The drug pricing controversy continues to make news with lawmakers now questioning Medicaid rebates for Mylan N.V.’s (NASDAQ:MYL) EpiPen and Democratic Presidential candidate Hillary Clinton announcing a health care plan that will address the excessive price hikes of treatments that have been available for years.

But First a Look at the EpiPen Medicaid Issue…

Mylan is currently in the midst of a drug pricing controversy due to a huge hike in the price of EpiPen -- according to lawmakers, as of May 2016, Mylan hiked the price of this life-saving combination product by more than 480% in the U.S. – from $103.50 for a set of two in 2009 to $608.61. While Mylan took steps to lower the impact of this issue by increasing the maximum value of its savings cards to $300 (from $100), expanding eligibility of its patient assistance program and announcing the upcoming launch of a generic EpiPen at a 50%+ discount to the branded product, the company remains in troubled waters with lawmakers now questioning Medicaid rebates for the product.

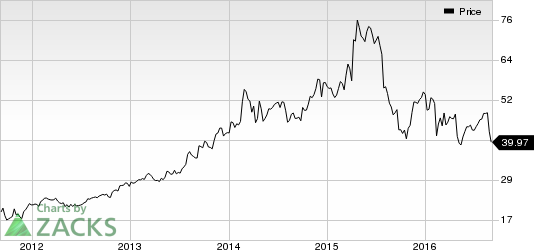

U.S. Senator Amy Klobuchar said that the Centers for Medicare & Medicaid Services (CMS) found that Mylan had misclassified EpiPen as a “Non-Innovator Multiple Source Drug,” or a generic drug. This led to millions of dollars in overpayment for the drug by states and the federal government through the Medicaid Drug Rebate Program. Klobuchar said that the Minnesota Department of Human Services has estimated that this misclassification will cost the state more than $4 million dollars in overpayment this year alone. And this is just one state, one drug and one year. Klobuchar said that an immediate and thorough nationwide investigation into the overpayments by all states should be conducted. Mylan’s shares are down 24% so far in 2016.

MYLAN NV Price

Clinton Unveils New Plan

Meanwhile, Hillary Clinton, who had tweeted about the EpiPen pricing controversy, announced a new plan to curb drug prices. In her statement, she mentioned that during the 2008-2015 timeframe, prices of almost 400 generic drugs were hiked by more than 1,000%. Most of these drug companies did not even manufacture the drugs themselves -- they acquired the drugs and raised the prices.

Clinton’s plan includes the setting up of a group that will check whether a longstanding treatment has been priced exorbitantly – once this is established, steps will be taken like increasing competition and making alternate treatments available, emergency importation of treatments from developed countries with strong safety standards and holding drug makers accountable for unjustified price increases with new penalties.

Clinton reaffirmed her earlier broader plan as well which was announced last year in September with the aim to lower drug prices for all Americans.

Impact on Drug Stocks

Over the past one year, drug companies have been under immense pressure due to the pricing controversy. While the high price of drugs has always been a matter of concern, political and media focus on this issue has increased significantly since last September following Hillary Clinton’s “price gouging” tweet.

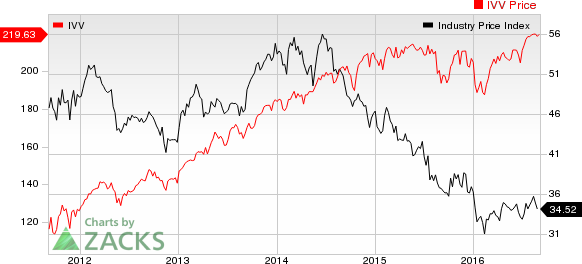

Both pharma and biotech stocks with high-priced drugs have seen their share prices falling reflecting investor concerns regarding their profitability if drug prices are cut. While the NASDAQ Biotechnology Index is down 20.3% over the past one year, the NYSE ARCA Pharmaceutical Index lost 6% during this period.

MEDICAL-BIOMED/GENETICS Industry Price Index

Valeant Pharmaceuticals International, Inc. (NYSE:VRX) was one of the companies hit hard by the pricing controversy due to its strategy of acquiring companies and selling their drugs at higher prices with shares declining 87.7% over the last one year. Other companies that were affected by the increasing focus on drug prices last year include Gilead Sciences Inc. (NASDAQ:GILD) and Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) among others.

Meanwhile, earlier this year, lawmakers asked the Department of Health and Human Services and the National Institutes of Health (NIH) to hold a public meeting related to the pricing of Medivation, Inc. (NASDAQ:MDVN) and Astellas Pharma, Inc.’s (OTC:ALPMY) prostate cancer drug, Xtandi.

With drug costs remaining a major concern and lawmakers focusing on the need to control drug prices and make prescription drugs affordable, drug companies may find it a bit difficult to justify their high prices by citing the years and funds that go into bringing new treatments to market and the need to invest in R&D to bring additional treatments to market.

According to the Aug 2016 Kaiser Health Tracking poll, two-thirds of voters believe the future of Medicare and access and affordability of health care are top priorities for the candidates to be discussing during the 2016 presidential campaign.

Irrespective of who wins the presidential race, drug pricing will remain a topic of discussion among policymakers, the media and the general public. We expect to see more volatility in this sector as the drug pricing debate continues.

Confidential: Zacks' Best Investment Ideas

Would you like to see a hand-picked "all-star" selection of investment ideas from the man who heads up Zacks' trading and investing services? Steve Reitmeister knows when key trades are about to be triggered and which of our experts has the hottest hand. Click for his selected trades right now >>

VERTEX PHARM (VRTX): Free Stock Analysis Report

GILEAD SCIENCES (GILD): Free Stock Analysis Report

MEDIVATION INC (MDVN): Free Stock Analysis Report

MYLAN NV (MYL): Free Stock Analysis Report

VALEANT PHARMA (VRX): Free Stock Analysis Report

Original post

Zacks Investment Research