Yesterday, as it was expected, the ECB announced that it is keeping their interest rates the same. The deposit facility rate remained at -0.50% and the interest rate stayed at 0.00%. But as we mentioned yesterday and in the beginning of this week, it was expected that the Committee will be highly concerned with the current pandemic situation.

As per Christine Lagarde’s comments made yesterday, during the ECB press conference, which followed 45 minutes after the rate announcement, she said that the Bank understands that the virus resurgence presents new challenges ahead. She also added that consumers are cautious and that the virus is weighing in on businesses.

The ECB is also ready to adjust their instruments, in order to better support the economy. All that suggests the ECB could take action in December, when the Monetary Policy Committee meets for the last time this year.

On the positive side, today we will be getting some key economic data sets from the eurozone. The preliminary inflation numbers and GDP figures will be released. So far, the only forecasts we have are for the October YoY CPI reading, which is expected to come out the same as previous, at -0.3%, and the Q3 YoY GDP figure, which is believed to have also stayed the same, at -15.0%.

That said, according to yesterday’s comment by Christine Lagarde, the preliminary GDP number might come out as a surprise. If so, it may help EUR/USD to stabilise, after yesterday’s decline.

US Preliminary GDP

The US also delivered a few important data sets yesterday, which were one of the factors that helped the US equities to close in the green. The preliminary QoQ for Q3 GDP figure showed up at +33.1%, which beat the initial forecast of +31.0%. The actual number set a new record, showing the largest expansion rate in history. It has been the fastest recovery from the Q2, which came out at a record drop, at -31.4%.

US Initial jobless claims were also on the better side, showing up at 751k against the forecasted 775k. That said, the continuing claims were a slight disappointment, coming out at 7756k, instead of the forecasted 7700k. Although the data looks somewhat positive, still, it is being outweighed by the coronavirus problem, which forces governments to implement lockdown measures.

Japan's Inflation Disappoints But Employment Improves

During the Asian morning today, we received several data sets from Japan. The country delivered on its unemployment number for September, which came out at 3.0%, which is better than the expected 3.1%. However, inflation numbers were not at their best. The Tokyo Core CPI YoY figure showed up as expected, at -0.5%, but the previous reading was only at -0.2%. The headline YoY CPI number was also a disappointment, coming out at -0.2%, when the previous one was at +0.2%.

However, on the positive note, the Japanese MoM industrial production figure rose to +4.0%, when the initial expectation was for +3.2%. Overall, the Japanese data came out slightly on the brighter side and we saw the yen strengthening this morning.

That said, given yen’s safe-haven’s status, it is unclear if the currency attracted buying interest due to the better than expected data, or because of the lockdown fears. We are leaning somewhat towards the second scenario, because of the negative activity seen this week in the equity world.

