Following a second consecutive week of choppy trading, bull conviction has significantly diminished, while bears struggle to capitalize on daily setups. Though oversold, price rebounds are consistently vanishing at resistance levels. This week, the market is expected to find a directional resolution.

1. Dow Jones - The Godfather of the Indices Shows How Price Is at a Critical “Make or Break” Level

Based on the volume profile indicator, see the different shelves and gaps between them as follows:

- A) The indecision candle that anticipated the reversal in February happened at the higher edge of the shelf, since the reversal occurred, the move from the top to the bottom happened rapidly.

- B) Price action is looking for consolidation at the lower edge, in confluence with the annual $41,7K level. A loss of the current shelf could send price rapidly through the volume gap B, as you will see it happened with IWM in the following chart. Price action travels rapidly in volume “limbos”.

- C) Is the next strong support level if the $41.7K zone is lost, next week we will learn if the 40MA acts as a strong resistance.

- D) There Is a more dramatic volume gap, which as of now is presented since it is part of the chart, but as of now let’s be focused on A and the possibility of migrating to B.

Which direction? The Dow Jones index today suggests a bullish continuation if the key level of $41,882.8 continues as support and more importantly, if the monthly $42,103.7 level that sets resistance during all the week is conquered. If those two conditions happen, the immediate bullish target of $42,352.8 (very close to the 40MA).

Conversely, if the price breaches $41,882.8 and drops to $41515.3, it would indicate a potential bearish reversal. If the bullish target is conquered, the next level to watch is $42,720.3.

2. IWM - This Is What Happens When a Volume Shelf Is Lost

See the rapid move when $217 was lost; the volume gap was passed quickly and price action today is trying to find support at the higher edge of the volume shelf. The difference with Dow Jones is that oscillators are oversold already and price action shows two consecutive weeks of indecision, opening the technical doors for a bounce. This type of indecision at the lower Bollinger band has preceded bounces as highlighted in the chart.

Small caps would confirm the bullish reversal if the price recovers $204.4, with an immediate target of $207.1. If the price action doesn’t make it above $204.4, the potential bearish reversal towards $201.1 would be likely.

The same in-depth charts and analysis describing the current setups, with price targets and key annual support and resistance levels continues for SPX, VIX, NDX, SMH, PLTR, DXY, GLD, SLV, TLT, MSTR), GOOG, AAPL, NVDA, META, MSFT, TSLA, AMZN, and BTC; with volatility and breadth indicators analyzed. If you actively invest or trade any of these securities, this publication is essential for making informed investment decisions.

Last week, the charts open for everyone were SMH and PLTR (as today DJI and IWM), presenting bullish setups; one was confirmed for PLTR since the stock jumped 5% this week; while SMH continues with constructive price action.

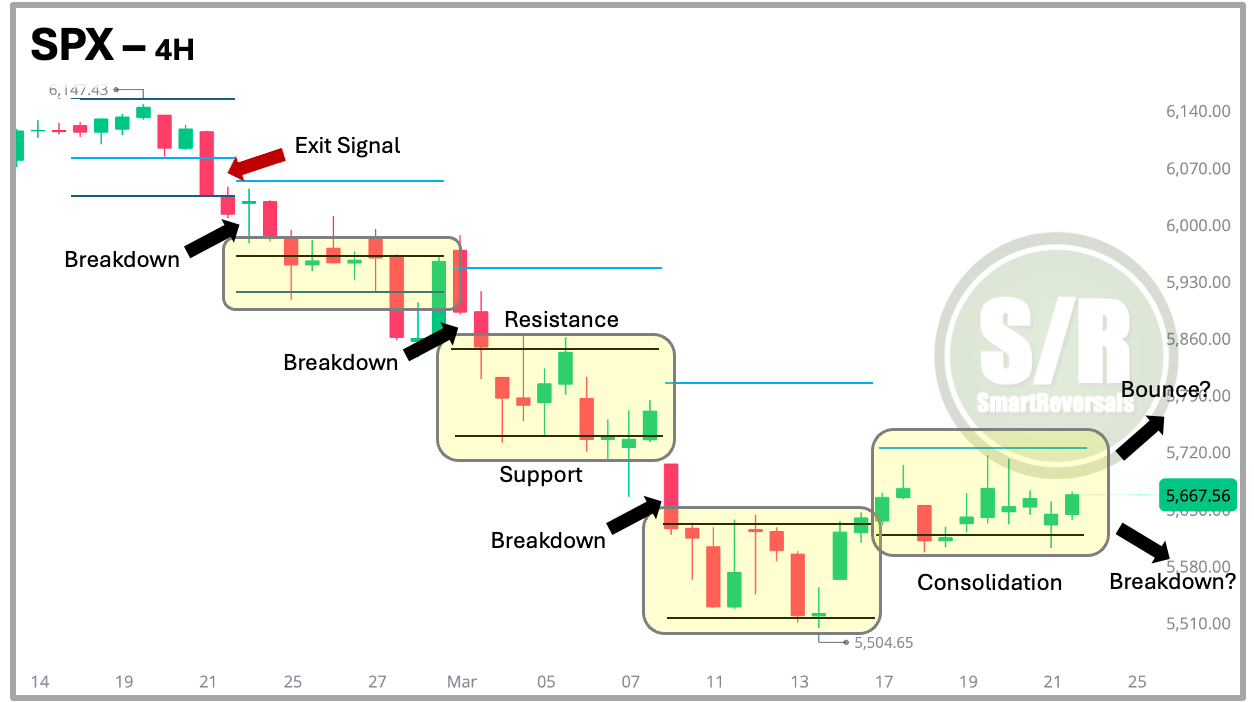

3. SPX - The Importance of the Support and Resistance Levels

Every Friday a set of levels is published for the next week, those S&P 500 levels have proven to be a reliable frame of the incoming price action.

