What does it mean when a company has beaten earnings expectations? In theory, it implies that a public corporation is performing extremely well, justifying a higher price for its stock shares.

The reality? Market analysts intentionally set the expectations bar near the ground. This is how a business entity can get away with non-existent profit growth.

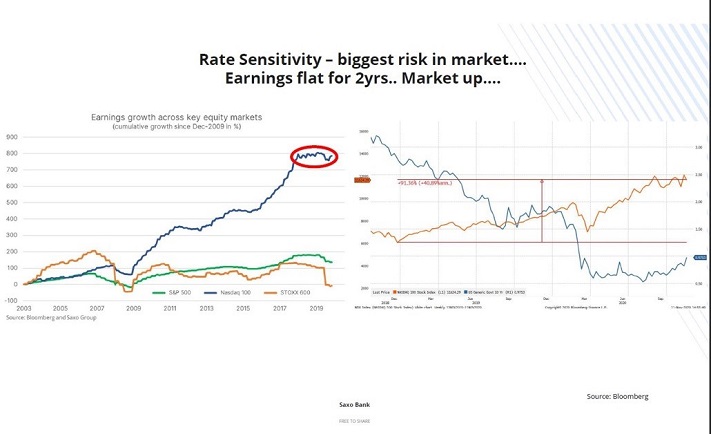

For example, aggregate GAAP earnings for the S&P 500 in the recent quarter are about where they were in the fourth quarter of 2016. That’s four years of stagnation.

Four years earlier, when the S&P 500 traded near 2200, investors paid 23x earnings. Yet today’s investors are eagerly ponying up 37x (Current P/E 37) for 2016-level profitability.

Some might argue that tech stocks and large-cap growth via the “New Economy” NASDAQ 100 are growing profits dramatically. Maybe the mega-caps have. However, the collective earnings growth for the NASDAQ 100 has been flat for two years. Meanwhile, in the same time span, its exchange-traded fund proxy (QQQ) catapulted more than 80%.

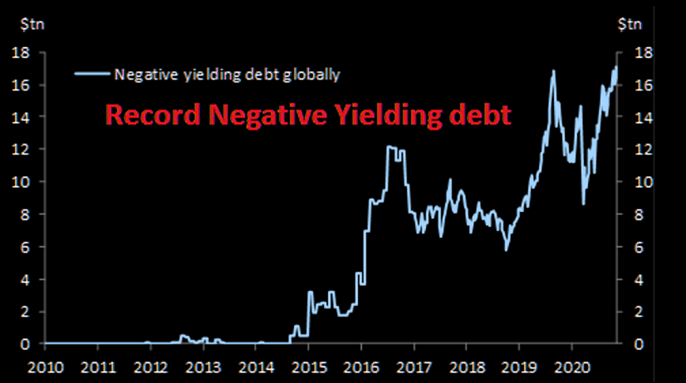

So if it’s not about profits, what’s really driving the stock bubble higher? Unprecedented exuberance about lower interest rates.

Central bank commitment to interest rate suppression fosters bubbles in a number of ways. For one thing, companies that pay less interest on debts may continue to plow money into share buybacks, lowering the supply of shares available. In a similar vein, endowment firms and pensions must take more risk in stocks to achieve target return requirements.

Even individual investors find it difficult to stick with 1%-2% in bonds when stocks offer similar dividends alongside the prospect of price gains. And the safer haven of sovereign debt? Only if you’re excited by negative yields.

Investors can make money in a stock bubble, of course. They just need to avoid getting wet when it explodes.

For instance, with the S&P 500 hitting new market highs this week, the “Big 5” accounted for 23% of the index. Can the parabolic move higher over the last few years continue unabated? Or have we moved closer to a tipping point? Keep in mind, after a parabolic move higher by mega-caps in the late 1990s, the 2000 stock bubble finally burst.

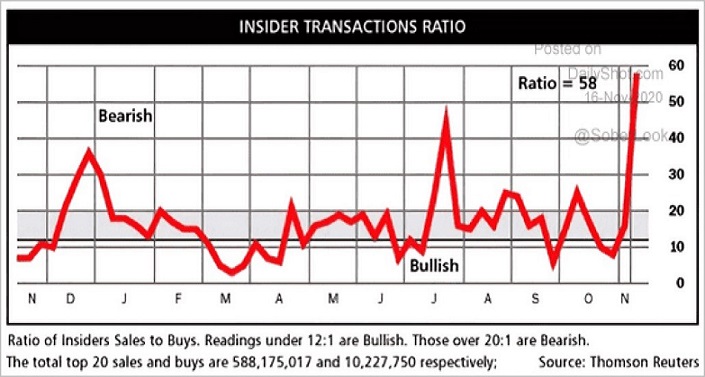

One thing is for certain. Corporate insiders seem to feel that their respective stock shares have limited upside from here. Insider selling is hitting extremes.