US futures are pointing to a stronger open on Thursday, with the NASDAQ seen leading the way boosted by earnings from Facebook (NASDAQ:FB) as we await results from a number of other companies on what is likely to be one of the biggest days of earnings reports this year.

Earnings Filling the Void Left By Trump’s Failures

Earnings season has arguably taken on additional importance this quarter due to the inability of Donald Trump to, so far, deliver on the growth agenda that won him the White House back in November. While US Treasury yields have come off their post-election highs and the dollar has fallen to a more-than one year low, the three major stock indices – which are up around 20% since early November – continue to trade at record highs.

Even in the absence of tax cuts and fiscal stimulus, corporate America has continued to perform well as is once again evident in this seasons results, with companies exceeding expectations on both the top and bottom line. With so many companies reporting today – 73 of those on the S&P 500 – a continuation of this performance could see more record highs being registered in the US, even as investors continue to question whether there remains value in the country compared to other areas such as Europe.

USD Softer as Fed Inflation Concerns Grow

The US dollar is under pressure again on Thursday after the FOMC statement on Wednesday failed to convince traders that the pace of tightening won’t slow in the years ahead. While the Fed did suggest that the unwinding of its balance sheet will begin relatively soon, it also repeatedly referred to inflation running below target, a concern that has been highlighted by policy makers in recent months. With traders already not convinced that we’ll see another rate hike this year, these statements don’t do anything to change that.

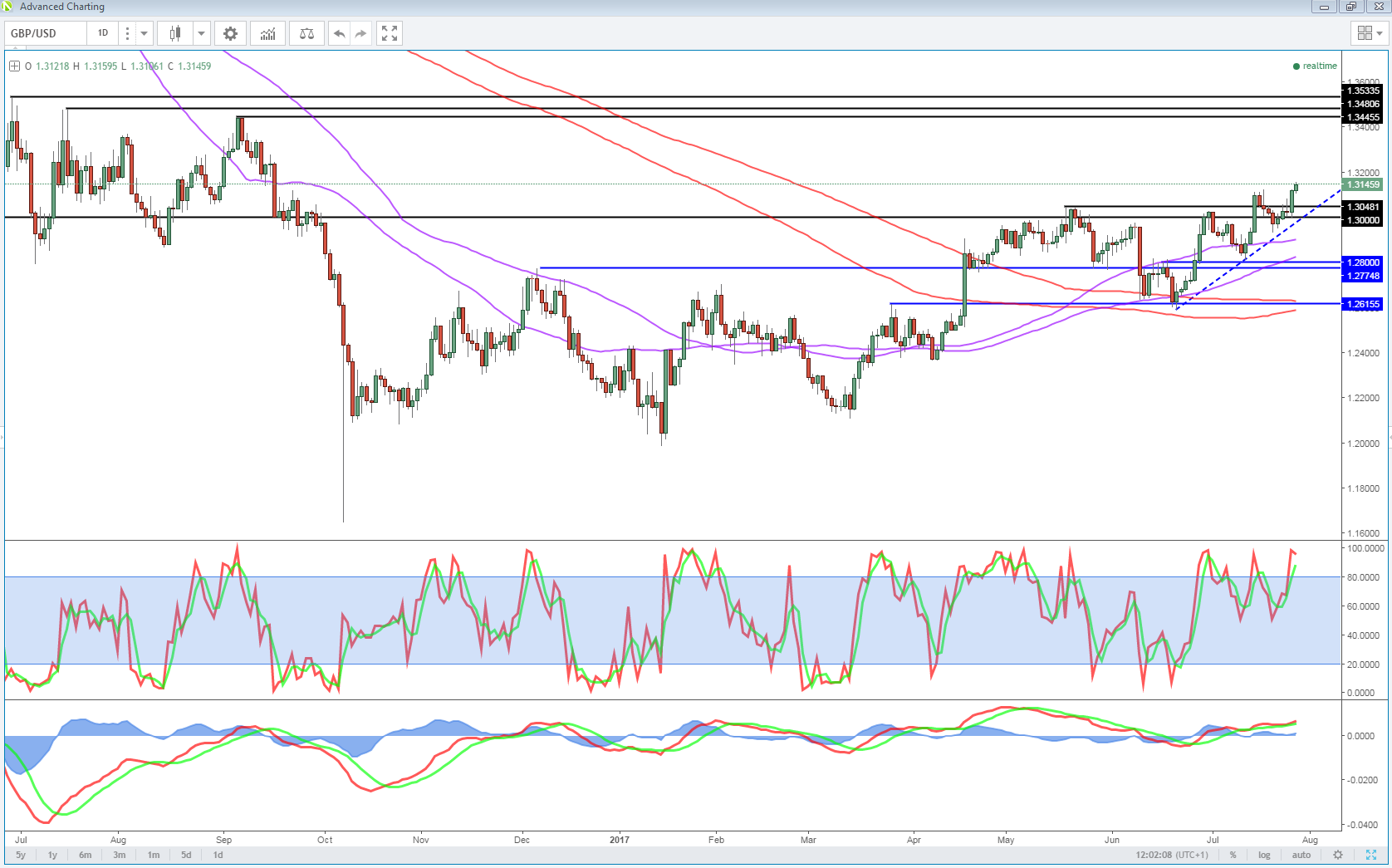

GBPUSD Trades at 10-Month High on USD Weakness

The pound hit a new 10-month high against the dollar, aided by the weakness in the greenback and a break through 1.31 which had previously been a strong resistance zone. While gains today have been more moderate, the break could be quite a bullish signal for the pair and see it possibly heading back towards last summer’s levels of 1.35 in the months ahead. The move has also seen the pound make gains against the euro and yen, although the former still appears to be very much in the driving seat at the moment.

Earnings aside, we’ll get some data from the US today with durable goods orders and jobless claims being released. The more closely watched core durable goods orders number can be quite volatile from month to month but the last few have disappointed and it will be interesting to see whether this trend can be broken today.