Saudi/Iran Tensions Spike; A Look at OOil:

Welcome back to your trading desks for the new year, now let’s make sure it’s a good one! Well, it didn’t take long to set up a massive new spin on an old theme, did it!

Shia cleric Sheikh Nimr al-Nimr was executed by Saudi Arabia over the weekend, beheaded for terrorism offences along with 46 others. The execution has pushed Shia/Sunni tensions over the edge with the two sectarian powerhouses set to lock horns in more way than one. Speaking to the Iranian state news agency, the largely Shia Iranian foreign ministry spokesman, Hossein Jaber Ansari dropped this yesterday:

“The Saudi government supports terrorists and takfiri extremists, while executing and suppressing critics inside the country.”

This was followed up by a cartoon image posted on the website of the Supreme Leader of Iran Ali Khamenei, publicly questioning the difference between ISIS and Saudi Arabia.

While Sunni/Shia tensions are nothing new, the fact that tensions have so quickly escalated between the two opposing powerhouses in Saudi Arabia and Iran poses huge uncertainty for not only the oil market, but the entire forex risk-on paradigm. The Saudi embassy in Tehran was firebombed and this morning we have seen Saudi Arabia sever all diplomatic ties with Iran, expelling Iranian diplomats from the country and giving them 48 hours to leave its borders. Watch this space…

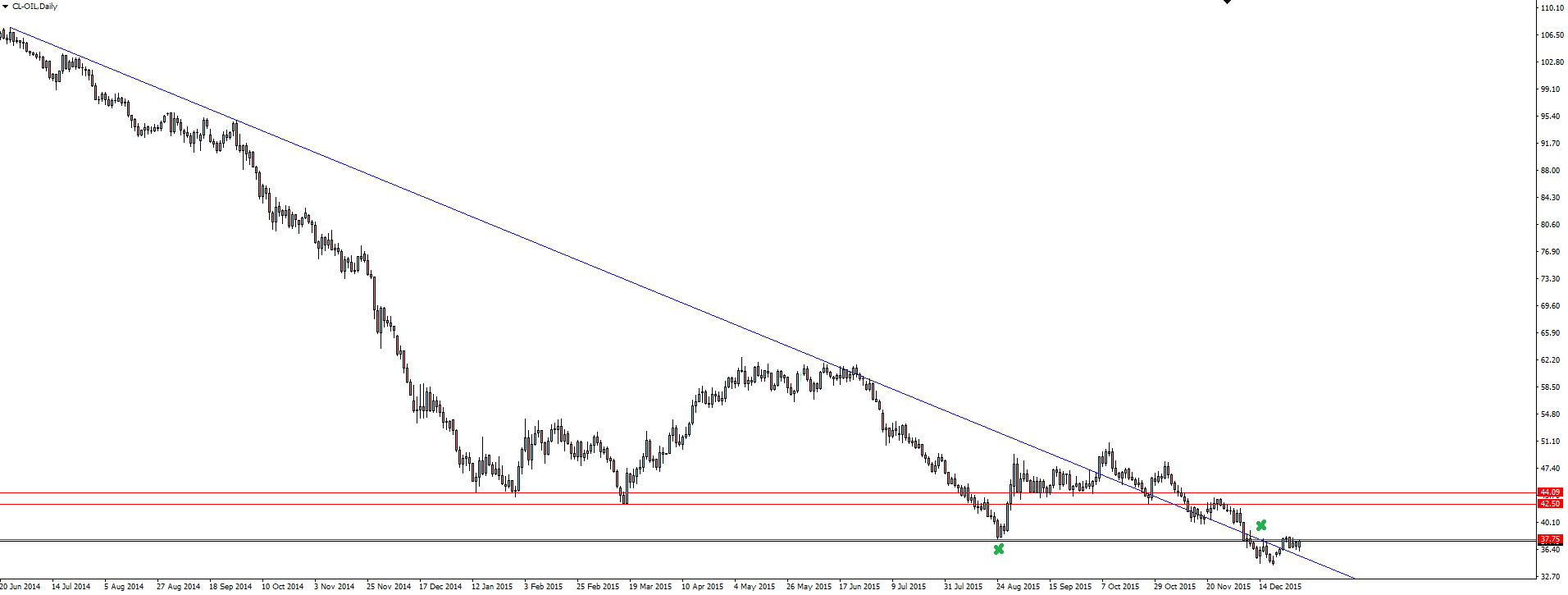

Oil Daily:

With the threat of event risk resting so finely on a knife’s edge, ask yourself which side of the Oil market you see the greatest risk, and avoid trading in that direction. In this case however, it’s a little harder said than done because both sides of the market face such uncertainty. Does that risk mean higher oil prices as uncertainty over supply takes over, or will this mean that both sides pump more in an attempt to hurt the other? Take your pick!

