The big banks start reporting next Friday, July 12th, ’24. Look for JPMorgan (NYSE:JPM), Citigroup (NYSE:C), and Wells Fargo (NYSE:WFC).

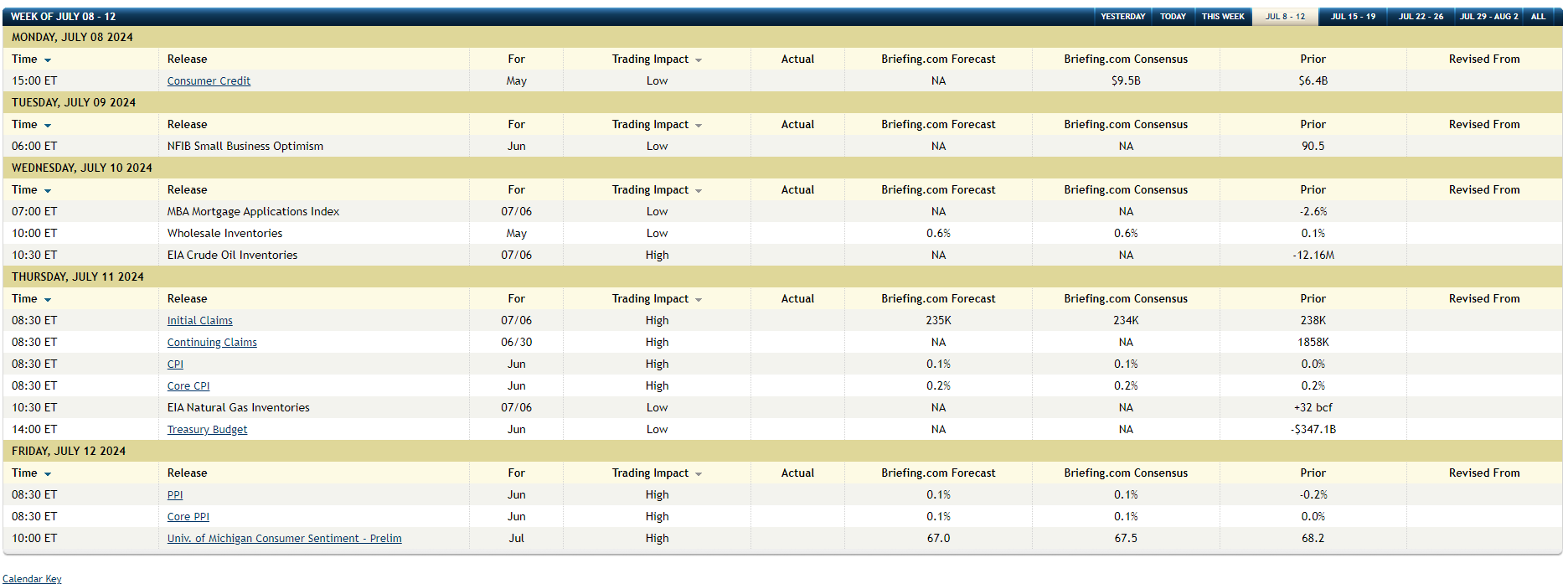

The June CPI and PPI data are also due this week, with CPI Thursday, July 11th, and PPI scheduled for release Friday, July 12th, 2024.

This table from Briefing.com takes readers through the expected economic data for the week of July 7, ’24.

Consumer credit will be released Monday afternoon. It doesn’t typically get a lot of press, but it’s been somewhat weak the last few months.

