Weakening volume after an extended rally phase is fairly common. It represents a complacency in the markets where traders/investors are unwilling to chase an extended rally phase at higher prices. Often traders are waiting for some type of market correction or rotation to happen – which will allow them to deploy capital back into the markets at decreased price levels. Sometimes, this diminishing volume presents a unique scenario where traders shift their expectations away from traditional “buy the dip” thinking that can sometimes create what is called a flash crash event.

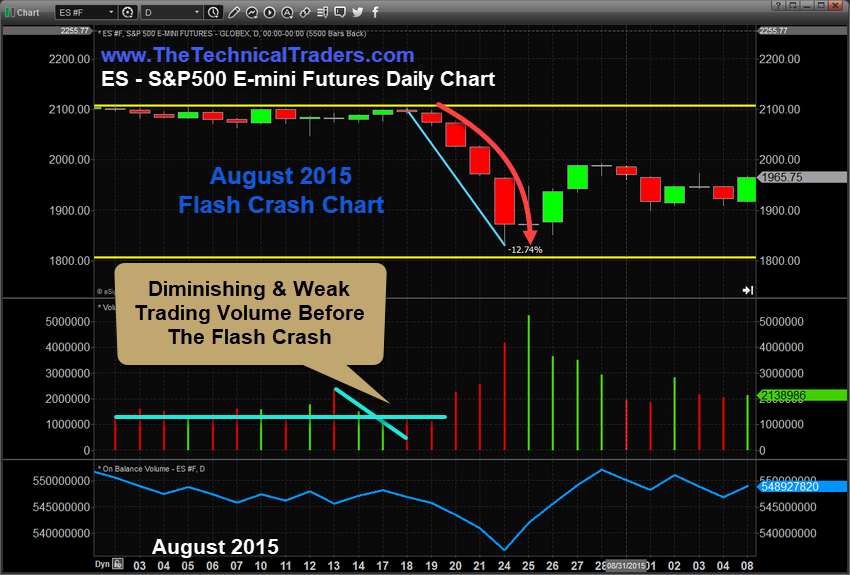

Revisiting August 2015 Flash Crash Event

In August 2015, a unique flash crash took place that prompted a 12.5% collapse in the S&P 500 in just four trading days – after a bout of selling pressure on a Wednesday/Thursday/Friday. The following Monday, the markets opened with a small lower opening gap, yet traders were unwilling to buy into the 'ask,' and this created a very unique scenario where price exploration created a widening price void. As algos and computers continued to try to find active buyers in the marketplace, the ask/bid spreads continued to widen as the liquidity trap had sprung.

Without active participation in the price exploration process (a lack of buyers supporting the market in this case), sell-side systems kept working active orders while chasing the ask lower and lower through the price void. This is a type of liquidity trap that unfolds when the equilibrium between active buyers and sellers becomes skewed. The price void becomes a very tangible liquidity trap that eventually closes after a substantial price move – when traders become bargain hunters and start to fill the liquidity trap.

It is the opinion of my team and I that the components of a flash crash event consist of three unique market dynamics aligning to create this type of outcome.

- Complacency in the marketplace – or lack of urgency by many traders to understand and recognize the risks within the markets right now.

- Diminishing trading volume – a weakening total volume level suggests traders are not actively engaging in the price exploration process. This creates the potential for a price void to come into existence – disrupting the normal ask/bid spreads.

- An extended, almost ritualistic, price trend cycle that materializes to shake traders away from normal risk protection processes. In this type of scenario, stops are very wide or sometimes non-existent. Traders are committed to the trend and have over-leveraged themselves into the belief that “nothing could go wrong.”

In August 2015, the U.S. markets had been trending higher since the August 2011 deep market correction (consisting of a 22% correction). The rally from those 2011 lows lasted almost 3.5 years and consisted of a 95% upside price advance before the 2015 flash crash. Average volume throughout this span of time was near 2.6 million ~ 2.7 million shares a day. Over the 90+ days before the August 2015 flash crash, daily trading volume dropped to 1.3 million ~ 1.5 million shares a day. Additionally, price had entered a decidedly sideways “melt-up” in 2015, which eventually rolled over after May/June 2015.

