Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Jerome Powell, who hasn't been approved by the Senate to chair FOMC yet, already starts to criticize the Fed, and investors shift to cache followed by treasury yields growth doesn't strengthen dollar. Investors are obviously confused by large sales of developing countries’ currencies alongside with the increase in rates of 2-year American debts up to nine-year highs. At the same time, there is a surplus of ultra-low yields. According to Bloomberg-Barclays indexes, about $11 million of government and corporate bonds in the world’s biggest markets are trading with negative yields.

Dynamics of negative yielding bonds

Source: Financial Times.

Investors act like they don’t know what to do. Buy stocks? But their quotes already include the factor of potential U.S economy growth due to the fiscal incentives. And what if the reform isn’t adopted in the Congress in 2017? S&P 500 correction will allow to buy the securities at more favourable prices than now. Buy bonds? But the American economy is in a good state, the Fed doesn’t give up monetary normalization and the tax reform will cause surge of sales. Cache is left, the withdrawal to which makes the US dollar and treasury yields move in different directions.

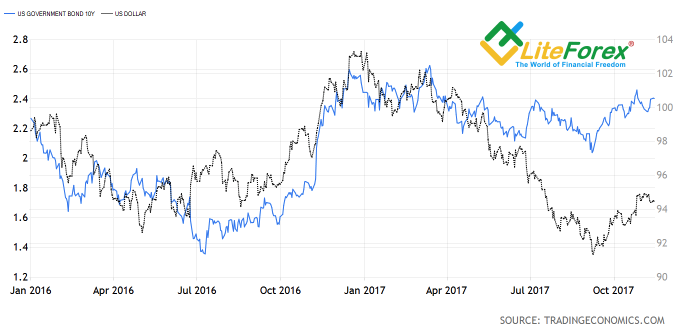

Dynamics of USD index and government bond yields

Source: Trading Economics.

Investors are waiting for the clues from central banks, whose conference is devoted to the regulators’ communication with financial markets. Before Janet Yellen, Mario Draghi, Mark Carney, Haruhico Kuroda will share their opinions about the issue, the soon-to-be new Fed chairman, Jerome Powell has already done this. According to him, the conversation between the central bank and the market is like an American cartoon, where the master asks the dog not to break into the bins, and the dog only hears, “bla-bla-bla, ginger, bla-bla-bla”. Simply put, the markets are like people: they hear only what they want to.

At the same time, Powell criticized Dot points, calling them an out-date tool. It is better to use consensus forecast instead, which indicates what exactly the Fed will do if internal and external economical environment changes in the USA. Well, it is always interesting to see, what a person, who was silent, will change after coming to power.

To my mind, media unfairly ignore the factors of euro strengthening, paying attention only to the U.S. events. But the fall of the Old World’s stock indexes during 5 trading sessions in a row is taking place in the context of quitting EUR/USD long positions, opened when hedging currency risks.

Dynamics of Euro Stoxx 50 and EUR/USD

Source: Trading Economics.

EUR/USD bulls are consolidating all the forces to storm the resistance at 1.169, but they are unlikely to break significantly higher than 1.175 on the first try, unless there is sad news from the Congress about the USA tax reform and new drivers of euro growth.