Energy stocks have not been a good buy-and-hold investment for the past few years. Looking back over the past 5 years, energy has lagged all of the S&P 500 sectors and is the only S&P sector that has a negative 5-year return. Could this trend be ending? A couple of things have caught our eye lately.

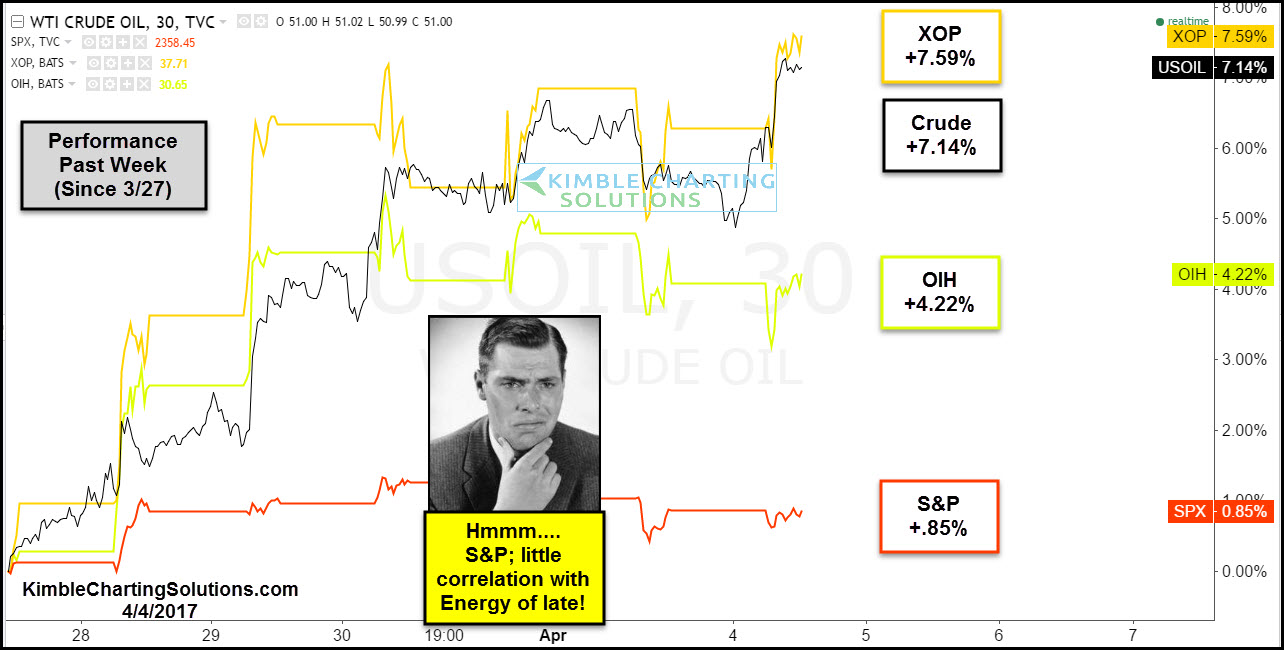

This chart looks at crude oil's performance, two energy ETFs and the S&P 500. We haven't seen this kind of energy strength across the broad market in a good while.

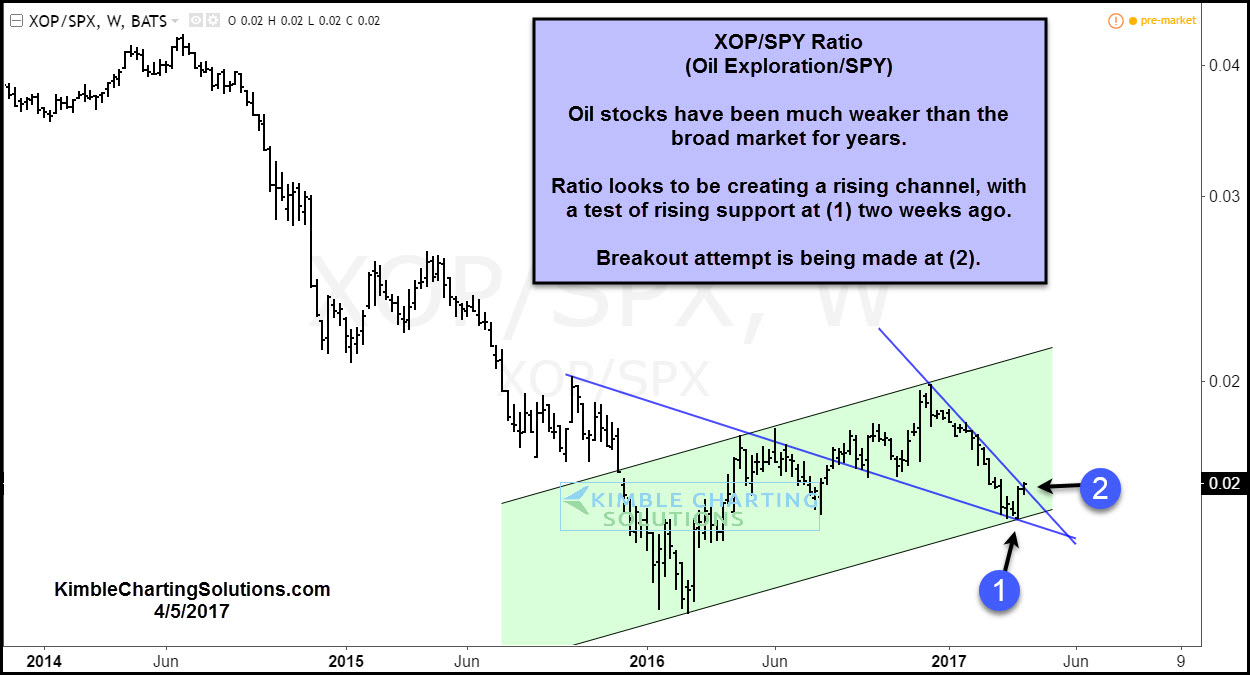

Below looks at the XOP/SPY ratio during the past three years. The chart shows that XOP has been much weaker than the S&P 500 since 2014.

A year ago this ratio made a low and since then, it has tried to create a series of higher lows and higher highs. It recently hit rising channel support at (1) and is now attempting to break above resistance of a bullish falling wedge at (2), which sends a bullish message to this sector.

We noted last week that a two-thirds chance of a bullish breakout was in play. A week later, the breakout of the bullish falling wedge is happening.

Full Disclosure: members are long this sector.