What we can safely say, is that the daily chart is still in a huge down trend, and I still think talk of an Oil bottom in December still looks to have been too soon. The bearish trend is just too strong for me to think about any little trend line breaks, especially as this long term trend line dating back to June 2014 has been broken before and price has simply consolidated along it in the direction of the trend.

———-

Chart of the Day:

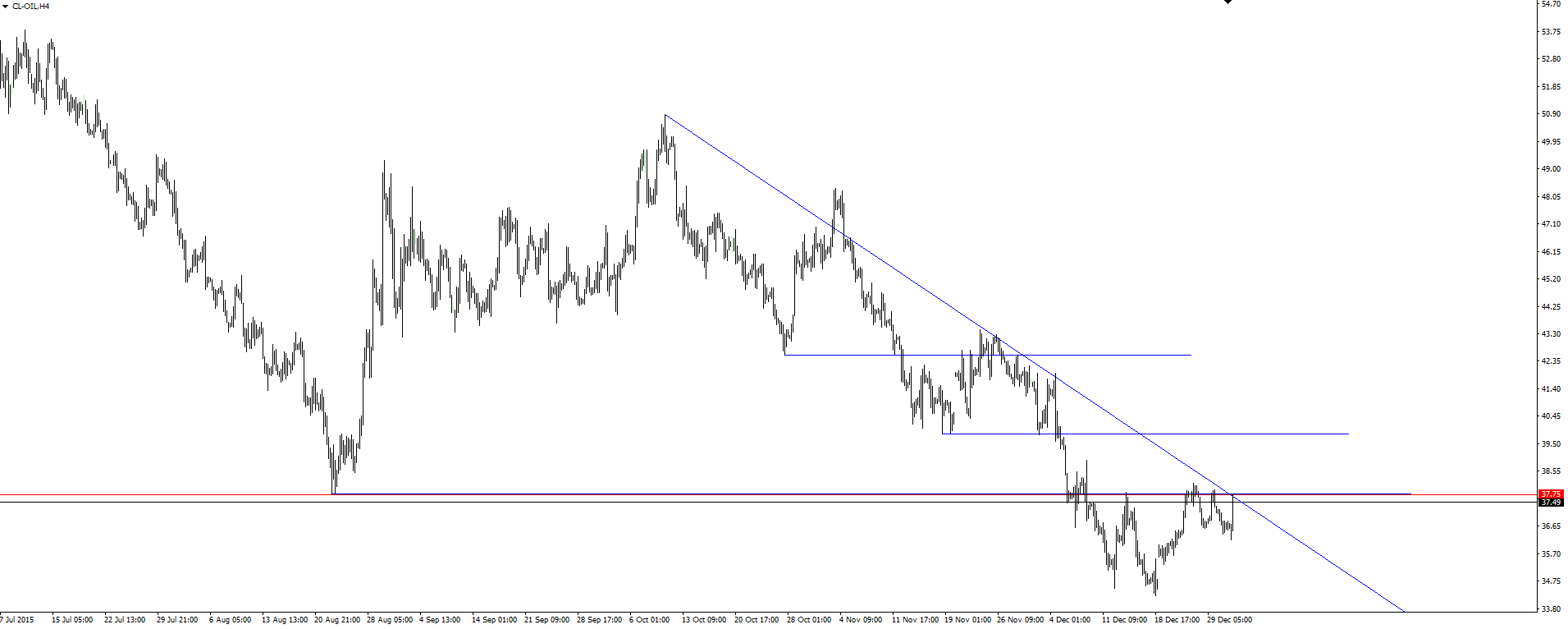

We continue our look at Oil in the first chart of the day for 2016, zooming into the 4 hour chart.

Oil 4 Hour:

The 4 hour chart highlights the point I make about the bearish trend above, with price cleanly stepping down between both short and long term support/resistance levels.

Support break, re-test previous support as resistance, rinse and repeat.

On the Calendar Monday:

NZD Bank Holiday

CNY Caixin Manufacturing PMI

“New Zealand banks will be closed in observance of Second New Year’s Day.”

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and Australian Forex broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.