The dollar index started Monday’s Asian session lower as it was dragged down by losses on Wall Street on Friday. Falling bond yields also weighed on the dollar. Weaker-than-expected new home sales figures from Friday did not help the greenback either, which overshadowed strong manufacturing PMI data.

The dollar has been steadily weakening against the yen for the past week and was trading at 123.45 in late Asian session. The euro, which has been benefiting from the pause in the dollar rally, continued to advance against the greenback and jumped to 1.1028 just before the start of European session. The single currency was also higher against the pound at 0.7094, while cable rose to 1.5540.

Asian shares were hit by losses in US and European shares with Chinese indices being weighed down by negative sentiment from weak manufacturing PMI on Friday, as well as wider concerns on the slowdown in Chinese growth. The Shanghai Composite and CSI300 index were both down by over 8% near their close.

Commodity prices continued to slide, pulling the Australian dollar to a new 6-year low on Friday. The aussie was steadier in Monday’s Asian session, climbing to 0.7284 against the greenback. The kiwi was also firmer, rising to 0.6601.

Gold prices staged a small recovery on dollar weakness, rising to a near one-week high of $1103.73 in late Asian trading. Brent crude oil prices started the day heading lower but rebounded by 0.5% to $54.88 later in the session.

With little data to excite the markets on Monday, much of the attention will be on Wednesday’s FOMC meeting where the Fed is expected to signal a rate rise for September. US GDP data will also be closely watched the following day where second quarter growth is forecast to improve to 2.5% on an annualized basis.

Before that, UK GDP data is due on Tuesday, which is expected to strengthen the Bank of England’s case for a rate rise in early 2016. However, comments on Friday by MPC member Andy Haldane contradicted the Governor Mark Carney’s rhetoric that the time for an interest rate rise is getting closer by saying there’s “no rush” for a rate increase.

In the meantime, US durable goods orders out later today should provide some focus for investors. Also to watch out for today is the IFO Business Climate index for Germany, which is expected to show a small improvement in July.

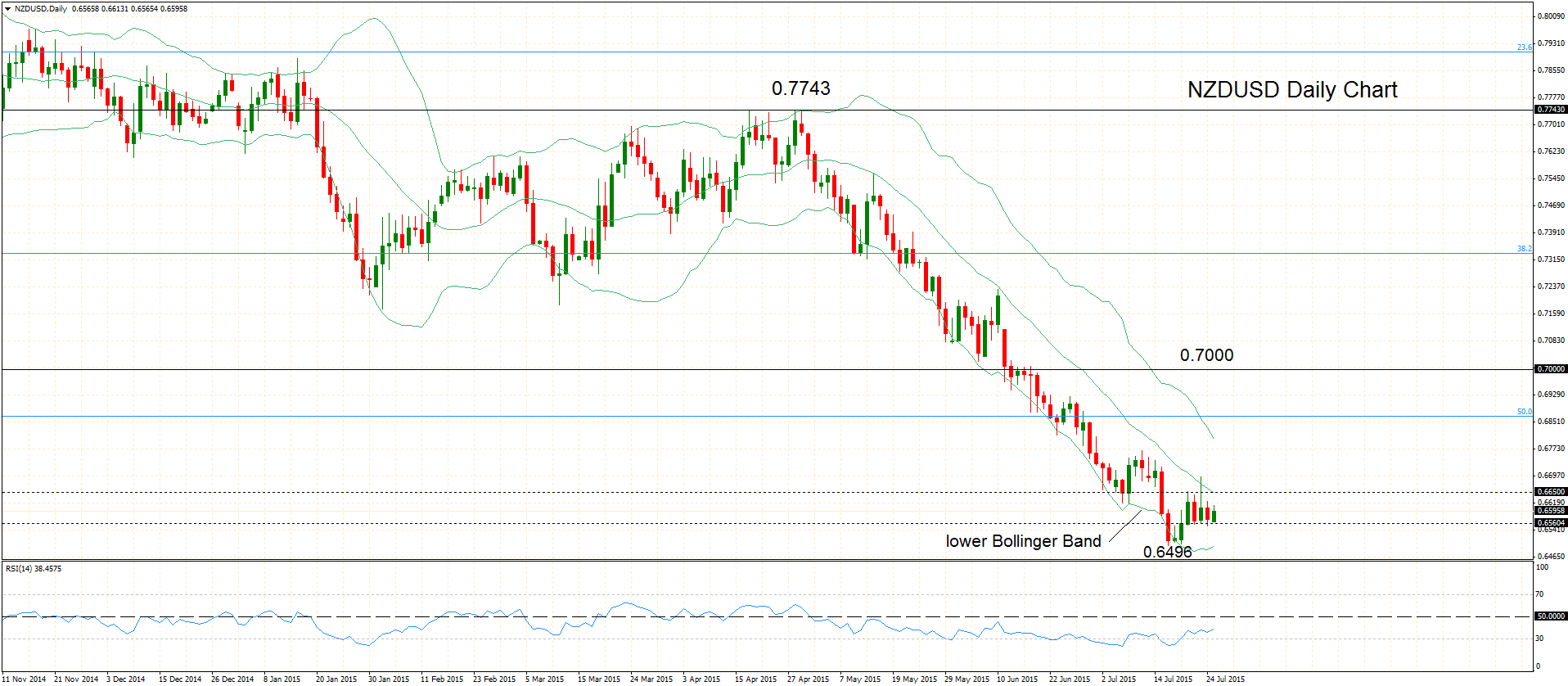

Technical Analysis – NZD/USD bearish in falling Bollinger Band

NZD/USD maintains a downside bias, with scope to retest the lower Bollinger Band® at 0.6496 (a six-year low). The RSI remains in bearish territory below 50, although it is trending sideways, which suggests consolidation in the market in the near-term. The overall market structure is bearish due to the bearish alignment of the Bollinger Bands which keep prices in a downward channel. The market tried to make a short-term recovery move but failed well ahead of the falling 20-day moving average (middle of the band) and since then the market traded between a range of 0.6553 and 0.6693. As long as prices remain below the key 0.7000 level, the bearish market bias remains strong. A breach of the 0.6496 low would open the way toward the 0.6400 area. The market has been in a bearish trend since the fall from 0.7743 on April 28.