Slightly removed from the retail forex trading world, but majorly important for the price of the Aussie dollar, iron ore rallied nearly 5% at its latest price fix and is now attempting to test the $US60 handle. Along with the price of oil and US dollar weakness across the board, we’ve seen the Aussie still reaching for new highs again as I’m writing this sentence.

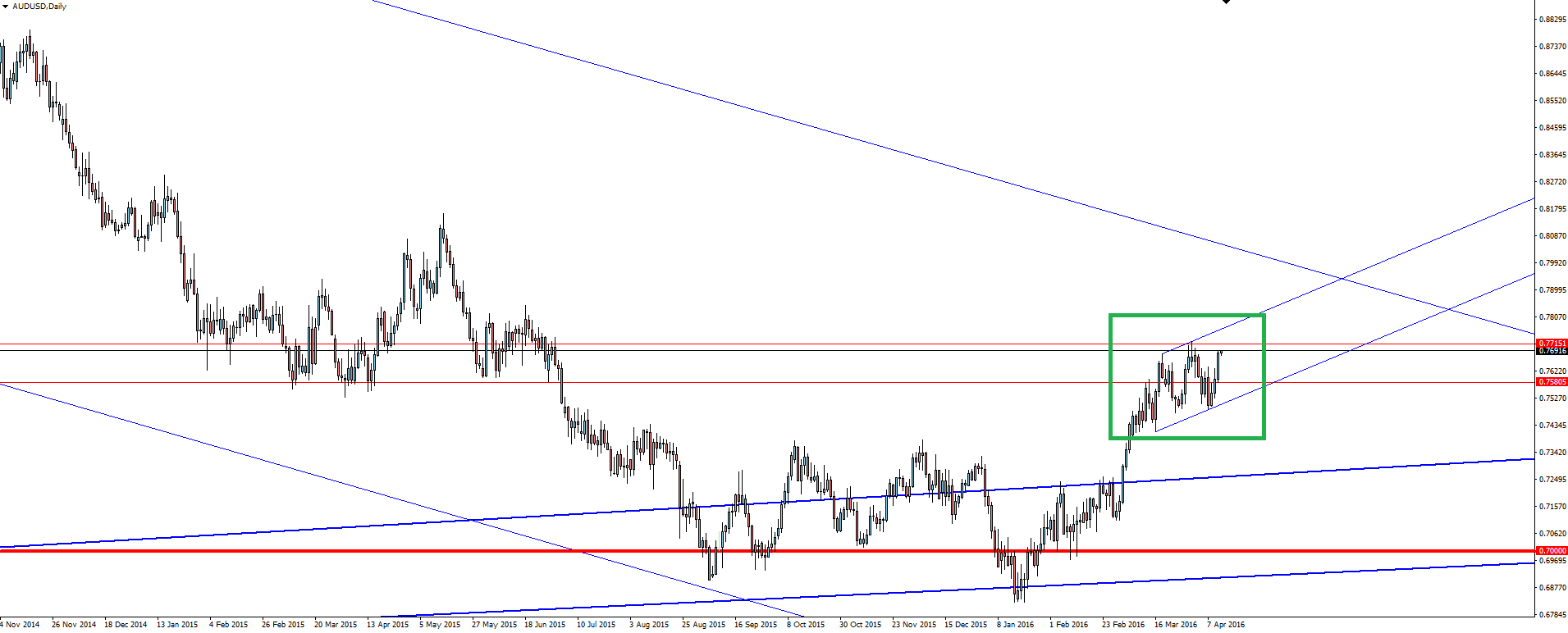

AUD/USD Daily:

The daily view is important because it shows price at the top of a zone which has previously acted as support in the past, as well as showing a shorter term channel that we are still moving between.

Because of this channel, we could easily push through the horizontal zone without a problem which clouds trading opportunities.