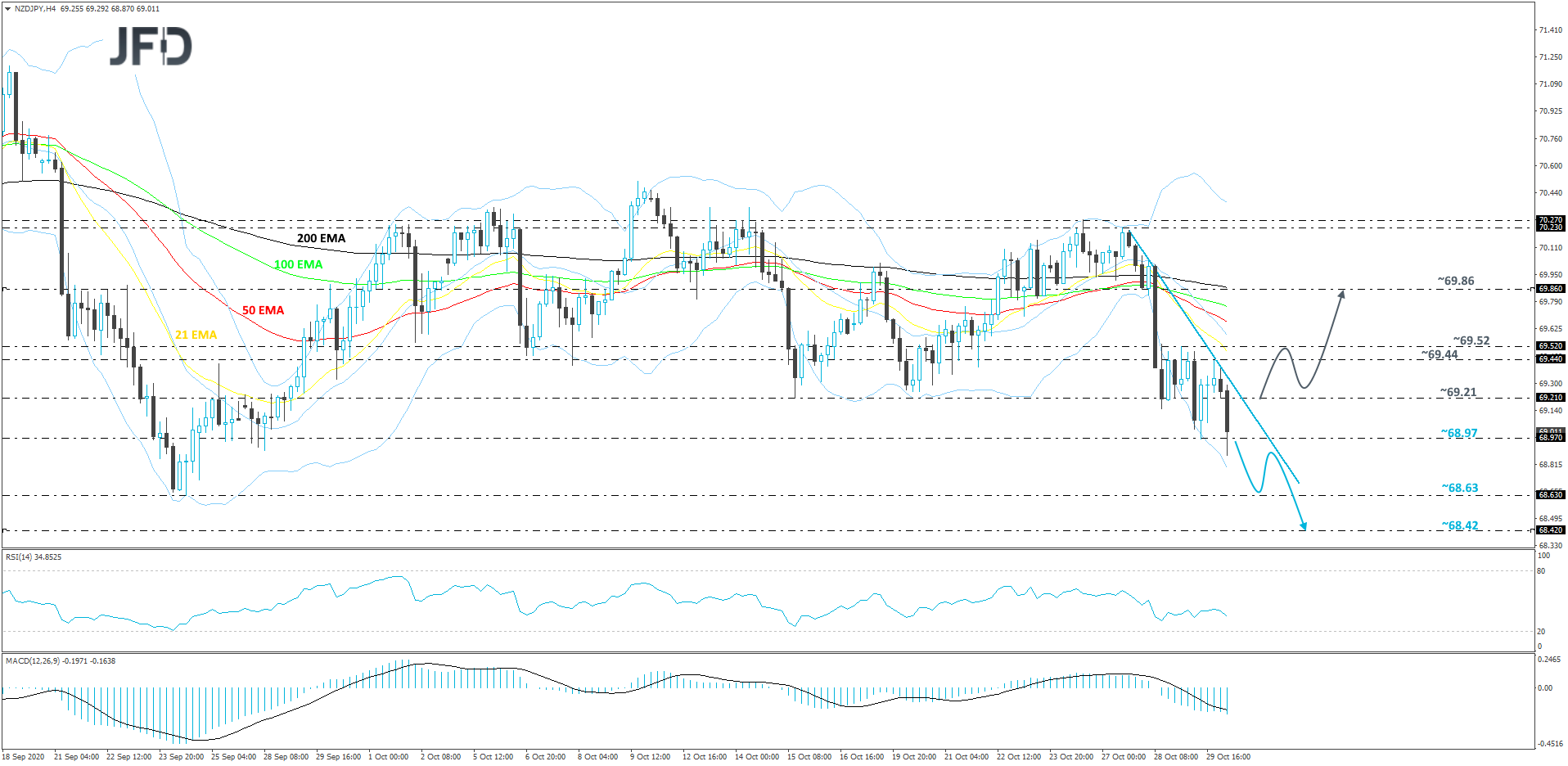

NZD/JPY Technical Outlook

NZD/JPY continues to drift south, while trading below a short-term downside resistance line taken from the high of Oct. 27. As long as that downside line remains intact, we will stay bearish, at least with the near-term outlook.

A further slide below the 68.97 hurdle, which is yesterday’s low, may interest more sellers in joining the game. If so, NZD/JPY might drift to the 68.63 hurdle, marked by the lowest point of September. That hurdle may initially provide decent support, possibly resulting in a small rebound.

If so, the pair could go for a slight correction higher, however, if the aforementioned downside line stays intact, that might apply bearish pressure on the pair again. Another drop may push the rate below the 68.63 obstacle, a break of which could set the stage for a move to the 68.42 level, marked by the low of June 24th.

Alternatively, if the rate breaks the previously-discussed downside line and then climbs above the 69.21 barrier, marked by the low of October 15th and by an intraday swing low of today, that may spook the bears from the field temporarily, allowing more buyers to jump in.

NZD/JPY could then travel to the 69.44 obstacle, or to the 69.52 hurdle, marked by yesterday’s high. Initially, the pair might get held there, but if the buying doesn’t stop there, the next possible target could be at 69.86, which is marked by an intraday swing low of October 28th.

