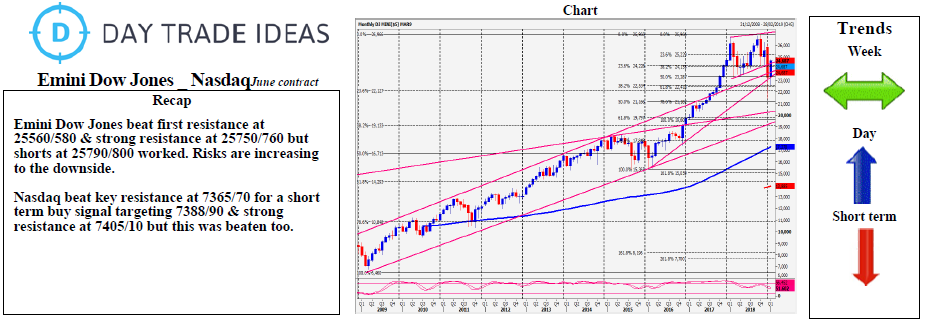

Emini Dow Jones - Nasdaq Daily Forecast - March 27, 2019

Emini Dow Jones shorts at 25790/800 worked on the slide back to 25560/580. Below 25550 risks a slide to important trend line support at 25440/430. A sustained break below 25380 is an important sell signal targeting 25250/240 then 200-day moving average support at 25190/180. On further losses look for 25110/100.

A bounce from 25560/580 does not look likely but if seen targets 25610 and 25670/680, perhaps as far as 25780/800. Sell again with stops above 24830.

Nasdaq risks are to the downside at this stage. Below the 3-week trend line at 7335 tests support at 7306/02. A break below 7300 retests the low last week at 7290 then support at 7260/55.

Minor resistance at 7505/10 A break above 7520 retests 7445/50. A break above 7460 targets 7466/69 and 7487/90.