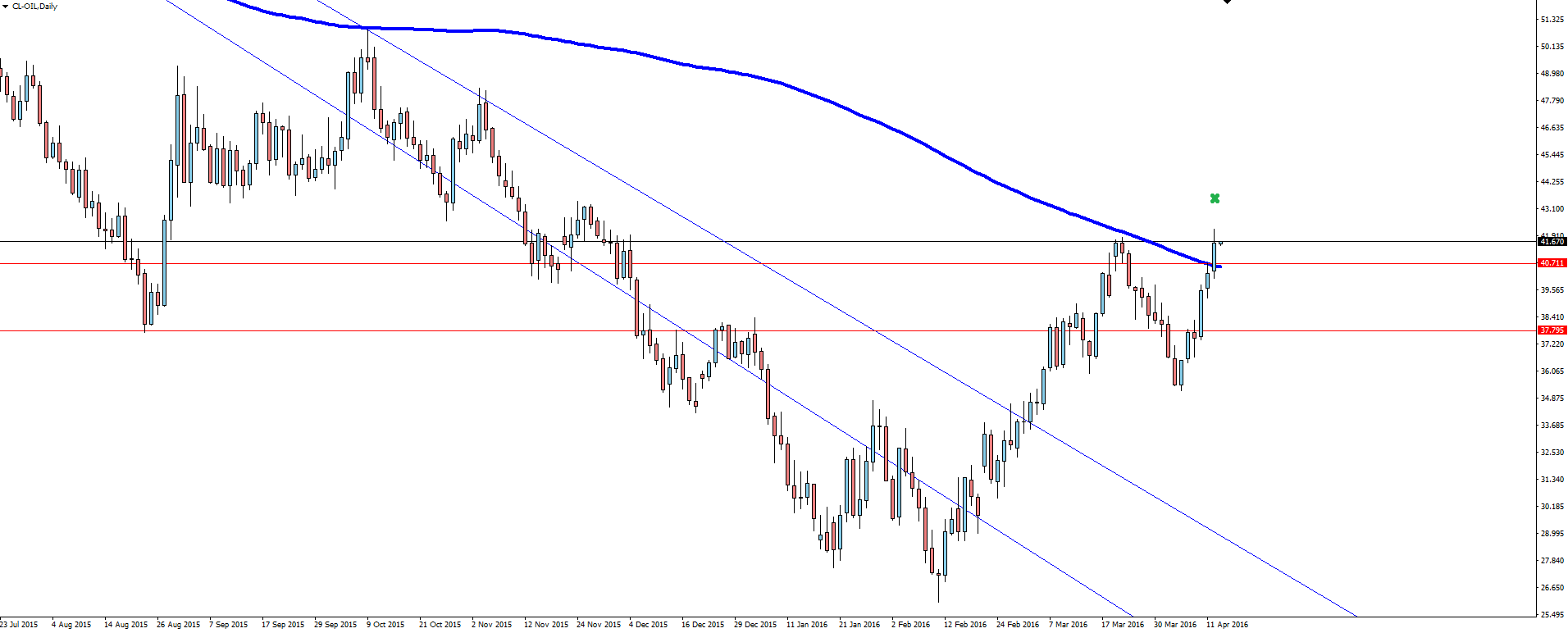

Oil Daily:

As for oil, it’s still all about this weekend’s meetings and the perceived outlook that we are going to get a positive outcome. Even with the Saudi/Iran rift, it is Russia who has been the most vocal saying that they are most confident that a deal can be reached. How can you take anything from that…?

Iran of course doesn’t want to allow their neighbour an advantage following their re-admission back into the world trading fold and are therefore reluctant to cut supply. Russia has it’s own vested interest in the price of oil and of course are going to say whatever they can to get a reaction.

I might sound like a broken record talking about oil this week, but I really do see it as an excellent trading opportunity. Anyone reading this blog knows that I like to look for trading opportunities where market expectation has a chance to disappoint, and who better to rely on for market disappointment than Saudi Arabia and Iran talking oil!

No matter how I look at it, I just can’t see any sort of positive surprise from the talks. The oil market has essentially set itself up to be disappointed no matter the outcome. If talks go smoothly, then it has been priced in. If one falters then we would see another re-pricing back down. And this could be major. There is over 1000 pips back to re-test the broken bearish trend line on that oil daily chart after all!

Finally, I wanted to include a headline that I came across during my morning’s reading (with where it came from omitted).

‘Hope’.

That headline sums it all up for me.

