Here are the latest developments in global markets:

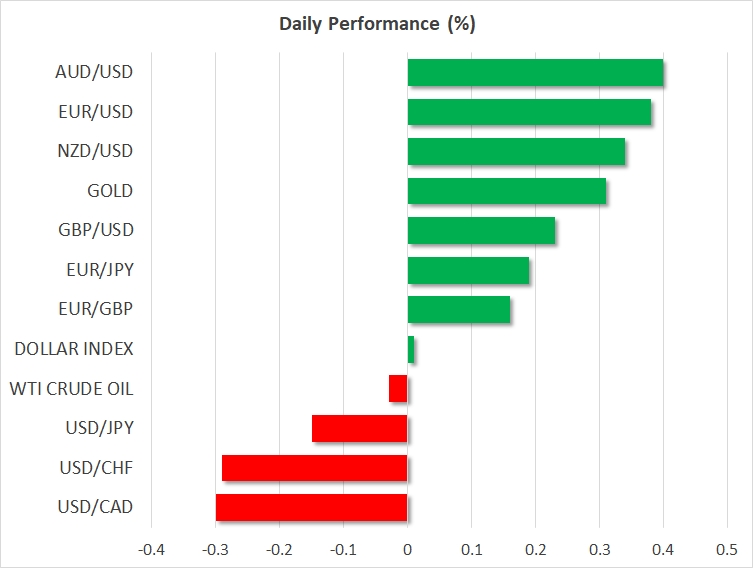

- FOREX: The US dollar index, which gauges the greenback’s strength against a basket of six major currencies, was practically unchanged on Thursday after it touched its highest level in 2018 yesterday, in the aftermath of the Fed’s policy meeting.

- STOCKS: US markets closed lower yesterday, following the FOMC meeting. Although stock indices spiked higher immediately on the decision, that sentiment quickly turned around and equities edged lower to finish in the red. The S&P 500 and Dow Jones both fell by 0.72%, while the Nasdaq Composite declined by 0.42%. Futures tracking the S&P, Dow, and Nasdaq 100 are currently in positive territory, albeit marginally so. In Asia, Japanese markets remained closed for a public holiday, while in Hong Kong, the Hang Seng tumbled by 1.4%. In Europe, futures tracking the major indices were a sea of red, pointing to a lower open for these benchmarks today.

- COMMODITIES: Both WTI and Brent are down on Thursday, but by less than 0.1%. Prices responded little to a surprisingly large build in US inventories yesterday. Another interesting point is that oil has remained elevated lately despite a resurgent US dollar, which typically exerts downward pressure on the precious liquid. The obvious conclusion is that expectations around fresh sanctions being imposed on Iran soon are currently strong enough to offset both signals that US production is soaring and recovery in the dollar is underway. In precious metals, gold is trading 0.4% higher today, last seen near the $1,308 per ounce mark. The safe haven traded like a roller coaster yesterday after the FOMC decision, initially surging and then quickly giving those gains back, overall moving in opposite directions with the dollar.

Major movers: Dollar drops after Fed but quickly recovers to touch 2018 high

The Fed kept borrowing costs unchanged yesterday, as was widely anticipated. There were three noteworthy changes in the accompanying statement. Starting with the dovish ones, policymakers removed a sentence that previously stated the economic outlook had strengthened, signaling that economic data have begun to moderate. In addition, the Fed included the word “symmetric” when describing its 2% inflation target. This was interpreted as a hint it may be comfortable allowing inflation to run above 2% without raising rates for a while, since it was running below it for so long. The result was a sharp drop in the dollar immediately following the decision.

However, the tumble was short-lived, and the greenback recovered all its losses to trade higher in the following hours, as the dust settled and market participants digested the hawkish signals in the statement as well. The Fed also erased a sentence that previously indicated “the Committee is monitoring inflation developments closely,” which is likely a hint that officials are becoming more confident inflation will rise, and that downside risks have dissipated. The dollar index surged to reach a fresh high for 2018 in the aftermath.