As we move forward into this research article, I wanted to bring something interesting to your attention. Have you noticed the deep correction in 2011 happened in August? The 2015 flash crash happened in August. The deep market correction in 2018 started on Sept. 2, just days after August 2018.

Historically, August typically shows a nearly 2:1 downside propensity over the past 28+ years (for the SPDR® S&P 500 (NYSE:SPY): 13 years showing an average of -6.34 vs. 15 years showing an average of +3.45). The largest monthly positive and negative values for the SPY are +8.82 and -14.42, respectively. In other words, the month of August, or transitioning into September, can be full of very big surprises at times.

Current SPY Diminishing Volume May Be Setting Up An August Surprise

The continued melt-up over the past 8+ months since the November 2020 elections may be presenting a very real opportunity for another type of August volatility event. We are starting to see weakening volume while the SPY continues to grind higher in a more narrowing range. Recently, the dramatically weaker trading volume seems to have fallen off a cliff over the past few weeks.

The 2015 flash crash set up on the week of Aug. 10 through Aug. 14. Are we setting up for another type of volatility event, or flash crash, right now with this diminishing volume?

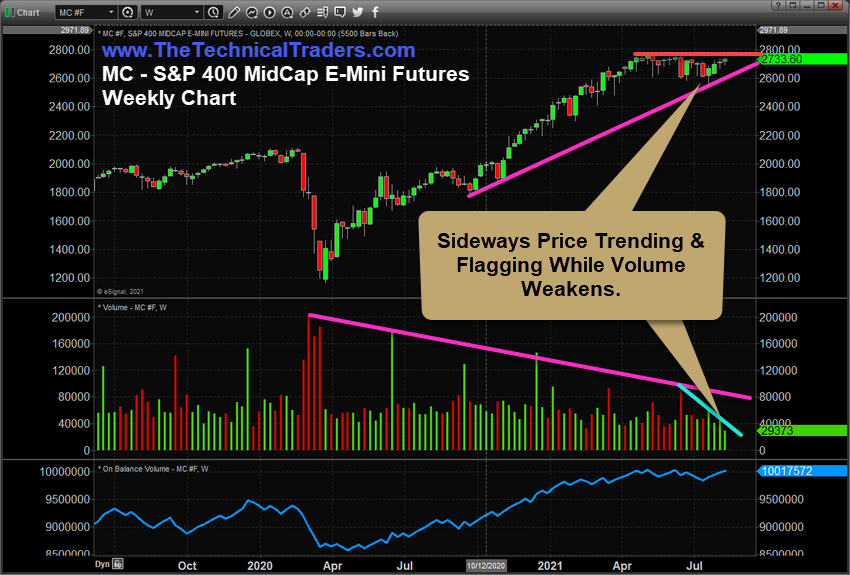

S&P 400 Mid-Cap Futures Show A Very Clear Diminishing Volume Setup

Historically, the average volume on this MC, S&P Midcap 400 weekly chart, has been somewhere near 65,000 to 75,000 over the past 2+ years. Currently, the average weekly trading volume has dropped to approximately 38,000 to 44,000 over the past 6+ months. Additionally, we've seen a dramatic decline in volume over the past 3+ weeks – almost as if volume levels have fallen off a cliff while price has continued to move in a decidedly sideways price channel.

As we continue to push through the month of August, it might be wise to reconsider risks related to an August surprise while continuing to focus on protecting assets and growing wealth over time. We are not trying to push any fear into your heads related to our research, we are simply pointing out the similarities to the 2015 flash crash and the August surprise events that have taken place over the past 8+ years.

Our data shows that August typically presents a 2:1 downside price volatility exception even though August has historically been higher 15 of the last 28 years. That means that August may continue higher with a nearly 55% chance of no August surprise event. But the flip-side of that is there is nearly a 45% chance that a broad downside market event will take place in August that may be in excess of -6.34 to -14.42 points for the SPY. Translating that for the MC would represent -50.33 to -95.5 points with roughly the same accuracy ratio.

One thing is certain, there are only about 12 more trading days in August 2021. We'll know soon enough if there is going to be any type of volatility event associated with the diminishing volume we are seeing in the markets right now. There is not much time left for this event to take place – only about 15 to 25+ days based on our expectations.