You might have heard the news that the first new coal mine in a decade opened this month in a small Pennsylvania town called Friedens. The Acosta Mine—the output from which will be used in the production of steel—is expected to employ between 70 and 100 people over 15 years, with salaries ranging between $50,000 and $100,000. President Donald Trump, a strong supporter of coal and fossil fuels in general, even appeared live on video during the grand opening, saying it “signals a new chapter in America’s long, proud coal mining tradition.”

Like the president, I applaud the mine’s opening. In a region that’s been hit particularly hard by the dramatic reduction in coal demand over the past five years alone, the local economy should benefit nicely from the fresh injection of high-paying jobs and tax revenue.

But does the Acosta Mine really “signal a new chapter”? Will it stanch the decades-long loss of coal mining jobs? Will it help make coal more competitive than natural gas or renewables such as wind and solar?

The simplest answer to the questions above is: Not likely.

Energy markets are in full transition mode, both in the U.S. and abroad, and there really isn’t much that can be done to stop it, despite Trump’s best efforts.

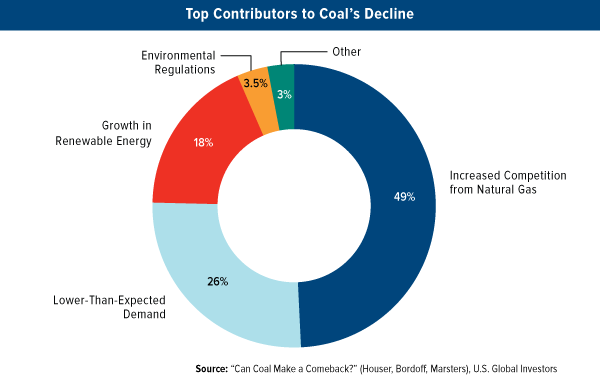

An April study conducted by Columbia University’s Center on Global Energy Policy concluded that “President Trump’s efforts to roll back environmental regulations will not materially improve economic conditions in America’s coal communities.” According to the report, nearly half of coal consumption’s decline can be attributed to increased competition from natural gas. Solar and wind are responsible for about 20 percent of the decline. And as for industry regulations? They’re responsible for only 3.5 percent of coal’s decay, the study’s researchers say.

In light of this, I think it would be prudent for investors in natural resources and energy to adjust their holdings to reflect this transition. In the past year, we’ve overweighed renewable energy stocks in our Global Resources Fund, and the allocation is now a core driver of the fund’s performance.

Coal at a Tipping Point

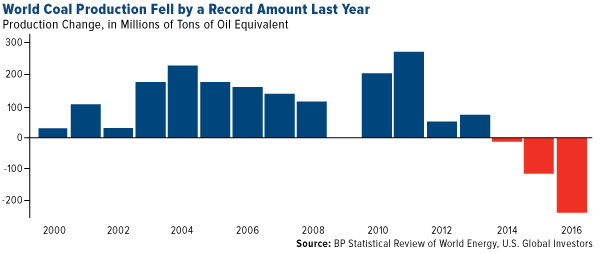

Let’s look at the facts. This month, just as Trump was celebrating the opening of a new coal mine, British oil and gas company BP (LON:BP) reported in its annual review of global energy trends that coal production saw a record decline in 2016. Coal fell 6.2 percent, or 231 million tons of oil equivalent (mtoe), on a global scale. In China, the decline was even more severe.

BP’s chief executive, Bob Dudley, showed little optimism that coal can be revived, even going so far as to say that 2016 marked the completion of “an entire cycle” for coal. Production and consumption were “falling back to levels last seen almost 200 years ago around the time of the Industrial Revolution,” he said, adding that the United Kingdom recorded its “first ever coal-free day in April of this year.”

The U.S. might not have had a coal-free day, but domestic consumption is definitely in freefall. Last year, for the first time ever, natural gas represented a larger share of U.S. electricity generation than coal. Gas provided 34 percent of the nation’s power, coal 30 percent. This gap will only widen as more coal-fired plants are converted to burn natural gas, which is cheaper and cleaner. Facilities that still burn coal are rapidly aging into obscurity, with a vast majority of them (88 percent) built between 1950 and 1990.