Overall, the key takeaway was that the Fed is becoming a little more cautious about the economy’s performance, but considerably more optimistic on the inflation outlook. As for the dollar, all eyes will now turn to tomorrow’s employment report, which should provide some direction – particularly if there are any surprises in the wage figures. Lastly, the greenback may also be impacted by fresh signals on trade. Note that US Treasury Secretary Mnuchin arrived in China for negotiations today, so we may see some market attention fall back on trade issues.

In the antipodean currencies, aussie/dollar and kiwi/dollar are higher by 0.4% and 0.35% respectively today, catching their breath following roughly two weeks of continued declines for both.

Day ahead: Eurozone inflation, UK services PMI, US trade data and services PMI on the agenda

Thursday’s calendar features a number of important releases, including flash inflation figures for April out of the eurozone.

At 08:00 GMT, the Norges Bank’s decision on interest rates will be made public. No change in rates is expected though the Bank’s communication could well lead to positioning in Nokkie pairs. At the same time, the Swedish central bank will be holding an open hearing with Governor Stefan Ingves on the report “Account of Monetary Policy 2017.” In this respect, Swedish krona pairs will also be monitored.

Attention will next turn to the UK which will be on the receiving end of PMI data for the all-important services sector, which contributes around 80% of the nation’s GDP; an acceleration in activity is expected. In the two preceding days, the respective PMI readings for the manufacturing and construction sectors surprised to the downside and delivered a beat correspondingly.

Politics are also in focus in the UK which holds local elections today. PM May’s Conservatives Party is projected to lose council seats. Should the number of lost seats exceed expectations, then a leadership challenge could be put back on the table, further complicating things and leading to additional losses for sterling pairs. Meanwhile, Brexit uncertainty looms large with an ongoing debate on whether the nation should remain within a customs union with the EU after it officially exits the bloc.

Preliminary inflation figures for the month of April are due out of the eurozone at 09:00 GMT. Headline inflation, as gauged by the Harmonised Index of Consumer Prices (HICP) that uses a common methodology across EU countries, is anticipated to grow at 1.3% y/y, the same as in March. This compares to the ECB’s target for annual inflation of close to but below 2%. Core inflation, that excludes volatile food and energy items, will also be watched. Euro area producer price data for March are scheduled for release at the same time.

Trade data out of the US will be in focus at 12:30 GMT, with the country’s trade deficit expected to narrow in March after rising to a nine-and-a-half-year high in February. The numbers pertaining to the bilateral trade deficit with China will also be closely monitored amid ongoing trade tensions – which have eased somewhat lately – between the world’s two largest economies. Weekly jobless claims data, as well as numbers on Q1 labor costs and productivity will hit the markets at the same time, while Canada will also be seeing the release of March trade data at 1230 GMT.

Later in the day (14:00 GMT), factory orders for March and April’s ISM services PMI will be generating attention out of the US. On an annual basis, factory orders are forecast to grow at a faster pace compared to the month that preceded, while service sector activity as gauged by the ISM’s PMI is anticipated to ease, though still comfortably remain in expansion territory (above the 50 threshold).

Activision Blizzard (NASDAQ:ATVI) and Xerox (NYSE:XRX) are among companies releasing quarterly results on Thursday; both corporations will be reporting after today’s US market close.

Policymakers making appearances include ECB Vice President Vitor Constancio and ECB Executive Board member Benoit Coeure, who will be talking on fostering a banking and capital markets union within the eurozone at 12:00 GMT and 12:30 GMT respectively.

