After a rough fourth quarter of 2018, the stock market has been in rebound mode in 2019. In fact, the Dow Jones Industrial Average (DJI) and NASDAQ Composite (IXIC) just notched their sixth straight weekly wins -- a feat not accomplished for either index since late 2017. What's more, the strength the Dow and NASDAQ have shown during this most recent win streak is something Wall Street hasn't seen since right around the March 2009 bottom.

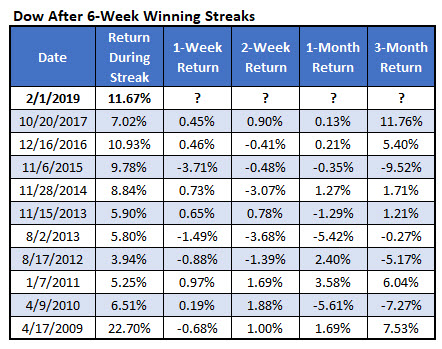

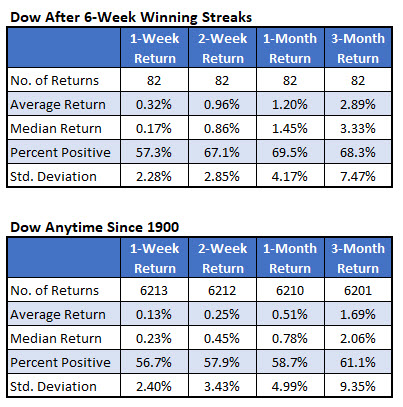

Specifically, the DJI gained 11.67% during this year's six-week rally -- the biggest gain during such a streak since it surged 22.7% in the six weeks ended April 17, 2009. Likewise, the NASDAQ shot 14.7% higher during the latest weekly win streak -- the biggest since that same stretch after the March 2009 bottom, when it rallied 29.31%, per data from Schaeffer's Senior Quantitative Analyst Rocky White.

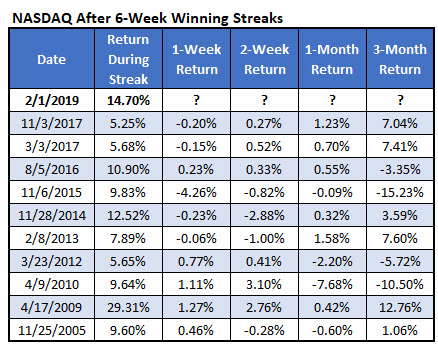

Historically, six-week winning streaks have preceded even more strength for both indexes. The Dow has enjoyed 82 of these streaks since 1900, after which the blue-chip barometer extended its run to a seventh week 57.3% of the time, averaging another one-week gain of 0.32%. That's compared to an average anytime one-week gain of 0.13%, with a win rate of 56.7%.

In fact, the DJI tends to outperform at all checkpoints, looking three months out. A month after six-week win streaks, the index was up 1.2%, on average -- more than twice its average anytime return -- with a stronger-than-usual win rate of 69.5%. Three months later, the DJI was up 2.89%, on average, and higher 68.3% of the time -- much better than usual.

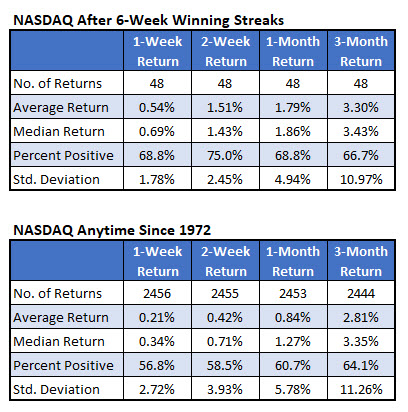

It's a similar story for the NASDAQ. There have been 48 six-week win streaks since 1971, and the IXIC went on to enjoy a seventh straight weekly gain 68.8% of the time, averaging a one-week return of 0.54%. That's compared to an average anytime one-week gain of just 0.21%, with a positive rate of 56.8%.

Two weeks out, the NASDAQ was up 1.51%, on average -- more than three times its average anytime two-week return of just 0.42% -- and was higher a whopping 75% of the time. Three months later, the IXIC averaged a stronger-than-usual gain of 3.3%, and was higher two-thirds of the time.