We are entering the peak period of the second-quarter reporting cycle this week. The quarter, undoubtedly, is off to a strong start.

As of Jul 21, 2017, 97 S&P 500 members, accounting for 28.1% of the index’s total market capitalization, reported results, according to Earnings Preview. Of these, 59.8% beat both revenues and earnings estimates compared with 50.5% in the first quarter.

Total earnings for these 97 index members were up 8.4% from the year-ago quarter on a 5.1% improvement in revenues. The beat ratio was 78.4% for earnings and 72.2% for revenues.

The earnings momentum is expected to continue through the season. Per the report, total earnings for S&P 500 companies in the second quarter are expected to grow 8.6% year over year on 4.7% higher revenues. This follows 13.3% earnings growth in the first quarter on 7% increase in revenues, the highest in almost two years.

Among the pharma bigwigs, Johnson & Johnson (NYSE:JNJ) J&J reported mixed second-quarter results, beating on earnings but missing on sales. On the other hand, Novartis’ (NYSE:NVS) second-quarter results were encouraging as the company topped both earnings and sales estimates. On Jul 25, Lilly (NYSE:LLY) and Biogen Inc. (NASDAQ:BIIB) released their second quarter results. Both the companies beat earnings and revenue estimates. Lilly raised its previously issued 2017 adjusted earnings and sales outlook. Biogen also raised its earnings and sales outlook for 2017.

Let’s take a look at three pharma giants that are set to report second-quarter results on Jul 26. Let's see how things are shaping up for this quarter.

Gilead Sciences, Inc. ( (NASDAQ:GILD) )

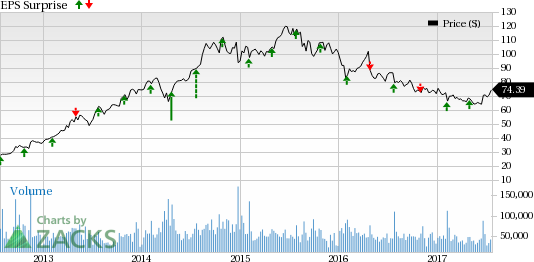

Gilead which is scheduled to release earnings after the closing bell, had delivered a positive earnings surprise of 0.92% last quarter. Gilead’s earnings performance has been mixed with earnings missing expectations in one of the last four quarters and beating in the remaining three, resulting in an average positive surprise of 3.52%.

For this quarter, Gilead has an Earnings ESP of +3.32% and a Zacks Rank #3 (Hold), indicating a likely beat this quarter. The Zacks Consensus Estimate is pegged at $2.11 per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

HIV and other antiviral product are expected to boost sales in 2017. However, the HCV franchise continues to be under pricing pressure. (Read More: Is Gilead Poised for a Beat This Earnings Season?).

Vertex Pharmaceuticals, Inc. (NASDAQ:VRTX)

Vertex is also scheduled to announce results after the closing bell. Vertex’s average positive earnings surprise for the last four quarters is 406.25%. In the last reported quarter, Vertex posted a positive surprise of 225%.

The company has an Earnings ESP of +33.33% and a Zacks Rank #1 (Strong Buy) and is thus expected to beat earnings estimates this quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

Investor focus at Vertex’s second conference call will be on its triple combination cystic fibrosis (CF) regimens, which are crucial for long-term growth of Vertex. Data from VX-152 and VX-440 phase II and VX-659 phase I triple combination studies presented last week, have showed that all three combinations led to a pronounced improvement in lung function.. (Read More:Is a Beat in the Cards for Vertex in Q2 Earnings?)

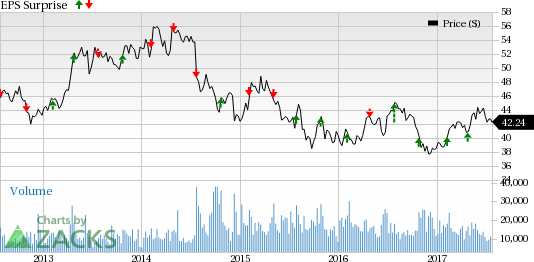

GlaxoSmithKline plc (NYSE:GSK)

The company is expected to report before market hours. GlaxoSmithKline reported in-line earnings last quarter. Glaxo’s performance has been pretty impressive, with the company reporting positive surprises consistently. The average earnings beat over the last four quarters is 12.28%.

The company has an Earnings ESP of 0.00% and a Zacks Rank #3.

Glaxo’s Pharmaceuticals and Vaccines segments are expected to drive sales in the second quarter as well. Meanwhile, the Consumer Healthcare segment has slowed down due to the impact of general sales tax and continued slowdown in the nutrition category in India, challenging economic conditions in some other international markets and the Nigerian beverage business divestment. These factors might impact second-quarter results as well. (Read More: What Lies in Store for Glaxo this Earnings Season?)

Eli Lilly and Company (LLY): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

GlaxoSmithKline PLC (GSK): Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Biogen Inc. (BIIB): Free Stock Analysis Report

Original post

Zacks Investment Research