This article was first published at TopDown Charts

- Most EM central banks are raising interest rates while DM policymakers are just beginning to tighten monetary policy

-

After weak 2021 performance, EM stocks are up slightly so far in 2022 despite an 8% YTD S&P 500 drop

-

Investor allocations are historically light while long-term valuations remain attractive

2021 was a year to forget for investors in emerging market equities. The niche lost major ground on an absolute basis and relative to developed markets. While it’s hard to pin down a single culprit, central bank rate hikes softened growth prospects. EMs are further down the credit tightening track as the US Federal Reserve is almost certain to hike its policy rate in March. There could be four more Fed rate increases through December.

The Case for EM Now

We assert that 2022 could be a strong year for EM equities and FX. EM sovereign bonds also offer attractive relative yields versus developed market fixed income. Our flagship Weekly Macro Themes report details why EM could be an area equity investors should overweight looking out 12-18 months.

After suffering a terrible year relative to other stock markets in 2021, EM equities got off to a strong start this year. Latin America stocks have been particularly favored as US growth and small caps sell off hard.

Monetary Policy Less of a Headwind for EM

We noted the quick monetary policy inflection from easing to tightening among EM central banks that began in the middle of 2020. Currently, more than two-thirds of EM nations have pivoted to rate hike mode while only about 35% of developed countries are raising rates. This is actually a relative advantage for EM since they are further down the credit tightening path.

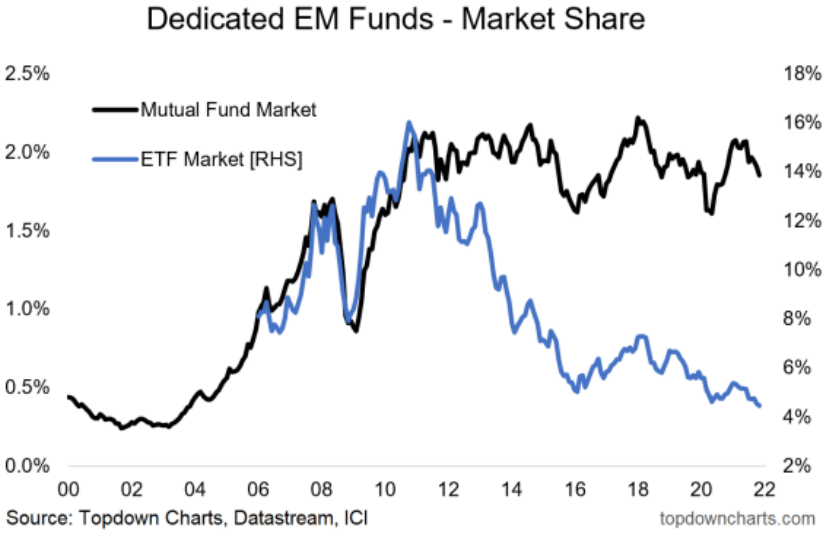

ETF Investors Have Thrown In the Towel

Our featured chart shows investors’ despondency towards EM stocks. Dedicated EM mutual fund market share is near its average of the last decade—close to 14%. ETF market share is at a record low, however. One could argue that ETF investors are more active while mutual fund investors, often those investing for retirement in 401(k)s and IRAs, are less likely to shift allocations.

Featured Chart: Implied Positioning in EM ETF Is at a Record Low

Allocations vs. Global Market Weight

Moreover, a recent fund manager surveys report revealed slightly net-underweight positioning. These light investor allocations occur as EM’s percentage weight in the global equity market is near 15% (versus an all-time high above 20% a bit more than a decade ago). These positioning data reinforce the case that EM stocks are unpopular.

Better Longer-Term Valuations

At a broader level, the EM vs DM valuation gap remains huge—favoring EM. While absolute valuations are about neutral, we find that EM vs USA stocks feature a nearly 50% discount. DMs sport a lofty forward PE ratio near 25x while the average EM PE ratio is near 18x. On a PE10 basis, EM equities are historically cheap at just 15x. We included a look at global PE10s in our 12 Charts to Watch in 2022 report.

Bottom line: Being further down the credit tightening road amid cheap valuations and with light investor allocations, EM stocks could be a winning play in 2022 following last year’s dreadful relative performance.