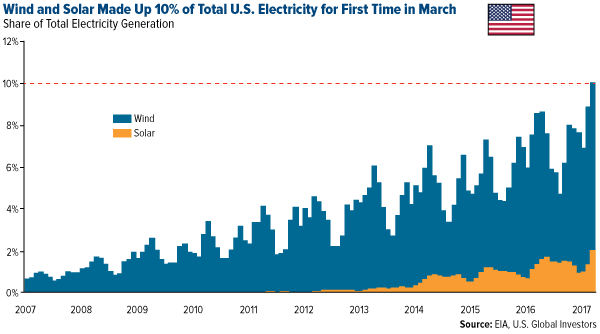

Coal is also facing steep competition from renewables. For the first time in March, wind and solar made up 10 percent of total U.S. electricity generation, according to the U.S. Energy Information Administration (EIA). Windfarms in Texas, Oklahoma, Iowa and other states provided 8 percent, while commercial and residential solar installations represented about 2 percent.

As I shared with you last month, 2016 saw record installation of new renewable capacity across the world, with investment in wind and solar double that found in coal, gas and other fossil fuels. In the U.S., solar ranked as the number one source of new electricity generating capacity.

Renewables Cheaper than Coal

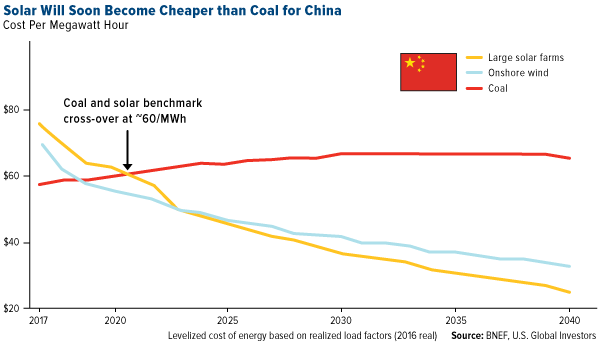

Part of the reason we’re seeing such significant growth in renewable capacity is that solar and wind make good economic sense. Bloomberg New Energy Finance (BNEF) recently reported that solar costs already rival coal in Germany and the U.S. and very soon will do so in China, the world’s largest investor in renewable energy.

For years, solar has been regarded as an inefficient and costly source of energy. But its economics are now beginning to become cheap enough to potentially push coal and even some natural-gas plants out of business faster than what was once previously forecasted.

According to BNEF, costs of new energy technologies are falling so fast that it’s more a matter of when than if solar power and alternative energy sources gain a larger market share than fossil fuels.

China and India a $4 Trillion Opportunity

BNEF now estimates that China and India, the two most populous countries, represent a $4 trillion investment opportunity in new energy capacity by 2040, with most of the investment (nearly 75 percent) in wind and solar.

Although coal will likely be needed to meet the huge population explosions in the two economic powerhouses, its role will steadily diminish, falling to a 17 percent share in India by 2040, according to BNEF estimates. Renewables, meanwhile, will represent about half of all energy capacity.

Wind and Solar: Performance Drivers

This is why we’ve given renewables an overweight position in our Global Resources Fund (PSPFX). There’s still room in the fund for coal—Australia’s Whitehaven Coal Ltd (AX:WHC) has gained more than 190 percent for the 12-month period as of June 20—but we see attractive opportunities in wind and solar.

Among our favorite energy stocks right now are SolarEdge Technologies (NASDAQ:SEDG), up 50 percent year-to-date as of June 20; Vestas Wind Systems (OTC:VWDRY), the largest wind farm manufacturer in the world, up 33 percent; Siemens Gamesa (MC:GAM), up 15 percent; and Sociedad Quimica y Minera (NYSE:SQM) (SQM), one of the world’s top three lithium producers, up 16 percent. (Lithium is used to manufacture lithium-ion batteries.)

Year-to-date, these companies are outperforming the broader S&P 500 Energy Index and are strong drivers of PSPFX’s performance.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Because the Global Resources Fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by the Global Resources Fund 3/31/2017: BP PLC 0.13%, Whitehaven Coal Ltd. 1.47%, SolarEdge Technologies Inc. 1.25%, Vestas Wind Systems A/S 1.54%, Gamesa Corp Tecnologica SA 1.30%, Sociedad Química y Minera de Chile 1.22%.