However, there are times when a company will pre-announce estimates of forecasts weeks or days prior to the actual announcement. This tactic can be viewed as a “mid-course correction” giving the investors a “heads-up” so there aren’t extreme negative surprises on the actual earnings report date. Pre-announcements can be either positive or negative but most tend to be geared to pessimistic forecasts. This article will highlight, explain and categorize the reasons why companies may choose to pre-announce earnings reports.

Regulatory

Companies that trade shares on US exchanges are subject to the rules and regulations of the SEC (Securities and Exchange Commission). The SEC serves to protect investors and requires corporations to share and disclose meaningful information to all investors. In other words, all investors should have the same information within the same time frame. As soon as meaningful information is obtained, companies are required to share that information with the entire investment community.

Cynical

Skeptics may feel that pre-announcements are more manipulative in nature, avoiding the embarrassment of competitors positive reports during earnings season. As analysts use the mid-course correction to re-analyze report consensus, there may actually be a positive tone when the reports are actually made public.

Marketing

The hope is that their investors will focus in on the openness of the early disclosure rather than the disappointing results. When earnings season arrives, companies that pre-announce may out-perform those that did not, attracting future investors rather than losing current ones.

Legal

Shareholders can sue companies that have information that is not shared with their investors claiming that money was lost as a result of not having information which the company was aware of. For example, investors who purchase the stock after the company had access to the unfavorable report can claim a lack of transparency on the part of the corporation. These lawsuits may not decide favorably for the investor but can prove to be expensive and time-consuming for the company.

Discussion

There are several reasons why a company may pre-announce earnings. Most make good sense as a corporate action. We, as option-sellers, can be impacted by an earnings pre-announcement either favorably or unfavorably, usually the latter. Since we do not know if and when they will occur, there is nothing we can do about them as with all other unexpected news disclosures. Keep in mind that frequently pre-announcements will occur in the same contract month as the actual report so we may not even own those shares at the time of the announcement as we routinely avoid earnings reports in the BCI methodology. When we can mitigate risk, we always take advantage of those situations as we do when we avoid the actual earnings releases. When share value declines due to an unfavorable pre-announcement we turn to our exit strategy arsenal.

Market tone

Global stocks set record highs this week in an environment of moderate growth and accommodative central bank policies. European shares have been laggards impacted by the recent rise in the euro, which hurts export competitiveness. The price of West Texas Intermediate crude oil remained unchanged at $46.35. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), was steady at a historically low 9.32. This week’s economic and international news of importance:

- Equity prices continue to rise, buoyed by a solid start to earnings season and steady interest rates. Among the indices setting records this week were the S&P 500, the MSCI World (NYSE:URTH), the Russell 2000 and the NASDAQ Composite

- For the year ended March 2017, foreign investment in US residential real estate hit a high, according to the National Association of Realtors

- Efforts by Senate Republicans to repeal and replace Obamacare went down to defeat this week, and work to repeal the 2010 health care law and replace it later has been complicated by news that Arizona senator John McCain was recently diagnosed with an aggressive form of brain cancer

- The Bank of Japan postponed by another year the date it expects to achieve its 2% inflation target

- European Central Bank president Mario Draghi said the bank did not discuss tapering asset purchases at its meeting on Thursday but would address the issue this fall

- With 21% of S&P 500 companies having reported, the Q2 earnings season has gotten off to a solid start. Seventy-six companies reported an 8.6% rise in earnings on 5.4% revenue growth

THE WEEK AHEAD

Monday July 24th

- Global July flash purchasing managers indicies

- US existing home sales

Tuesday July 25th

Wed, July 26th

- United Kingdom Preliminary Q2 gross domestic product

Thu, July 27th

- US Fed interest-rate decision

- US Durable goods orders

Fri, July 28th

- US Preliminary Q2 gross domestic product

For the week, the S&P 500 rose by 0.54% for a year-to-date return of 10.44%

Summary

IBD: Market in confirmed uptrend

GMI: 6/6- Buy signal since market close of July 13, 2017

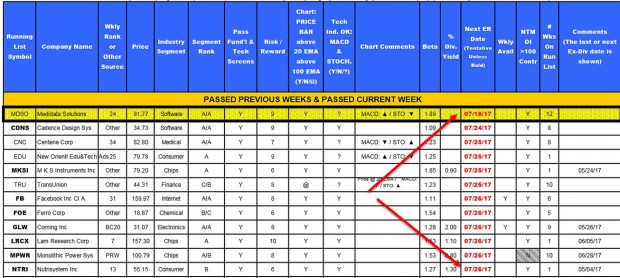

BCI: I am fully invested in the stock portion of my portfolio currently holding an equal number of in-the-money and out-of-the-money strikes. Planning to move to a more bullish position for the August contracts favoring out-of-the-money strikes 3-to-2.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a bullish outlook. In the past six months, the S&P 500 was up 9% while the VIX (9.32) moved down by 20%.

Much success to all,

Alan and the BCI team