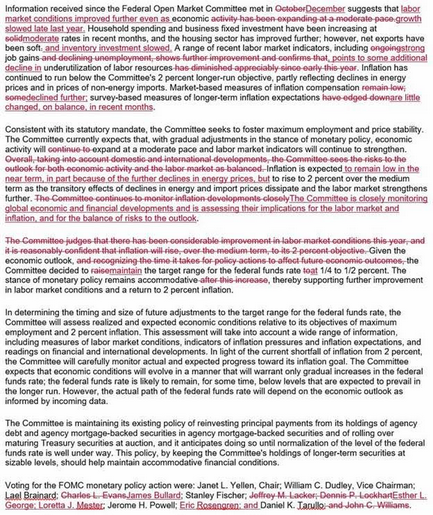

As we noted in Tuesday’s FOMC preview, the central bank hardly appeared to face a decision on Wednesday. After the Federal Reserve raised interest rates for the first time in nearly a decade last month, a pause to evaluate the impact of rising rates was inevitable -- and the recent market turmoil was merely the icing on the cautious Fed cake. Indeed, Wednesday’s statement showed a notable, but hardly irreversible, shift toward the doves [emphasis mine]:

- FOMC: KEEPS POLICY RATE UNCHANGED AT 0.25-0.5%, VOTE 10-0

- FED REPEATS ECONOMY EXPECTED TO WARRANT ONLY GRADUAL RATE RISES

- FED ASSESSING GLOBAL DEVELOPMENTS FOR ITS BALANCE-OF-RISK VIEW

- FED ‘CLOSELY MONITORING’ GLOBAL ECONOMIC, FINANCIAL DEVELOPMENTS

- FED REMOVES 'REASONABLY CONFIDENT' REFERENCE TO 2% MEDIUM-TERM INFLATION LEVEL

- LABOR MARKET SHOULD CONTINUE TO STRENGTHEN

- ECONOMIC GROWTH ‘SLOWED LATE LAST YEAR’

The nod to global economic and financial developments was widely expected, though the decision to remove the comments about being reasonably confident that inflation would rise to 2% over the medium-term was a bit more difficult to parse. To be fair, that line was hardly meaningful in the first place (how confident is “reasonably confident”? What would make Fed officials “reasonably confident”? How long is “medium-term”? etc). In our view, that decision is an effort to increase the central bank’s flexibility moving forward; in other words, it’s one less anchor that Fed members will have to grapple with when deciding whether to raise rates in the future.

The vote in favor of the interest rate “decision” was predictably unanimous, though the notoriously hawkish St. Louis Fed President James Bullard did dissent to the monetary policy statement on longer-run goals. For now, the central bank seems in general agreement, at least to the extent a group of 10 ambitious academics can be.

Market Reaction: Muted

With the statement coming out almost exactly as most analysts (including us) expected, the market’s reaction has been predictably muted. The dollar initially fell as in a kneejerk reaction to the dovish shift (at least relative to last month), but that move was starting to unwind as we went to press: EUR/USD was ticking back down toward 1.0890 from a peak of 1.0910 and 1.0870 before the announcement.

Meanwhile, US equities fell deeper into the red, with the DJIA trading down about 70 points and the S&P 500 off 3. Oil, likewise, dropped off while gold caught a bid. In bonds, the benchmark 10-year treasury yield was come off 4bps to 2.01%, signaling that at the margin, fixed-income traders think the rate-hike path will be more aggressive than they did before the release.