“Other than my Cincinnati Bengals breaking my heart, few things are more consistent than stocks higher in April.”

As a stock nerd and NFL fan, I love this quote from Ryan Detrick, the chief market strategist at LPL Financial (NASDAQ:LPLA).

Historically in April, the S&P 500 has seen gains in 14 of the past 15 years. April has also been the strongest month for stocks over the past 20 years.

April 2021 has been no exception. Although March and Q1, for that matter, ended with more questions than answers, this month has been nothing but white hot.

The month kicked off with a blowout jobs report. It then continued with two consecutive weeks of jobless claims crushing estimates, retail sales coming in almost a third higher than projected, and bank earnings blowing past forecasts. The Dow Jones and S&P 500 seemingly hit fresh record highs every other day, and despite complications with Johnson & Johnson one-dose vaccine, all signs point towards our life returning to normal by this summer.

While optimism is high right now, I implore you to remain cautious. I’m really not sure how much higher the Dow and S&P can go without pulling back somewhat. Not to mention, it still has not been smooth sailing for Cathie Wood stocks or SPACs for the last two months either. This rotation into recovery names is very real.

Remember that every month in 2021 thus far has started off hot and saw a pullback and volatility occur by the second half of the month.

We are now officially in the latter half of April. Although, as I said, April is historically a strong performing month, think about this. By the second half of January, we had Reddit trades spooking investors. In February and March, we had surging bond yields, inflation fears, or comments from Fed Chair Jay Powell that rubbed people the wrong way. These concerns won’t just disappear because we want them to. If we could make things magically disappear, COVID would’ve been over yesterday.

According to Binky Chadha, Deutsche Bank’s chief U.S. equity strategist, we could see a significant pullback between 6% and 10% over the next three months because of potentially full valuations and inflation fears. Even if this $2-trillion infrastructure plan doesn’t pass in full, do we really need to spend any more trillions with an economy starting to turn red hot?

Plus, how do you think this will be paid for? Hiking taxes, namely corporate taxes. Those gains that high growth stocks saw after then-U.S. President Donald Trump cut corporate taxes in 2017 could very well go away. While President Biden has indicated a willingness to negotiate his 28% corporate tax proposal, it’s still a tax hike.

To sum it up:

We’re hot right now.

However, we could see more volatility and more muted gains than what we’ve come to know over the last year.

April is historically strong, but please monitor overvaluation, inflation, bond yields and potential tax hikes. Be optimistic but realistic. A decline above ~20%, leading to a bear market, appears unlikely. Yet, we could eventually see a minor pullback by the summer, as Deutsche Bank said.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Dow Jones: How Much Higher Could We Go?

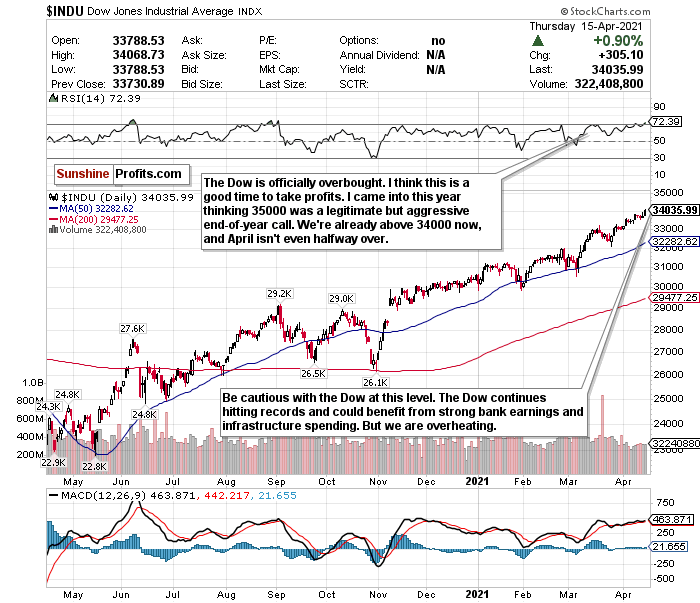

Figure 1: Dow Jones Industrial Average

The Dow Jones remains red hot in 2021. Strong bank earnings, a recovering economy, and the potential for further infrastructure spending have sent the index to record highs in what seems to be every other day. Unfortunately, we are nowhere close to buyable any longer and are firmly overbought with an RSI over 72.

For the longest time, I’ve said to 'hold' the Dow and let the gains ride. Now, I think it’s an excellent time to trim and take profits. Many analysts believe the index could end the year at 35,000 or higher, and the wheels are still in motion for that to happen. The problem, though? We’re above 34,000, and we’re only in mid-April.

You could do a heck of a lot better for a buyable entry point.

Having Dow exposure is valuable. The index has many strong recovery cyclical plays that should benefit from what appears to be an economic recovery and reopening going even better than expected. The Dow could also be quite beneficial as a hedge against volatile growth stocks and SPACs. You won’t see bond yields spooking this index as much.

But at this level, it’s probably better to 'sell' and consider trimming profits.

For an ETF that aims to correlate with the Dow’s performance, the SPDR® Dow Jones Industrial Average ETF Trust (NYSE:DIA) is a great option.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI