- Softer yields lift stocks despite Ukraine fears and rate cut doubts.

- Gold extends rebound, oil also higher in choppy trading.

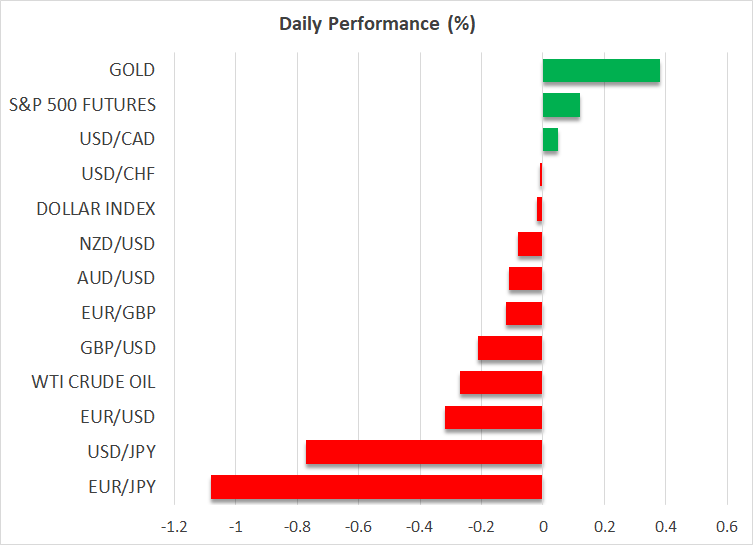

- Dollar on the backfoot amid lack of direction as yen firms.

Stocks Rebound But Struggle for Momentum

Equity markets were in a perky mood on Tuesday as a recovery on Wall Street helped Asian stock markets advance, although European shares were more mixed. Soaring Treasury yields in the US on the back of a more hawkish Fed and expectations that the Republican trifecta will unleash inflationary policies had put the brakes on Wall Street’s post-election rally.

Worries about some of Trump’s picks for his cabinet as well as the increasing risk of a major escalation in the Ukraine-Russia conflict following President Biden’s approval of long-range missiles have added to the uncertainty over the outlook.

Nevertheless, the ‘Trump trade’ is still in play, at least for Tesla (NASDAQ:TSLA), whose stock jumped 5.6% on Monday on reports that the incoming administration will ease regulation on self-driving cars. The rally lifted the Nasdaq, and the S&P 500 also ended the session with decent gains.

However, the positive momentum is very feeble as concerns about sticky inflation in the US, Trump’s tariff threats and heightened geopolitical tensions are keeping the gains in check. It remains to be seen whether Nvidia (NASDAQ:NVDA) will be able to inject fresh life into the markets when it reports its earnings on Wednesday.

Gold Back in Demand, Oil Off Highs

In the meantime, gold is making the most of the uncertainty and the retreat in yields, climbing to one-week highs above $2,620. Gold’s correction lower went deeper than what many market participants had anticipated. But with geopolitical risks not subsiding anytime soon and the possibility of another chaotic term for President-elect Trump, there should be plenty of support for the precious metal even if it may be a while before it can set new record highs.

Oil prices dipped slightly on Tuesday after a late bounce back on Monday. Reports of a shutdown of a Norwegian oilfield gave oil futures a nudge up after failing to rise much from the Ukraine headlines.

Loonie Eyes CPI Data, Euro Skids

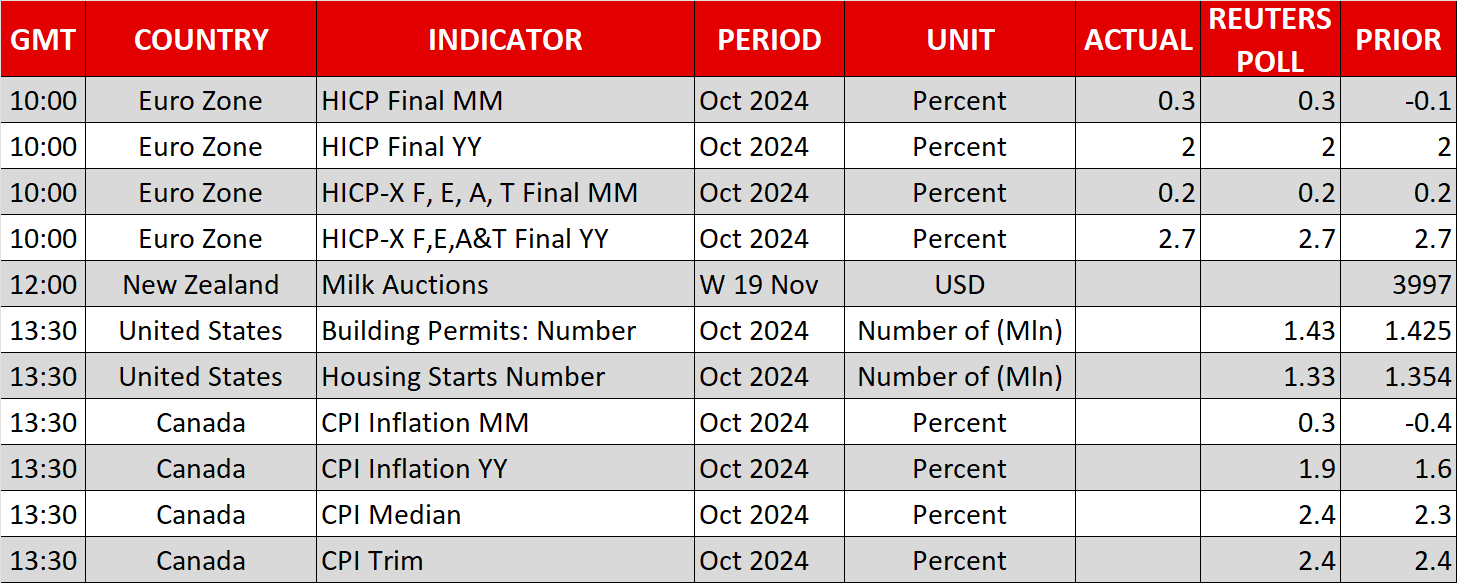

A weaker US dollar likely helped too, giving not just oil but other major currencies some reprieve. The Canadian dollar has been one of the currencies battered by the resurgent greenback as the Bank of Canada has outdoved the Fed. Canada’s inflation report for October is due later today and if CPI edges up as forecast, expectations for another 50-bps rate cut in December might suffer a further knock, boosting the loonie.

Bets for a 50-bps reduction by the ECB are also waning following not-so-dovish remarks by policymakers in recent days. Yet the euro is reversing Monday gains on Tuesday on headlines that Moscow is threatening to use nuclear weapons if Ukraine is allowed to fire its long-range missiles inside Russia.

Yen Finds Some Love, Aussie and Pound Slip

The elevated tensions between the West and Russia are likely aiding the yen’s rebound today. The dollar is back below 154 yen after Japan’s finance minister reiterated the government’s position that it would respond to “excessive moves”.

In other currencies, the Australian dollar is heading lower despite the minutes of the RBA’s latest policy meeting suggesting that a rate cut is not on the near-term horizon, while the pound is dangerously close to breaking below $1.26. There may be some support for sterling later today, however, should Bank of England Governor Andrew Bailey continue to sound cautious on rate cuts when he testifies before Parliament’s Treasury Select Committee.