A bright start Tuesday, with opening gap gains that ultimately were unable to follow through.

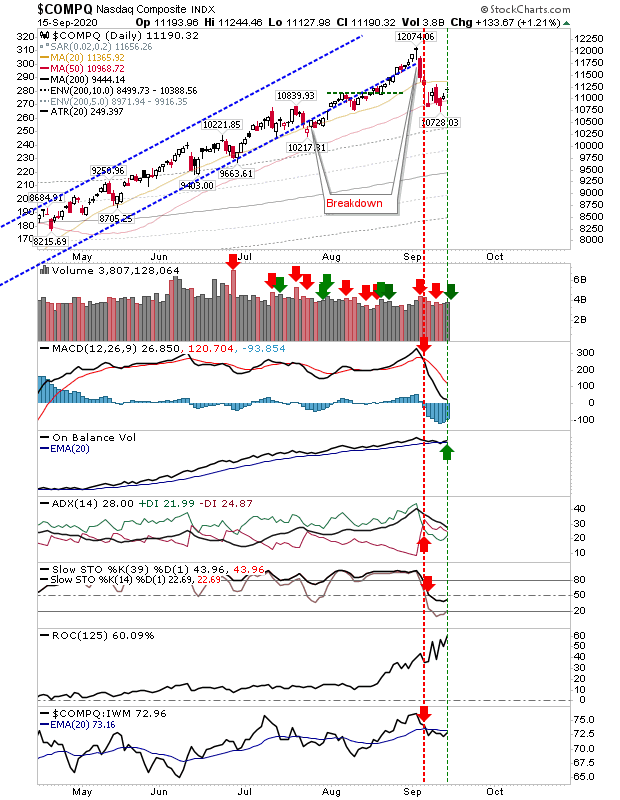

The NASDAQ gain came off its 50-day MA with a higher volume (accumulation) bounce. The gains were enough to see a 'buy' trigger in On-Balance-Volume but other technicals remain negative. However, as long as he 50-day MA holds this should be viewed as a pullback in a bullish advance.

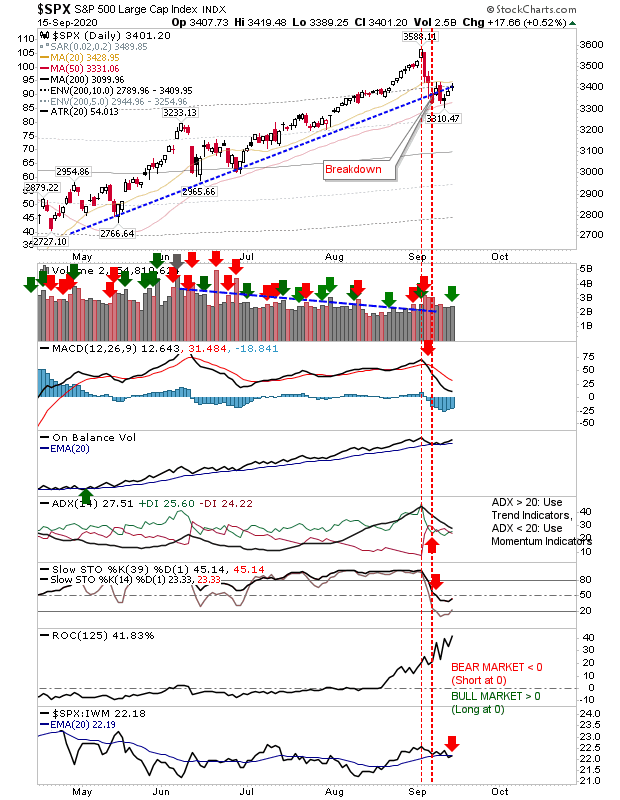

The S&P finished with a doji like the NASDAQ, but without the same gap higher. The spike low from last week bisected the 50-day MA in a successful pullback defence. Technicals, aside from OBV, are bearish. However, the move back to the 50-day MA also registered as a breakdown in the 4-month rally and at the very least marks a shift in the rate of advance.

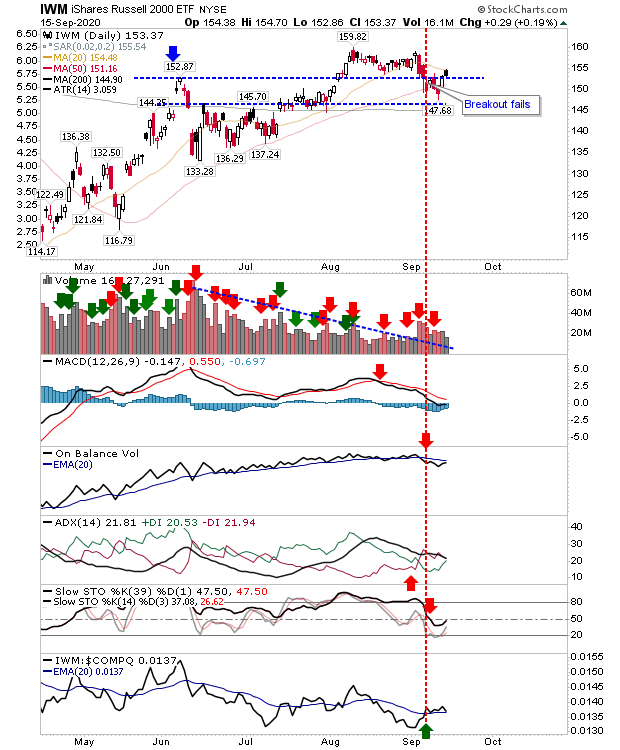

The Russell 2000 (via IWM) finished the day with a bearish black candlestick as it was rebuffed by the 20-day MA. However, in doing so it managed to get itself above breakout support.

It's currently outperforming the NASDAQ and S&P, which marks potential rotation into Small Cap stocks—a secular bullish event. But, for this to be maintained, it will be important for breakout support to hold.

There is a shift from 'high flying' Technology and Large Cap stocks into under appreciated Small Caps stocks. This may turn out to be bullish in the long term. However, we will need to see continued buying of Small Cap stocks with a new reaction high beyond $160 (IWM) to establish a continuation trend.