Those levels include a central level among layers of support and resistances, that central or key level is charted below with a blue line, and when it is breached by a 2H or 4H candle a sell signal is triggered. The central level was the confirmation of the major top thesis one month ago.

During the recent weeks, price action has done a rapid down move and stays in specific ranges based on the S/R levels posted before price action occurs, and for 35 securities, for access to the levels for next week click here.

The latest price action showed signs of consolidation, the levels for next week are below, with the technical reading that suggests the direction for next week.

In this publication, I use volume profile and Bollinger bands for most of the charts, and the most interesting element is that price reached the lower band and volume shelfs that one month ago would have sounded simply improbable. Nothing is improbable for the market when an indicator is raising a flag. For Educational content click in each one of the following three links. A paid subscription grants you access to all the links shared: Bollinger Bands - Volume Profile - Educational Technical Library

SPX - Bounce or Break?

SPX: A bounce is likely considering oversold conditions like price action below the weekly Bollinger band and the indecision candle; in the daily timeframe bullish continuation is likely considering candle and bullish MACD crossover.

During the week that just ended, the monthly level $5,670 rejected price every day. Since that line continues valid for one more week, it is one additional reference to watch (First of the four indicators to track). The index today indicates a bullish continuation if the price maintains above $5,660.2, with an immediate target of $5,722.7. If the price breaches the key level of $5660.2 it may fall to $5605.1.

The possibility for a rapid move upcoming is likely, in that case it’s worth considering $5,777.8 as the extended bullish target, and $5,542.6 for the bearish scenario. Technicals favor the bullish thesis.

If $5,777.8 is reached (which is likely), price action has to be monitored carefully, since that level is the one that makes the difference between a corrective or an impulsive bounce.

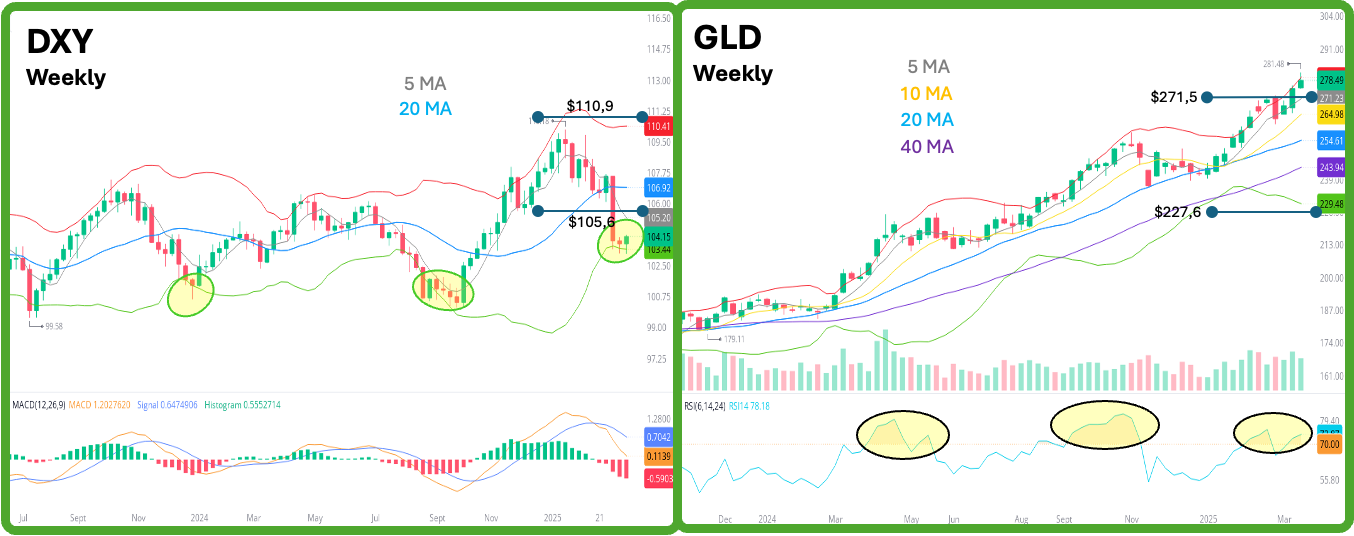

4. US Dollar Index

{{8827|DXY}}: A bounce is likely, this looks like a bottoming process as the one observed in November 2023 and October 2024, when indecisive candles appeared at the lower Bollinger band. $104.1 is the support level that if held, price could jump towards $106, with a hiccup at $105. Not much more downside is expected.

5. Gold Remains in Bull Trend

GLD: Gold is its bullish trend drawing a potential bearish divergence with lower RSI and higher price. Bullish continuation is dependent on the key level of $278.5 holding as support, with an immediate target of $281.5. A breach below $278.5, would aim at $275.4.

6. Bitcoin: Bounce Incoming?

The 40 weekly average, which is as relevant as the 200 daily average, is supporting price, and Stochastic reaching oversold levels maintains the thesis that a bounce is incoming.

See price action in September 2023 and 2024, the lower Bollinger band and the 40MA were both reached (and breached), with price less oversold. Bitcoin is in a zone where price action may favor the bulls even if the bounce incoming is technical or short-lived.

$88,6K continues as the key level that must be recovered to validate the bounce thesis, and given the weekly doji the targets remain similar to last week: 98K can be reached if $88,6K is recovered, otherwise $78-$79K could be tested.

***

The same in-depth charts and analysis describing the current setups, with price targets and key annual support and resistance levels for VIX, NDX, SMH, PLTR, SLV, TLT, MSTR, GOOG, AAPL, NVDA, META, MSFT, TSLA, and AMZN; with breadth indicators can be found at www.smartreversals.com.