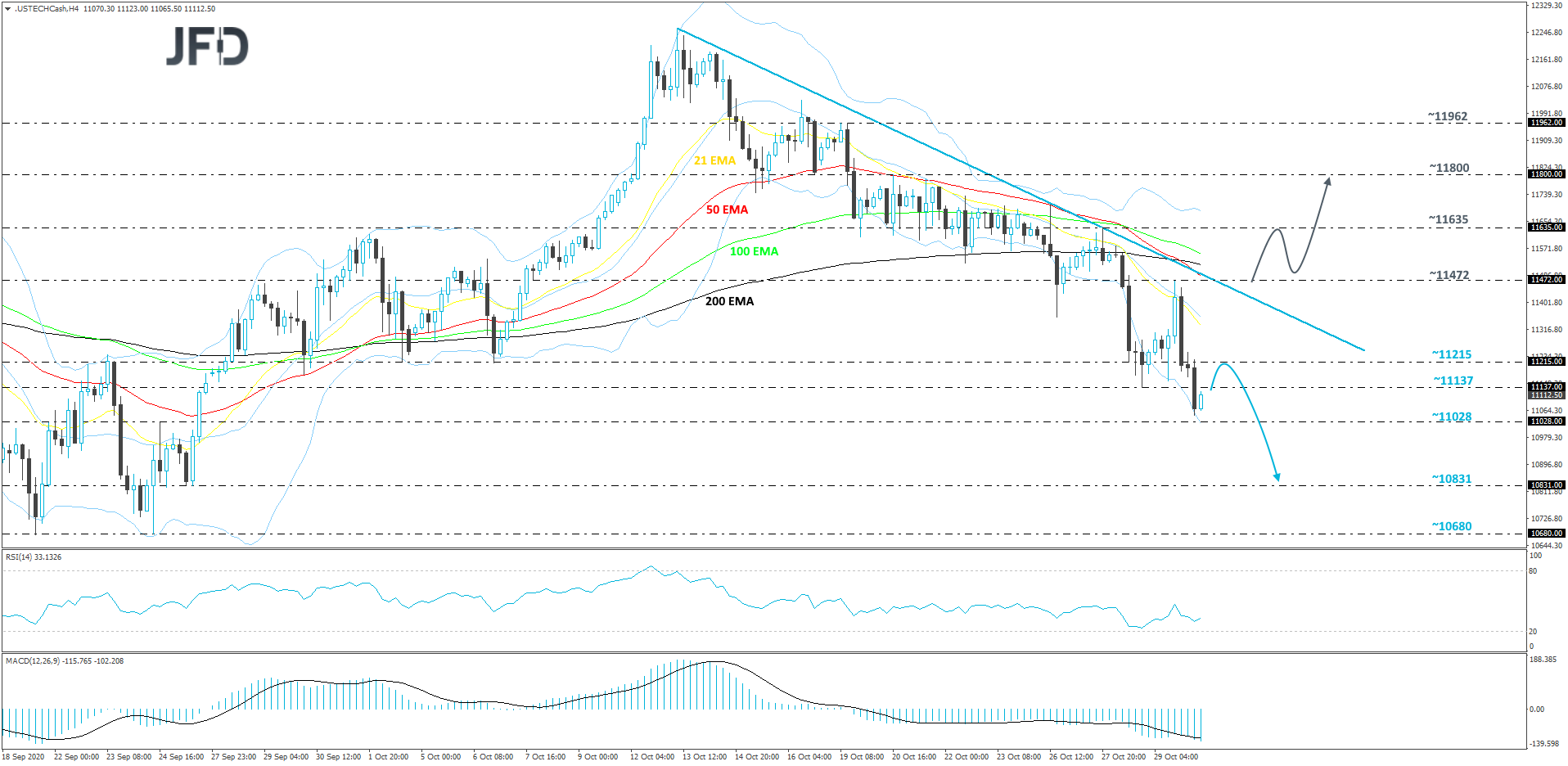

NASDAQ 100 Technical Outlook

The NASDAQ 100, together with other indices, remain under selling pressure this week, due to the pandemic. From the technical side, the Nasdaq 100 is still trading below a short-term tentative downside resistance line drawn from the high of Oct. 13.

Even though we could see a recovery move back to the upside, as long as that downside line remains intact, we will continue aiming lower.

A small correction back up could test the 11215 hurdle, marked by the lows of Oct. 2 and 6, which might provide resistance. If so, this may result in another slide, possibly sending the index to the 11028 area, marked by the inside swing high of Sept. 24. If the selling does not end there, the next potential target could be at 10831, marked by the low of September 25th.

In order to shift our attention to some higher areas, we would prefer to wait for a break of the aforementioned downside line and a price-rise above the 11472 barrier, marked by the high of Oct. 29. Such a move could open the way to the 11635 obstacle, a break of which might set the stage for a move to the 11800 level. That level is marked y the low of Oct. 16 and the high of Oct. 20.

As For The Rest Of Today's Events

Later on today, we will be getting the PCE figures from the US, both core and headline. There are currently no forecast available for the headline reading, but the core YoY number is believed to have improved by a tenth of a per cent, going from +1.6% to +1.7%. However, the core MoM PCE reading is expected to have slid from +0.3% to +0.2%.

Canada will deliver its MoM GDP figure for the month of August. The current expectation is for a worse number, going from the previous +3.0% to +0.9%. If the actual reading comes out as forecasted, or below it, that may prove negative for the Canadian dollar, which might lose some ground against some of its major counterparts.