The US dollar rose against nearly all the major and emerging market currencies in the past week. The notable exception among the majors is sterling, where hawkish BOE comments and another rise in average earnings goaded the bulls. Among the emerging market currencies, only three rose against the greenback, the South African rand, the Turkish lira, and the Chilean peso.

The focus of the market appears to be shifting from the Greek drama tragedy and the dramatic fall in Chinese shares to macroeconomics. Outside of some official cheerleaders, many are skeptical that demands that Greece has accepted, even if fully implemented, would put Greece's debt on a sustainable path and/or make the economy more competitive. Still, with the bridge loan falling into place—most likely allowing Greece to service its obligations to the ECB and IMF, and the new ELA—this will allow banks to likely re-open next week. This would mean Greece is not as urgent of a situation at this point. Its ability to have systemic impact is lessened.

Chinese shares have stabilized. They posted modest gains last week. Trading in more shares was unfrozen, though there were still over 630 issues that could not trade. If these measures do not prove sufficient, signals from officials indicate they are prepared to do more.

This allows the divergent trajectories of monetary policy to have greater sway in the foreign exchange market. Yellen confirmed that the Federal Reserve was still on track to hike rates this year, while Carney cautioned that the BOE anticipates raising rates. Other major central banks are easing policy either through orthodox means--rate cuts--like the Bank of Canada delivered last week, and the Reserve Bank of New Zealand is expected to do on July 23, or unorthodox means--QE--in which the ECB, BOJ and Riksbank are currently engaged.

The euro fell nearly 3% last week. It recorded a lower low each day last week and settled at its lowest level in two months. Arguably, the euro is simply moving to the bottom of its trading range. However, if the $1.08 level is convincingly violated, the technical condition would deteriorate markedly. The $1.08 area corresponds to a potential neckline of a double top pattern, which if valid, would suggest measuring objective of $1.04 or a little lower.

We offer two caveats. First, the euro finished the week near its lower Bollinger® Band (~$1.0850), which highlights the speed at which the euro has fallen. However, neither the RSI nor the MACDs suggest the market is over-extended. Second, while the focus is clearly on divergence, the premium the US pays over Germany actually fell last week in both the US 2-Year and US 10-Year sectors. The implied yield on the September Fed funds futures contract rose one basis point. The general narrative about divergence would have led one to expect a widening of the US premium and more than just a single basis point.

Rising equities and perceptions that the crises were ebbing weighed on the yen. The dollar made higher highs against the yen for six consecutive sessions through the end of last week. The dollar moved above the JPY124 level for the first time in a month. The dollar appears to have overshot the lower end of its trading range with the move to JPY120.50 last week. The upper end of the range is seen near JPY125. In the second half of June, dollar bulls turned more cautious ahead of JPY124.50. A move now below JPY123.80 suggests a consolidative tone, and would reinforce perceptions of the range.

Unlike the dollar's gains, sterling's gains have coincided with a backing up of short-term rates. The implied yield on the December short-sterling futures market rose as much as 14 bp above last week's high. Sterling is likely to find new buyers on pullbacks, and the $1.5540 area offers initial support. Only a break of $1.5500 would signal a top is in place. The technical indicators are neutral though the five-day average is poised to cross above the 20-day average. Initial resistance is seen near $1.5680, but it may take a move above $1.5700 to be convincing.

We had thought the Canadian dollar could have rallied on a sell the rumor, buy the fact activity on a rate cut. Instead the Canadian dollar sold off hard as the central bank adopted an apparent easing bias, and raised the possibility of QE, if necessary. The US dollar rose to new multi-year highs against the Canadian dollar, but the air got thin above the CAD1.30 area ahead of the weekend.

Both the RSI and MACDs are at their highest levels since January, and the upper Bollinger Band is near CAD1.3020. The risk is for some near-term consolidation before the greenback posts another leg up. During that consolidation, a pullback toward CAD1.2920 may offer a lower risk opportunity.

The Australian dollar's 0.9% loss last week place it second behind sterling as the best performing major currency against the US dollar. Falling milk prices and less than 0.5% year-over-year inflation in New Zealand fanned speculation of not just a 25 bp cut, but possibly a 50 bp cut next week. The Bank of Canada was more aggressive than expected, thus leaving the Aussie as least disliked among the dollar-bloc. The RBA does not meet until August 4, and officials do not seem in a particular hurry to cut rates.

