Thursday August 30: Five things the markets are talking about

Emerging currencies have sold off sharply again overnight after Argentina’s peso suffered its biggest one-day decline in three-years, with Turkey’s lira, the South African rand and the Indian rupee all feeling the heat.

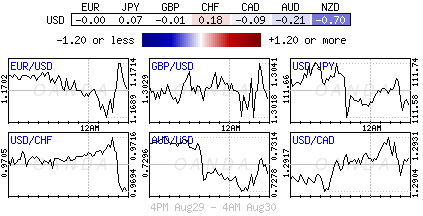

The dollar is under some pressure starting Thursday as easing concerns over trade conflicts has some investors increasing their risk appetite, however, month-end rebalancing may limit the ‘big’ dollars fall.

For N. American investors, the current state of Canada-U.S trade negotiations top the agenda. Both negotiation teams expressed optimism yesterday that they could reach a new NAFTA deal by Friday, although PM Trudeau indicated that a number of ‘delicate’ issues remained.

Elsewhere, sterling has been the big winner in the past 24-hours, finding support on hopes that Britain and the E.U will agree on future trade ties before Brexit takes effect. The E.U indicated yesterday that it’s prepared to offer Britain an “unprecedentedly close relationship, but that the bloc must prepare for a no-deal Brexit.”

In equities, European shares are tracking a decline in Asian trading, as weakness in Chinese markets overnight seems to be, for now, overshadowing any optimism that a NAFTA deal could be struck by the end of the week.

On tap: Canada GDP and U.S core-PCE are due at 08:30 am EDT.

1. Stocks see red

In Japan, the Nikkei thrashed out small gains after touching a three-month high overnight as positive developments in trade talks supported sentiment. Nevertheless, the sessions closed out with some month-end profit taking. The Nikkei share average ended +0.1% higher, while the broader Topic ended flat.

Down-under, Australian shares gave up early gains to finish largely unchanged. The benchmark S&P/ASX 200 index finished marginally lower, down -0.1%. On the economic front, reports on new building approvals and private capital expenditure painted a glum picture of the Australian economy. In S. Korea, the Kospi index stock index ended flat, giving up early gains and tracked the declines in China.

In Hong Kong and China, fears of slower Chinese growth amid an escalating trade war with the U.S is keeping investor sentiment fragile. The Hang Seng index fell -0.9%, while the China Enterprises Index dropped -1%. In China, the blue-chip CSI300 index fell -1%, while the Shanghai Composite Index also closed down -1.1%.

In Europe, regional bourses trade lower across the board following weakness in Asia overnight and weaker U.S futures. The FTSE remains an underperformer as sterling (£1.3011) trades atop the key £1.30 level.

U.S stocks are set to open in the ‘red’ (-0.2%).

Indices: Stoxx600 -0.6% at 384.0, FTSE -0.8% 7505, DAX -1.2% at 12413, CAC-40 -0.5% at 5473, IBEX-35 -0.7% at 9497, FTSE MIB -0.6% at 20626, SMI -0.7% at 9021, S&P 500 Futures -0.2%

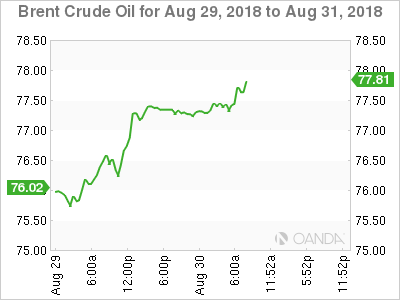

2. Oil prices rally on decline in U.S inventories, looming Iran sanctions

Oil prices have inched higher; extending Tuesday’s solid gains on a fall in U.S crude inventories and expected market disruptions to supply from Iran and Venezuela.

Brent crude oil futures are at +$77.21 per barrel, up +7c from the close, while U.S. West Texas Intermediate (WTI) crude futures are up +14c at +$69.65 a barrel.

EIA data yesterday showed that U.S commercial crude inventories fell by -2.6M barrels in the week to Aug. 24, to +405.79M barrels, while U.S production was flat from last week’s record +11M bpd.

This week, the IEA has warned of a tightening market towards the end of the year, due to a combination of supply concerns. OPEC will discuss in December whether it can compensate for a sudden drop in Iranian oil supply after U.S sanctions start in November.

