The US markets ended Thursday's trading strongly, creating positive momentum for trading on Friday. If the US labour market report does not lead to a big disappointment, we could say that the recent period of mixed market performance and the dollar's upward correction is over.

After touching all-time highs on Apr. 29, the NASDAQ 100 index was under pressure, subsequently losing around 5%. However, the increased buying in such a downturn suggests buying-the-dip bias still rules the markets. Notably, buying at the 5% correction was evident near the session's close on Tuesday and Thursday, indicating the confidence of institutional players in the fundamentals for buying stocks.

The Dow Jones avoided any significant drawdown at all, closing on the plus side each trading day in May and closing Thursday with a gain of 0.9%.

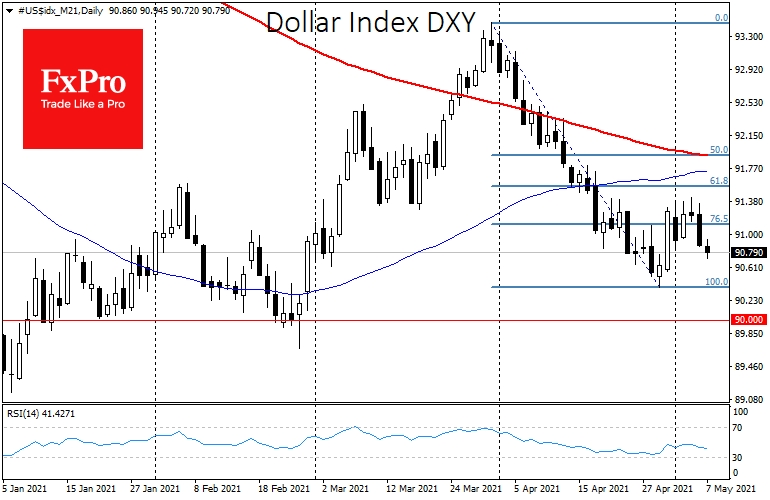

Meantime, the FX market had been signalling even earlier that we saw a short-term shake-out of portfolios rather than a full-blown risk-off. The USD strength has stalled in early May at the levels near 61.8% Fibonacci retracement of the move in April.

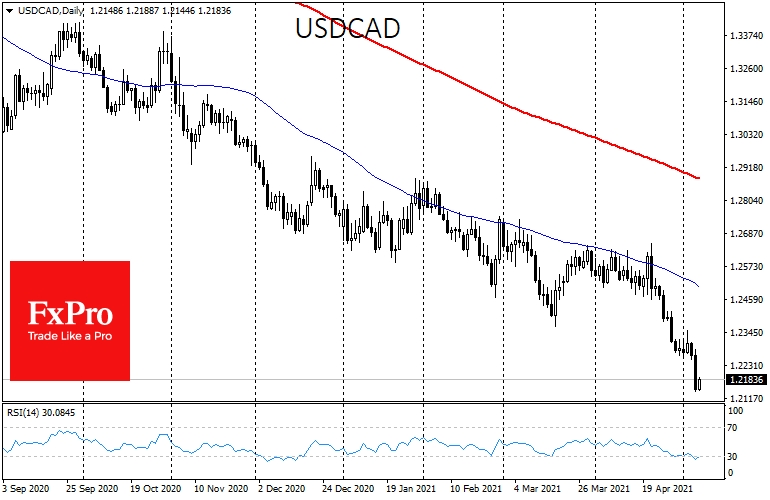

The USD/CAD bears have been methodically reversing the pair downward for the last five weeks. The Canadian dollar is the first among the major currencies to regain the highs against the dollar in recent years. This pair should be considered a manifestation of the interest of American investors, where the dollar bears are winning.

USD/CNH, an indicator of sentiment towards China, also completed its mini-correction. New local lows in the pair confirm the prevalence of demand for risky assets. It is still very weak in Chinese equities but by no means spoils the global risk appetite.

Global demand for equities and high-yielding currencies against low-yielding currencies is supported by optimistic labour market expectations and signs of a sustained recovery in demand for commodity assets, despite multi-year highs in prices.

These are favourable conditions for the equity market before the major regulators, the Fed, the ECB, the Bank of Japan, and the Bank of England make first steps toward a policy tightening. But they are not there yet.

Until then, in FX, the dollar risks being the main straggler, retreating against a wide range of currencies from CAD, AUD and NZD to EUR, GBP and CNY.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dollar Bears And Stock Bulls Take the upper hand

Published 05/07/2021, 07:39 AM

Updated 03/21/2024, 07:45 AM

Dollar Bears And Stock Bulls Take the upper hand

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.