First off, the dashed hope of a rocking bear market which ran so fervently early this year has been smothered to death in its crib. Volatility is, once again, a pathetic joke. We’ve got a sub-teens VIX, which doesn’t happen that frequently (I’ve tinted this sad, sad zone for clarity).

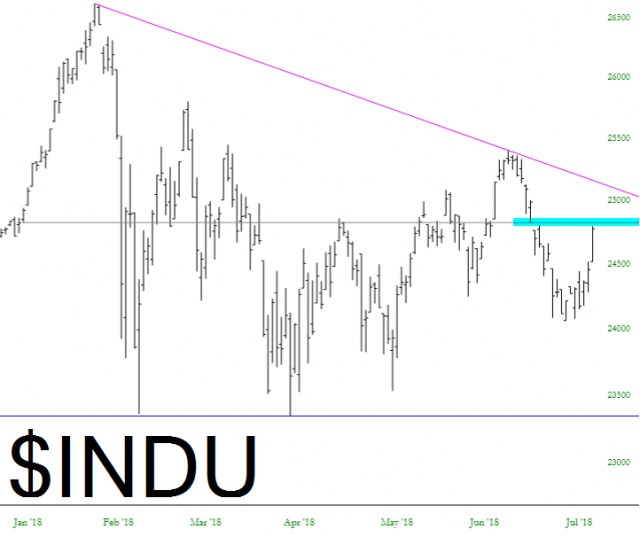

The Dow Industrials is a cat’s whisker away from closing its gap (tint) and will be in position to challenge its descending trend line, which would end, once and for all, the market’s utterly lame attempt to establish a downtrend in 2018.

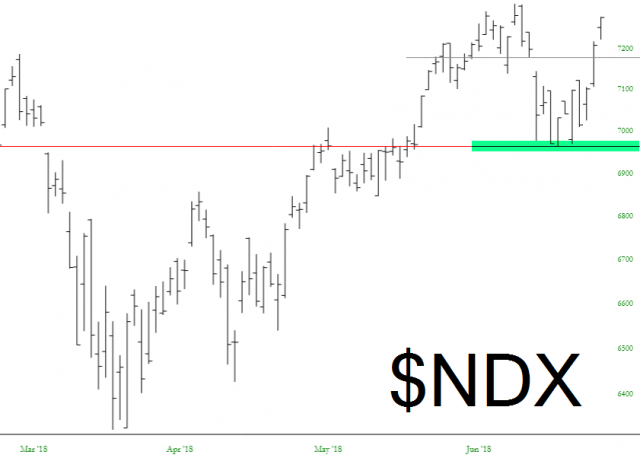

And in the same “there’s nothing bearish about these charts” mode, the NASDAQ looks posed to explode higher, having successfully tested its breakout region (green tint). I mean, if Amazon (NASDAQ:AMZN) isn’t a total bargain right now, what is?

As I said over the weekend, I am quite “light”, although I added some sizeable positions Monday related to interest rates (short EMB, JNK, HYG).