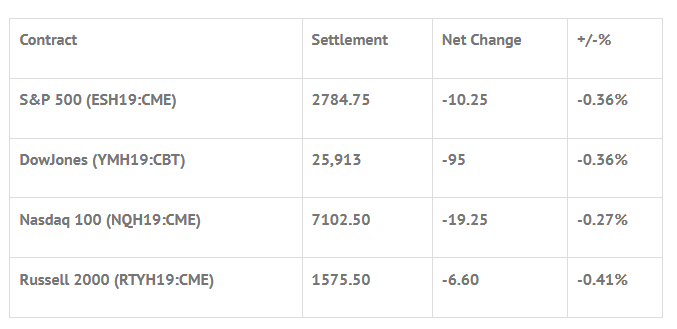

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp +1.80%, Hang Seng +0.63%, Nikkei +1.02%

- In Europe 12 out of 13 markets are trading higher: CAC +0.73%, DAX +1.29%, FTSE +0.56%

- Fair Value: S&P +0.46, NASDAQ +4.37, Dow -1.38

- Total Volume: 1.34mil ESH & 265 SPH traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Personal Income and Outlays 8:30 AM ET, Personal Income and Outlays 8:30 AM ET, PMI Manufacturing Index 9:45 AM ET, ISM Mfg Index 10:00 AM ET, Consumer Sentiment 10:00 AM ET, Raphael Bostic Speaks 12:50 PM ET, and the Baker-Hughes Rig Count 1:00 PM ET.

S&P 500 Futures: End of February ‘Walk Away Trade’ Sell $2.6 billion

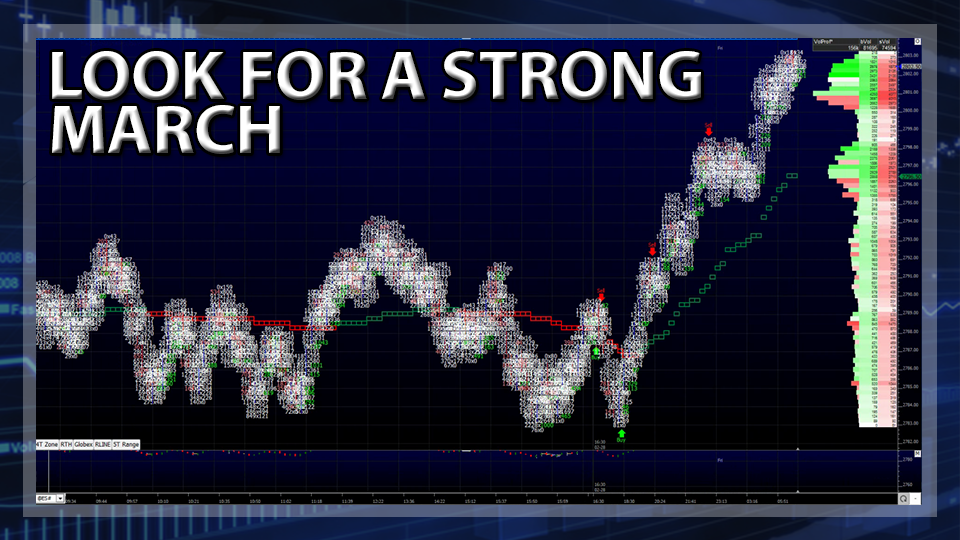

Chart courtesy of Scott Redler @RedDogT3 – $spx futures +17, Strong markets around the World. For this wedge to resolve higher. It needs to stay above 2795 and then 2813 is Monday’s high after three days of rest.

Being the president of the United States is not an easy job. After years of bad trade deals and debt piling up, Trump’s approach is not like any of his predecessors. He is a businessman who tries to do business deals. The problem is not everyone likes his hard nosed approach, and after toting what a great relationship he and North Korean leader Kim have, the nuclear negotiations broke down and the president walked out and headed back to the U.S. not only without a deal, but no sign of how things will move forward in the future. On top of that, there remains big obstacles in the China tariff deal also. Both were a big let down, but the #ES took it in stride, and sold off slightly before ripping higher overnight.

During Wednesday nights Globex session, the S&P 500 futures (ESH19:CME) printed down to a low of a low of 2781.75, and opened Thursday’s regular trading hours at 2789.25, down -5.5 handes. After the open the ES down ticked, traded up to 2793.25, then sold off down to 2784.25 at 9:10 am.

For the next hour and ten minutes the ES back and filled in a six and a half handle range. At 11:50 CT it rallied up to a new high at 2794.25. From there, the ES then sold back off down to the vwap at 2789.50, down -5.5 handles, pulled back to 2791.00 at 1:06, and then sold off down to 2786.25 as the MiM went from over $100 million to sell to $225 million to sell. After a small pop the ES retested the low was the MiM dropped to sell $611 million, and then upticked to 2790.75 while the MiM paired back $466 million to sell.

The ES traded 2786.50 as the 2:45 cash imbalance (MiM) showed sell $2.6 billion for sale, traded 2785.26 on the 3:00 cash close, and settled at 2784.75 on the 3:15 futures close, down -10.25 handles or down -0.36% on the day.

In the end it was kind of a messy day with several pop and drops. In terms of the ES’s overall tone, it acted weak. In terms of the days overall trade, total volume was better, with 1.3 million futures contracts traded.

Being the president of the United States is not an easy job. After years of bad trade deals and debt piling up, Trump’s approach is not like any of his predecessors. He is a businessman who tries to do business deals. The problem is not everyone likes his hard nosed approach, and after toting what a great relationship he and North Korean leader Kim have, the nuclear negotiations broke down and the president walked out and headed back to the U.S. not only without a deal, but no sign of how things will move forward in the future. On top of that, there remains big obstacles in the China tariff deal also. Both were a big let down, but the #ES took it in stride, and sold off slightly before ripping higher overnight.

During Wednesday nights Globex session, the S&P 500 futures (ESH19:CME) printed down to a low of a low of 2781.75, and opened Thursday’s regular trading hours at 2789.25, down -5.5 handes. After the open the ES down ticked, traded up to 2793.25, then sold off down to 2784.25 at 9:10 am.

For the next hour and ten minutes the ES back and filled in a six and a half handle range. At 11:50 CT it rallied up to a new high at 2794.25. From there, the ES then sold back off down to the vwap at 2789.50, down -5.5 handles, pulled back to 2791.00 at 1:06, and then sold off down to 2786.25 as the MiM went from over $100 million to sell to $225 million to sell. After a small pop the ES retested the low was the MiM dropped to sell $611 million, and then upticked to 2790.75 while the MiM paired back $466 million to sell.

The ES traded 2786.50 as the 2:45 cash imbalance (MiM) showed sell $2.6 billion for sale, traded 2785.26 on the 3:00 cash close, and settled at 2784.75 on the 3:15 futures close, down -10.25 handles or down -0.36% on the day.

In the end it was kind of a messy day with several pop and drops. In terms of the ES’s overall tone, it acted weak. In terms of the days overall trade, total volume was better, with 1.3 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.