Economic Calendar and Watch List

Morning Notes

US Futures are tracking modestly higher this morning while European stocks trade higher by over +.50% as markets await the US payroll report which may provide clues into the timing of the next rate increase by the FOMC. Asian stocks closed mostly mixed.

Technicals

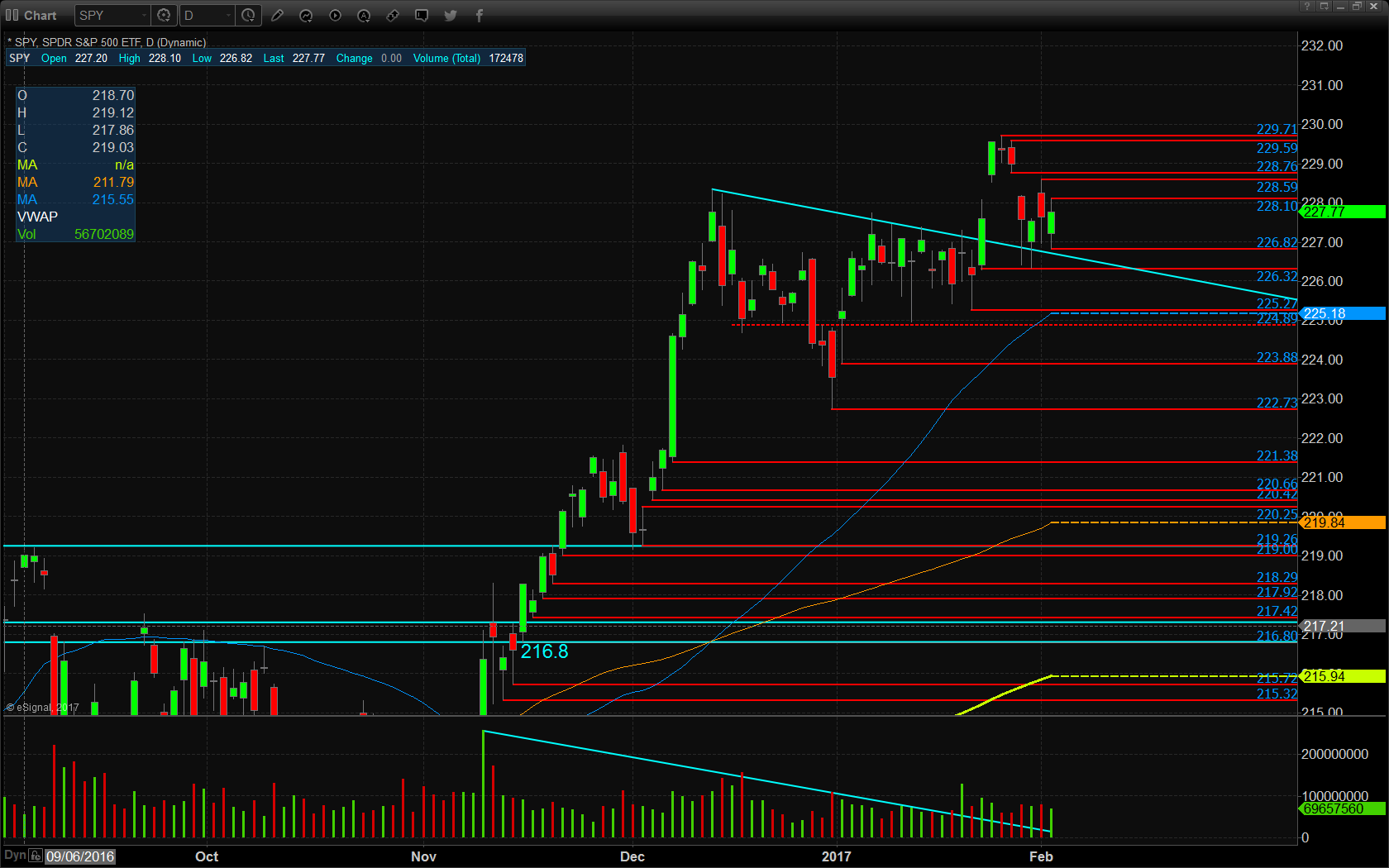

The SPY (NYSE:SPY) held the former descending resistance in yesterday’s session and attempted to pivot higher. Support will lie at the low of yesterday’s range at $226.82, followed by the former descending resistance at $226.70, then $226.32, $225.27, the 50 day moving average at $225.18 and the recent support pivot at $224.89. Resistance will lie at the high of yesterday’s range at $228.10, followed by $228.59, $228.76, $229.59, and record highs at $229.71.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

FTNT (NASDAQ:FTNT)

DATA (NYSE:DATA)

DECK (NYSE:DECK)

Economic Calendar

8:30 January non-farm payrolls expected +175K

8:30 January avg hourly earnings expected +0.3%

9:15 Chicago Fed President Charles Evans speaks

9:45 Revised January Markit services PMI

10:00 January ISM non-manufacturing PMI expected +0.4 to 57

10:00 December factory orders expected +0.7%

Notable Earnings Before Open

Apollo Global Management (NYSE:APO) – EPS Est. $0.77

Clorox Company (NYSE:CLX) – EPS Est. $1.22

Hershey Company (NYSE:HSY) – EPS Est. $1.08

Tuesday Morning Corp (NASDAQ:TUES) – EPS Est. $0.37

Notable Earnings After Close

NONE