Dragon Boat festivals in China and a holiday heavy Monday globally saw muted trading in Asia, but a data-heavy week should see the pace increase towards Friday’s Non-Farm Payrolls.

Monday’s Asia session was unlikely to be a memorable one with China and Taiwan being joined by Hong Kong tomorrow for the Dragon Boat Festival holiday. This meant no CNY fixing this morning either to enliven proceedings. The day will likely continue in this vein as both the United Kingdom and the United States have holidays today as well. The calm is unlikely to last though, as the week turns very data heavy with plenty of Tier 1 data culminating in the Non-Farm Payrolls on Friday. (see calendar below)

Other highlights Include Thursday’s Crude Inventory’s being the first major energy data point post last week’s OPEC meeting. This afternoon in Europe we have the ECB’s, Draghi speaking and one Wednesday we have China’s KManufacturing PMI. Any one of the above can rock the boat ahead of Friday.

During the Asian session, we saw an almost mandatory North Korean missile test which the markets completely ignored.

Equities

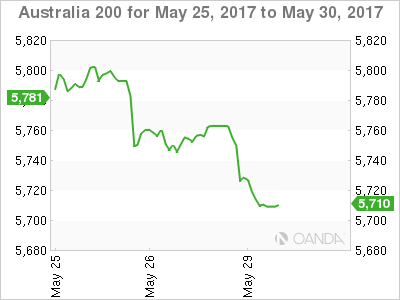

Asia equity markets traded sideways after an equally dull US close on Friday, with the region mixed holiday-thinned trade. The ASX 200 (-0.5%) as banks were sold, while the Nikkei 225 (+0.1%) and the Heng Seng (+0.1%) index delivered range-bound sessions.

FX

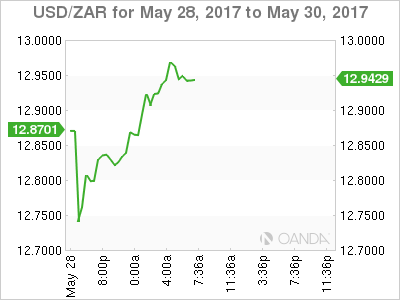

South African President Zuma survived an attempt by members of his ANC party order him to step down. This caused a brief flurry in the early hours of this morning with the ZAR rallying initially on the attempt news. But giving back most of its gains when the motion failed. If nothing else, demonstrating the market’s thoughts on Mr Zuma’s performance.

Oil

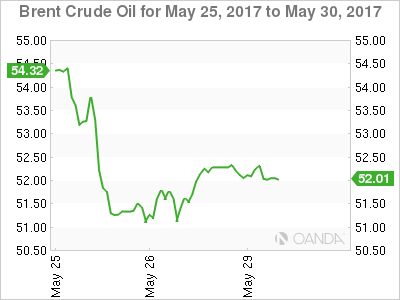

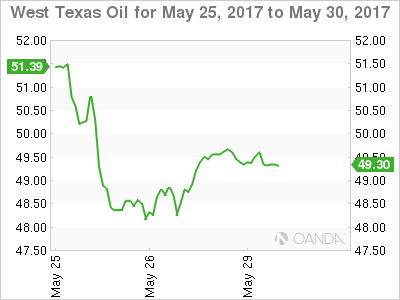

After the ructions of last Thursday and Friday, crude oil has had a quiet start to the week in Asia. Oil bounced some four percent on Friday, probably reflecting the short-term oversold nature of the market after Thursdays gigantic post-OPEC sell-off, rather than any structural shift.

Brent spot opened at 52.25 with support at 51.00 and resistance at 53.00.

WTI spot opens at 49.50 with support at 48.00 and resistance at 50.50.

Most likely, both contracts will struggle to make substantial progress to the upside in the early part of the week ahead of Thursday’s crude inventories from the U.S.

Gold

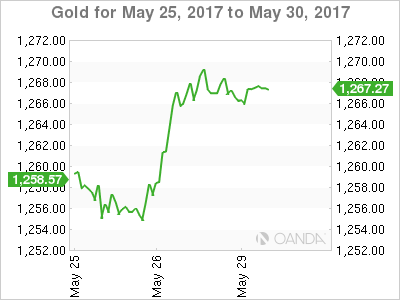

Friday’s 12 dollars safe-haven induced rally continued today with gold holding onto all of its gains in Asia. Movements in gold will likely be inversely correlated to the movements in oil and headlines coming out of Washington. Gold trades at 1267.00 with resistance at Friday’s highs around 1270.00 initially with support at 1265.00 and then 1257.00.

This week’s highlights.

Monday, May 29

13:00 EUR ECB President Draghi Speaks

Tuesday, May 30

12:30 USD Personal Consumption Expenditure Core (YoY) (APR)

14:00 USD CB Consumer Confidence

23:00 NZD RBNZ Financial Stability Report

Wednesday, May 31

01:00 China Manufacturing PMI

07:55 German Unemployment

09:00 Eurozone CPI

Thursday, Jun 1

01:30 AUD Private Capital Expenditure q/q

01:30 AUD Retail Sales m/m

08:30 GBP Manufacturing PMI

12:15 USD ADP Non-Farm Employment Change

12:30 USD Unemployment Claims

14:00 USD ISM Manufacturing PMI

15:00 USD Crude Oil Inventories

Friday, Jun 2

08:30 GBP Construction PMI

12:30 USD Non-Farm Employment Change

12:30 USD Unemployment Rate