Sept. 20, it paints a negative near-term outlook.

A move below 1.6950 will confirm another lower low and may see scope for declines towards the 1.6870 area, defined as a support by the low of May 6.

If that zone cannot stop the slide either, then its break could carry more significant bearish implications, perhaps extending the fall towards the low of Dec. 11, 2020, at 1.6770.

We will abandon the bearish case and start examining a bullish reversal only if we see a break above the 1.7170 obstacle, which stopped the bulls from climbing higher between Sept. 30 and Oct. 6.

The rate will already be well above the downside line, and we could see advances towards the 11.7245 level, marked by the inside swing low of Sept. 27, where another break may set the stage for extensions towards the peak of that day at 1.7368.

Elsewhere

Few hours after the UK employment data, we have the German ZEW survey for October, with both the current conditions and economic sentiment indices expected to have declined slightly, to 29.5 and 24.0 from 31.9 and 26.5.

Later, JOLTs job openings for August are coming out in the US, and the forecast points to a slight decline.

ECB Chief Economist Philip Lane, ECB Supervisory Board Chair Andrea Enria, ECB Executive Board member Frank Elderson, Fed Vice Chair Richard Clarida, and Atlanta Fed President Raphael Bostic are also due to speak.