This article was originally published at TopDown Charts

-

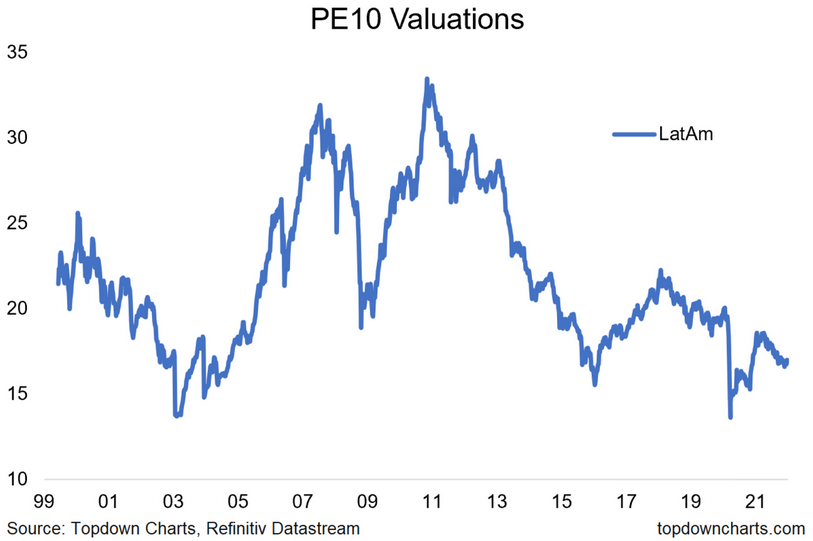

Valuations are not far from historic lows among Latin American stocks

-

After falling more than 30% during the second half of 2021, this emerging market region has seen a snapback as investors have turned away from growth toward value

-

Even with cheap valuations and a bullish reversal in price action, a hawkish policy rate trend is a headwind in 2022

The new year brought a rebound in value vs growth. Part of that turnaround includes a sharp rally in Latin American equities. LatAm stocks, dominated by Brazilian shares, dropped by about a third from their late 2Q 2021 peak to the November low. The iShares Latin America 40 ETF (NYSE:ILF) has snapped back more than 10% from that trough.

Still, shares remain about 20% off the 2021 peak. Long-term, the Latin American equity ETF is down 40% from its 2007 high (even when including dividends). That stark underperformance might leave investors wondering if there is a value play at hand.

Q1 2022 Idea

Our quarterly strategy pack for Q1 2022 details several interesting long ideas to consider. And a few “uninteresting” potential short plays. Within the emerging market space, Latin America is an interesting idea given how inexpensive valuations are. LatAm is a key piece of Emerging Markets—we outline some positive signs on EM’s tactical outlook in our strategy pack after putting the area on Risk Watch in mid-2021.

Knowing What You Own

Latin American stocks are intriguing for risk-seeking value investors. The top sectors are materials, financials, staples, and energy. Growth sectors like tech and health care are just a sliver of the index. From a country perspective, you basically own Brazil and Mexico with the popular Latin America 40 ETF—it is 57% Brazil, 28% Mexico.

Once Expensive, Now Cheap

We track LatAm equity valuations. Indeed, the region’s PE10 is close to historic lows, suggesting the niche is a potential source of emerging value. Our featured chart illustrates just how expensive this emerging market area was in not only 2007 but also post-GFC in early 2011.

Featured Chart: Latin America PE10 since 1999: Historically Cheap

Learn More: So what is the Quarterly Strategy Pack anyway?

With a PE10 of just 16.9 versus a long-term average of 21.9, value investors might consider dipping their toe. Moreover, FX valuations are also exceptionally low at almost two standard deviations below their long-term average.

Rate Hikes Persist

A headwind, however, is a clear trend toward higher interest rates among Latin American central banks. The average policy rate was under 2% a year ago but has since surged to nearly 5%.

Inflation in the region has forced the hands of policymakers to try to curb rising prices. That hawkish stance would typically fly in the face of a bullish thesis, but after such a severe drawdown during the second half of last year, one must wonder how much was priced in?

Bottom line: Since rate hikes remain on tap in Latin America, we are just cautiously optimistic for the region’s stocks. Long-term, there is certainly a case to be made for having exposure to these beaten-down equities that remain in a secular bear market.