Market Brief

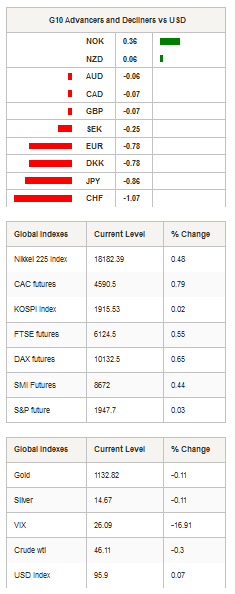

The last batch of data from the US came in mostly on the soft side yesterday. Ahead of Friday’s Non-farm payrolls, ADP indicated that the private sector added 190k in August, slightly below consensus estimates of 200k but up from July’s revised 177k increase. Factory orders grew 0.4%m/m (s.a.), below median forecast of 0.9% and down from June revised 2.2% expansion. Yesterday as well, the Fed’s Beige Book report indicated that “Most districts reported modest to moderate growth in labour demand,” and that “this tightening of labour markets was said to be pushing wages up slightly”. Overall, the report found that “economic activity continued expanding across most regions and sectors” in July and August. The US dollar strengthen against its main counterparts, especially against low yielding currencies such as the Swiss franc, the Danish krone, the Japanese yen and the euro. The dollar index had risen 0.60% yesterday and is currently grinding lower ahead of the London session.

In China, stock markets are closed due to World War II anniversary. In Japan, the Nikkei 225 edges up 0.48% while the broader TOPIX index gains 0.61%. USD/JPY response to better-than-expected Nikkei PMI was muted. August’s services PMI printed at 53.7 verse 51.2 consensus while Composite PMI came in at 52.9 versus 51.5 median forecast. The dollar is trading at Y120.40 at the moment with a positive bias.

In Australia, the trade deficit narrowed to AUD 2460mn in July, above consensus estimates of AUD 3160mn but up from July’s revised deficit of AUD 3050mn. In August, retail sales declined 0.1% compared to July as consumers cut spending in household goods and cafés and restaurants expenses. Australian shares paid the bill and dropped 1.44% in Sydney. AUD/USD dropped another 0.70% on the headlines and is gaining negative momentum. The Aussie lost around 3.70% against the US dollar since the beginning of the month and we see no reason for the Aussie to reverse the trend as bad news keep piling up.

Unsurprisingly, Brazil’s Central Bank left the Selic rate unchanged at 14.25% as the Copom kept the same statement of the July meeting. Meanwhile, industrial production contracted - for 16th straight month - by 8.9%y/y in July, well below median forecast of -6.3%y/y and previous read revised to -2.8%. The Brazilian real keeps sinking and lost another 1.60% yesterday against the US dollar and is heading toward the next key resistance standing at 3.8225 (high from December 2002 !).

In Europe, equity futures are trading in positive territory this morning with the FTSE 100 up 0.55%, the DAX 0.65%, the CAC 40 0.79% and the SMI 0.44%.

Today traders will be watching Markit PMI from Italy, France, Germany, United Kingdom and Euro zone; the ECB staff macroeconomic projections and ECB main refinancing rate; initial jobless claims, trade balance, Markit composite and service PMI, ISM non-manf. Composite from the US.

Currency Tech

EUR/USD

R 2: 1.1871

R 1: 1.1714

CURRENT: 1.1228

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5803

R 1: 1.5509

CURRENT: 1.5274

S 1: 1.5171

S 2: 1.5087

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 120.38

S 1: 115.57

S 2: 113.86

USD/CHF

R 2: 0.9904

R 1: 0.9799

CURRENT: 0.9703

S 1: 0.9151

S 2: 0.9072