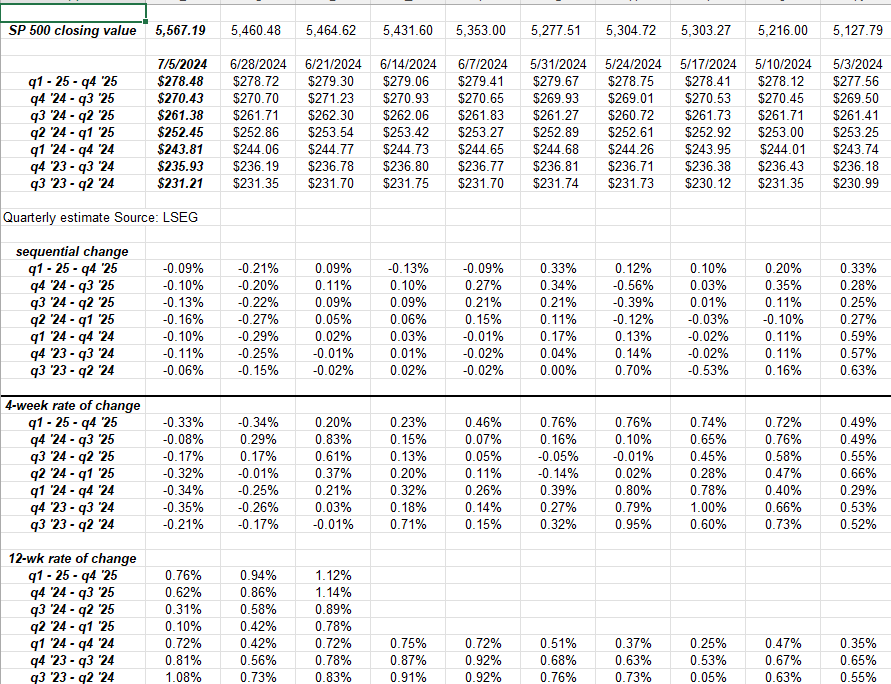

S&P 500 Data:

- The forward 4-quarter estimate jumped $9 this week as the old quarter (Q2 ’24 – Q1 ’25) fell off and new quarter was added (Q3 ’24 – Q2 ’25), with the new forward 4-quarter estimate now $261.39. The forward 4-quarter estimate the first week of January ’24 was $243.98.

- The PE on the forward estimate is now 21.3x versus 21.6x last week and 19x to start 2024.

- The S&P 500 earnings yield jumped to 4.69% from last week’s 4.63% despite the 1.5% increase in the S&P 500 this week, thanks to the big jump in the forward estimate.

- Per LSEG, only 19 companies have reported Q2 ’24 financial results thus far, so “upside surprises” or beat rates, aren’t meaningful yet.

There is no question that the S&P 500 earnings data is supportive of the bull market narrative. S&P 500 earnings are solid (so far).

Rate-of-Change:

This internal table using the expected quarterly EPS estimates for the S&P 500, shows the forward 4-quarter estimates looking out from Q3 ’24 through 2025, and then calculates the rate-of-change for the forward 4-quarter estimates sequentially, for 4 weeks and for 12 weeks.

The unusual strength in May and June ’24 is starting to weaken, but that’s what happens in the last two weeks of each quarter and then the first two weeks of the following quarter, until the earnings release docket starts to ramp.

It will be the week ending July 19th when we should start to see firming once again.

Remember though, the S&P 500 will peak before the S&P 500 EPS estimates start to roll over. While the S&P 500 itself is a leading indicator, I’d say – after doing this weekly post for 20 years – that S&P 500 earnings are more a coincident indicator.

For all the labor put into this weekly blog, readers should watch for negative pre-announcements of major large-cap stocks. I hate to constantly talk about market history, but going back to the year 2000, after the S&P 500 and NASDAQ topped in March 2000, Intel (NASDAQ:INTC) warned in September 2000, and GE’s Jack Welch was using the mainstream media (primarily CNBC) to beat up on Greenspan and warn him of a rapidly slowing US economy, just as the mainstream media was getting wise to GE’s “earnings manipulation” for the last 20 years.

One aspect that is rarely talked about today, is that in terms of earnings quality, the S&P 500 today is light years ahead of the late 1990’s, and where that is apparent is the cash-flow statement.

Technology sector EPS and revenue trends:

- Q2 ’24 (est): tech sector EPS expected to grow +16.9% while tech sector revenue is expected at +9.5% yoy;

- Q1 ’24 actual: tech sector EPS grew +27% yoy, while revenue grew +8.5% yoy;

- Q4 ’23 actual: tech sector EPS grew +24.2% yoy, while revenue grew +7.8% yoy;

- Q3 ’23 actual: tech sector EPS grew 15.3% yoy, while revenue grew +2.8% yoy;

- Q2 ’23 actual: tech sector EPS grew +5% yoy, while revenue was flat yoy;

- Q1 ’23 actual: tech sector EPS fell 8.3% y-o-y, while revenue fell -2.9% yoy;

The trend is your friend. What’s more interesting to me is looking at Q4 ’23 and Q1 ’24, (see the first table in this late June blog post), note the “upside surprise” for technology as each month progressed in the Q4 ’23 and Q1 ’24 quarters.

Tech is facing tougher compares in the back half of ’24, but note that revenue growth for the tech sector is starting Q2 ’24 at its highest level in 18 months.

Conclusion:

This blog has turned cautious on the S&P 500 and the Nasdaq given the bad market breadth, and the lack of participation in the broader market (only two sectors outperformed the S&P 500 YTD in ’24, and those are technology and communication services, per Bespoke), but this “affliction” can continue on indefinitely, as we saw in the late 1990s.

It’s a bull market in (some) stocks, so play it accordingly.

None of this is advice or recommendation, but only a personal opinion. Past performance is no guarantee of future results. Investing can involve the loss of principal, even for short periods of time. All EPS and revenue estimate data is sourced from LSEG.com.

Thanks for reading.