Note: Iran’s August crude oil exports is expected to drop to just over +2M bpd, versus a peak of +3.1M bpd in April, as importers adhere to U.S pressure to cut imports.

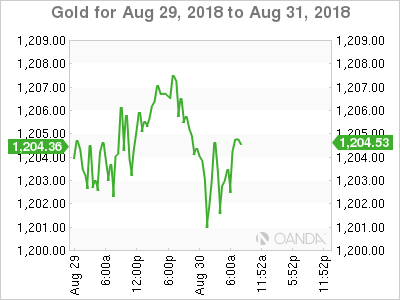

Ahead of the U.S open, gold prices ease a tad as the dollar firms amid expectations of higher U.S interest rates – positive U.S GDP data has boosted rate hike views – but the ‘yellow’ metal continues to hold above the key support level of +$1,200. Spot gold is down -0.4% at +$1,202.02 an ounce, while U.S gold futures are down -0.3% at +$1,207.80 an ounce.

3. U.S yield curve – rising rates resemble pre-2008

For fixed income dealers a narrowing Treasury bond yield curve between the two-year and 10-year bonds suggests a rising risk of recession.

The U.S 2’s/10’s spread is currently around +20 bps – it last traded here in 2005, three-years before the crisis took hold and seven interest rate increases before the Fed Funds rate peaked. Curve inversion happened for the first time in January 2006, with four further rate hikes to follow. The 2007-2008 financial crisis was followed by a global economic downturn.

Elsewhere, Germany’s 10-year Bund yield has increased less than +1 bps to +0.41%, reaching the highest yield in more than three-weeks. In the U.K the 10-year Gilt yield has advanced +1 bps to +1.489%, hitting the highest yield in more than three-months.

The spread of Italy’s 10-year bonds over Germany’s has declined -3 bps to +2.6937% points to the smallest premium in more than a week.

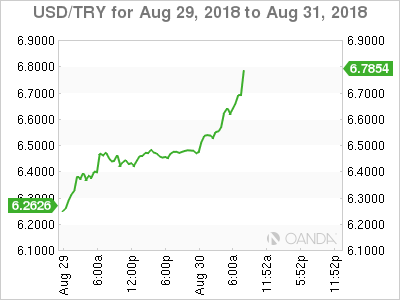

4. EM pairs plunge

The Argentine peso has plummeted over -7% after a collapse in investor confidence in President Macri’s government. The central bank has intervened to try and stabilize the peso and the IMF said it was studying Argentina’s request to speed up disbursement of a +$50B loan programme. The knock on effect from the peso’s decline is hurting TRY, ZAR and INR.

USD/TRY has rallied +2.6% to $6.6342, bringing it closer towards its recent record high of $7.1310. Analysts continue to see more upside over the coming weeks -Turkish inflation data is due next Monday and is widely expected to show a big increase, given that the lira has weakened significantly recently.

Note: Last month, Turkish inflation stood at +15.85% year-on-year and market odds of significant hike by the Central Bank of the Republic of Turkey (CBRT) next month are very low.

Sterling (£1.3014) jumped yesterday after E.U negotiator Michel Barnier said he is prepared to offer the U.K. a trade deal that has never been offered to a third country. The market has taken this as a sign that an agreement between the two sides has a greater likelihood of being achieved.

Note: The date to reach an agreement has been pushed back to mid-November.

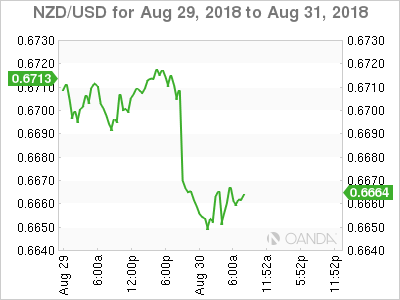

5. NZ business confidence weaker

Data overnight showed that New Zealand business confidence remained weak this month.

The general business sentiment fell further to -50.3%, the lowest headline print in a decade as firms’ own-activity expectations, which correspond more closely with GDP growth, was unchanged for the month.

A large part of the fall in business sentiment reflects individual firms’ discomfort with the new government’s policies, especially the planned changes to labor laws.

NZD fell as much as -1% to NZ$0.6645 after the release.