- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Dollar Retreats As Trade War Talk Escalates

Fed Chair's words boosted USD but Trump’s view on trade sparked a sell-off

The US dollar was set to end the week on a positive note after Fed Chair Jerome Powell testified twice and other Fed speakers signaled a hawkish view on the economy. The USD had appreciated on a weekly basis up until Thursday when President Donald Trump announced a 25 percent tariff on steel and 10 percent on aluminium imports. Markets reacted to the protectionist measure with Trump unfazed by criticism and tweeting that Trade wars are good, and easy to win. The decision turned a USD on the rise against major pairs into a mixed bag. The USD is up against the AUD, CAD, GBP and NZD but depreciated against the EUR and JPY.

- 4 central banks (RBA, BOJ, BOC and ECB) are expected to keep rates unchanged.

- US wages could rise increasing inflation anxiety.

- Employment data to be released in the US and Canada.

Central Banks and US Employment Data to Guide Markets

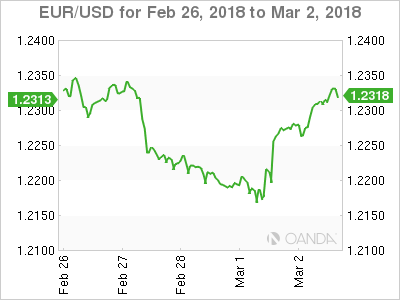

The EUR/USD gained 0.24 percent during the week. The single currency is trading at 1.2323 after the anti-trade measures announced by the Trump administration on Thursday. The dollar was headed for a strong month on the back of economic fundamentals and the hawkish comments from Fed Chair Jerome Powell. The market was beginning to price in another rate hike to the 3 already expected which boosted the USD across the board. The tariffs announced by President Trump reversed the gains against the EUR.

Next week will be a rollercoaster for investors with an economic calendar that features four central banks: Reserve Bank of Australia (RBA), Bank of Canada (BoC), European Central Bank (ECB) and the Bank of Japan (BOJ) as well as the release of employment data in Canada and the United States. The U.S. nonfarm payrolls (NFP) will be published on Friday, March 8 at 8:30 am EST with another gain of 200,000 jobs expected and a wage increase of 0.3 percent.

The ECB will deliver its rate statement on Thursday, March 8 at 7:45 am EST. President Mario Draghi will host a press conference at 8:30 am. There are no major changes expected to the interest rate or the quantitative easing program, but the central bank could take the opportunity to make minor tweaks to the language. The ECB will be cautious in its use of communication to avoid market overreaction. The central bank is expected to end its QE program at the end of the year, but it awaits a stronger inflationary pressures before signalling the move.

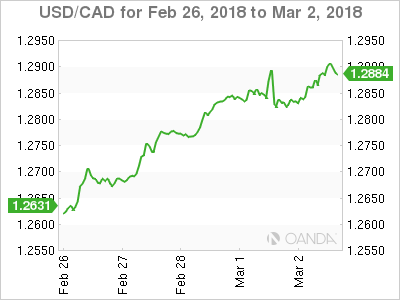

The USD/CAD gained 2.20 percent in the last five trading days. The currency pair is trading at 1.2907 after the Canadian currency could not deflect the one-two punch of Fed hawkish rhetoric and protectionist tariffs from the White House. Interest rates are expected to rise three to four times in 2018. Fed members have been very vocal on the subject and although it is still gradual as the moves will be for 25 basis points each, it does signal and end of low rates in the US.

The Bank of Canada (BoC) will release its rate statement on Wednesday, March 7 at 10:00 am EST. The interest rate is forecasted to remain at 1.25 percent but the central bank is still expected to hike two times this year. Growth expectations are lower after a slowdown in the final quarter of 2017 was evident with the release of the Canadian GDP on Friday. Annual GDP gained 1.7 percent, short of the 2.0 percent forecast and offering little support for the struggling loonie.

Canadian jobs data will land at the same time at US jobs on Friday, March 9 at 8:30 am. The U.S. non farm payrolls (NFP) will steal most of the spotlight as inflation anxiety has stricken stock markets around the globe. Wage growth in the United States will be key on Friday as inflation is the one factor missing that would force the Fed to raise interest rates to avoid the economy overheating.

NAFTA talks are still ongoing, but this week the steel tariffs are drawing a more dire future for the trade agreement. The seventh round will wrap up in Mexico City and so far there is very little progress. Mexico and Canada have said that they will retaliate if they fall under the steel and aluminum tariffs, but at this point, as is becoming the norm with the Trump Administration, there are few details on the full scope of the tariffs.

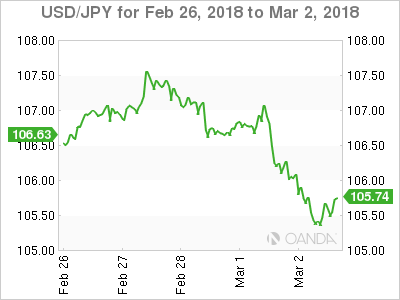

The USD/JPY lost 1.22 percent in the last five days. The currency pair is trading at 105.55. The Japanese Yen has been one of the biggest movers against the American currency appreciating 6.25 percent versus the greenback. The Yen has reached levels it hadn’t been trading at since prior to the US elections.

The Japanese currency was the big winner of the week that saw Fed rhetoric and trade war drive the market. The Bank of Japan (BOJ) will feature this week on Wednesday and Thursday when it release its rate statement and a press conference with BOJ Governor Haruhiko Kuroda. The Governor has just been reappointed for a second term and on Friday hinted about ending the massive stimulus in 2019.

Market events to watch this week:

Monday, March 5

4:30am GBP Services PMI

10:00am USD ISM Non-Manufacturing PMI

7:30pm AUD Current Account

7:30pm AUD Retail Sales m/m

10:30pm AUD Cash Rate

10:30pm AUD RBA Rate Statement

Tuesday, March 6

4:35pm AUD RBA Gov Lowe Speaks

7:30pm AUD GDP q/q

Wednesday, March 7

8:15am USD ADP Non-Farm Employment Change

8:30am CAD Trade Balance

10:00am CAD BOC Rate Statement

10:00am CAD Overnight Rate

10:30am USD Crude Oil Inventories

7:30pm AUD Trade Balance

Thursday, March 8

7:45am EUR Minimum Bid Rate

8:30am EUR ECB Press Conference

Midnight JPY BOJ Policy Rate

Midnight JPY Monetary Policy Statement

Friday, March 9

JPY BOJ Press Conference

4:30am GBP Manufacturing Production m/m

8:30am CAD Employment Change

8:30am USD Average Hourly Earnings m/m

8:30am USD Non-Farm Employment Change

Related Articles

Just recently, S&P Global released its 2026 earnings estimates, which, for lack of a better word, have gone parabolic. Such should not be surprising given the ongoing...

Trump threatens EU tariffs, creates confusion about Mexico and Canada duties Dollar rebounds but gold slides again Nvidia falls in after-hours trading as earnings fail to set...

Gold Consolidates Ahead of Key US Data Releases The gold (XAU/USD) price was relatively unchanged on Wednesday as markets remained cautious ahead of upcoming inflation data and...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.