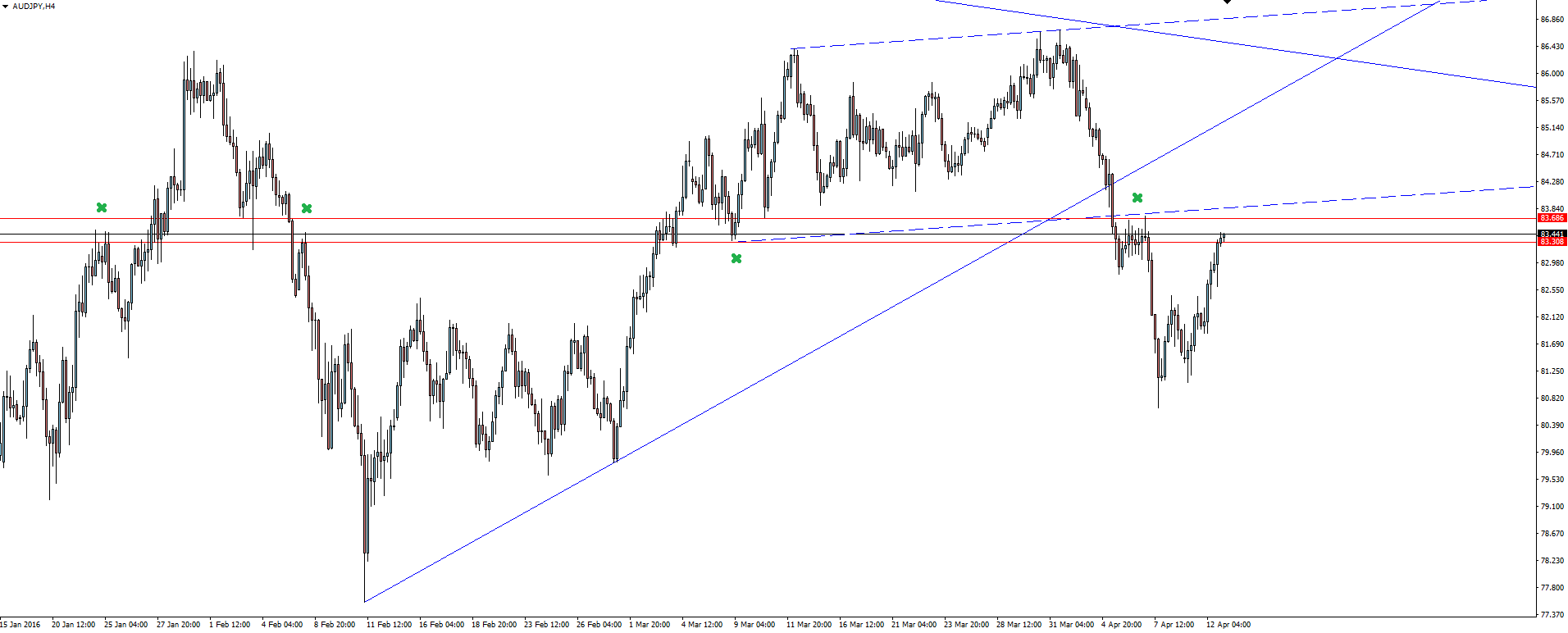

Chart of the Day:

The dynamic of the AUD/JPY cross right now is an interesting one, with commodity price strength and a higher yield seeing the Aussie dollar well supported, while at the same time the headlines out of Japan that we’re all aware of, has seen the Yen equally as strong.

AUD/JPY 4 Hourly:

The bottom, dashed trend line is simply a parallel drawn from the above line that has been touched 3 times. While there wasn’t even a 2nd touch of the bottom line, the fact that the re-test saw the level act as resistance makes me want to leave it there. In any case, the horizontal level is a huge support/resistance zone that price has reacted out of on multiple occasions.

With the momentum behind this almost immediate re-test of the horizontal zone, and the 25 pip or so gap between the horizontal level and the channel bottom, I just get the feeling that this isn’t going to hold.

Is there a play here for price to break higher?

On the Calendar Wednesday:

CNY Trade Balance

USD Core Retail Sales m/m

USD PPI m/m

USD Retail Sales m/m

CAD BOC Monetary Policy Report

CAD BOC Rate Statement

CAD Overnight Rate

USD Crude Oil Inventories

CAD BOC Press Conference

We’ve used the term ‘data deluge’ a little too wishy washy in the past, but THIS is what you call a deluge. Each of those data releases we have listed during the US session above are tier one.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Australian Forex Broker Vantage FX on the MT4 platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.