Still, the Australian dollar slipped to new multi-year lows last week. There is not much momentum. It finished the week almost a full cent above the lower Bollinger Band. The Aussie recorded an outside down day in the middle of last week, as the early attempt to rally was sold. However, there was no follow through, which may be an early warning that the bears are running out of steam. Still, bounces toward $0.7500 will likely be sold. On the downside, it is at levels not seen since the darkest days of the crisis. The $0.7000 area is the next significant objective.

The price of light sweet crude oil fell 4.2% last week, the third consecutive losing week. The preliminary deal with Iran, coupled with the continued overproduction in the US and OPEC weighed on sentiment, The September futures contract approached $50 before the weekend, which represents new four-month lows. The bears may turn a little cautious. The Iranian deal still needs to be ratified, and there will likely be a fight in the US Congress. If this support holds, the price can bounce. Technicals appear stretched. The $54.00-$54.50 level offers initial resistance, but the gap from earlier this month (~$56.00-$56.85) is key. However, the move to $50 would be the objective of the gap if it were a measuring gap.

The US 10-year Treasury yield recorded lower highs and lower lows since last Monday. The yield seems range-bound. The 2.45%-2.50% area marks the top while the 2.20%-2.25% area marks the lower end. The market need not go back to the bottom of the range just because the top was rejected. The 2.28%-2.32% area may be sufficient before bond sellers reemerge.

The NASDAQ rose to new record highs with a 4.2% gain last week. The S&P 500 moved within half a percent of its record high with a 2.4% rally. The S&P 500 trended higher last week, recording higher highs and higher lows each session. The NASDAQ advance was punctuated with three gaps higher openings that were not filled last week. With a strong close at record highs, there is some risk the NASDAQ can gap higher on Monday, as it did last Monday. Gaps on weekly charts are regarded as more significant than gaps on daily charts. Buying the S&P 500 on pullbacks to the 200-day moving average again proved successful. Immediate support is seen near 2100. The S&P 500 may set new record highs this coming week.

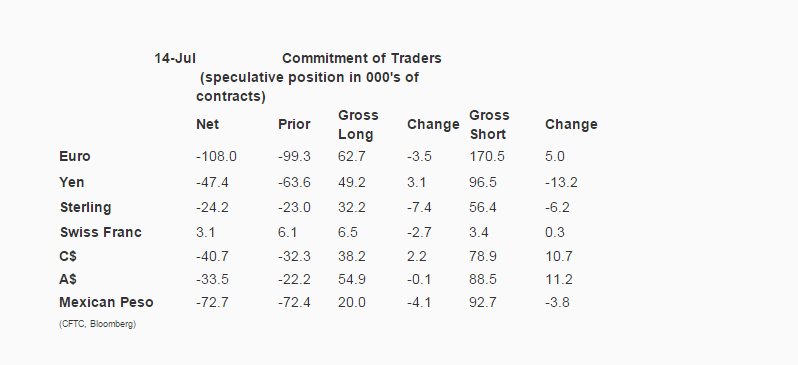

Observations based on speculative positioning in the futures market:

1. There were three significant (more than a 10k contract) adjustment in gross positioning by speculators in the currency futures for the reporting week ending July 14. The short yen position was by 13.2k contracts, leaving 96.5k. It is the fifth week in a row that speculators have cut their short yen position. It has fallen by a third. Speculators continued to sell the Canadian dollar. The gross short position rose by 10.7k contracts to 78.9k. It has grown every week since mid-May and risen nearly four-fold over that period. The bears have been growing their gross short Australian dollar position for several weeks. Last week they added another 11.2k contracts to bring the gross short position to 88.5k contracts.

2. The overall pattern favored the dollar. The net short foreign currency position increased in five of the seven currencies we track. The only currency that speculators are net long in the Swiss franc, and that position was halved to 3.1k contracts. The net short position in the yen fell. Gross longs were added only in the yen (3.1k contracts to 49.2k) and Canadian dollars (2.2k to 38.2k contracts). The adjustments to the gross short position were near evenly mixed, and after excluding the significant adjustments in the yen and the Canadian and Australian dollars, which we have already discussed, the other adjustments were modest.

3. The net short US 10-year Treasury position fell to 5.6k contracts (from 32.7k), which is the smallest since last September. This was largely the results of a reduction of gross short positions. They were cut by 35.7k contracts to 433.1k. The gross longs were shaved by 7.5k contracts.

4. Pressure mounted on the speculative oil bulls. The net long position fell by nearly 10% to 264.5k contracts. The gross longs were cut by 17.8k contracts to a 468k. The gross shorts added 13.9k contracts bringing the position to 203.6k contracts, and an increase of 50k contracts over the past three week.