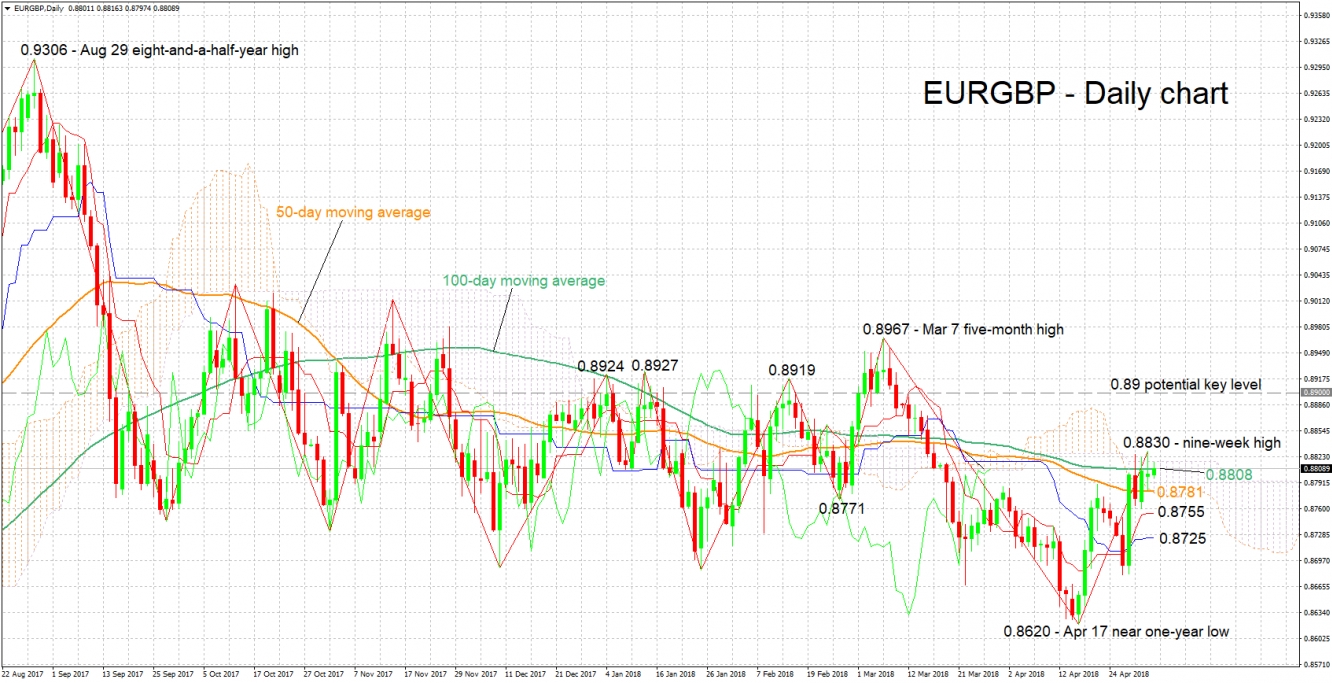

Technical Analysis: EUR/GBP short-term bullish, trades not far below 9-week high

EUR/GBP advanced considerably after hitting a near one-year low of 0.8620 on April 17, eventually posting a nine-week high of 0.8830 during Wednesday’s trading. The Tenkan- and Kijun-sen lines are positively aligned in support of a bullish bias. Notice though that the two have flatlined, this being a sign of easing positive momentum in the short-term.

Stronger-than anticipated inflation figures out of the eurozone are likely to refuel the positive momentum, pushing the pair higher. EUR/GBP is currently marginally above the 100-day moving average located at 0.8808, but could still be meeting resistance around it (the region around this MA also includes the Ichimoku cloud top at 0.8817). Further above, additional resistance could come around yesterday’s high of 0.8830, with attention next turning to the 0.89 round figure.

On the downside and in case of weaker eurozone data, support could come around the current level of the 50-day MA at 0.8781 (including the Ichimoku cloud bottom at 0.8779), and further below from the Tenkan-sen (0.8755) and Kijun-sen (0.8725) lines.

UK data and related developments can also move the pair during today’s trading.