It's been two months since Brexit temporarily shocked global markets.

Major indexes around the world have since recovered, with even London's FTSE 100 Index well above pre-Brexit levels.

For commodities, the reaction was a mixed bag. But most recovered from any initial stumbles.

On the other hand, some of the strongest-performing commodities this year grew even stronger.

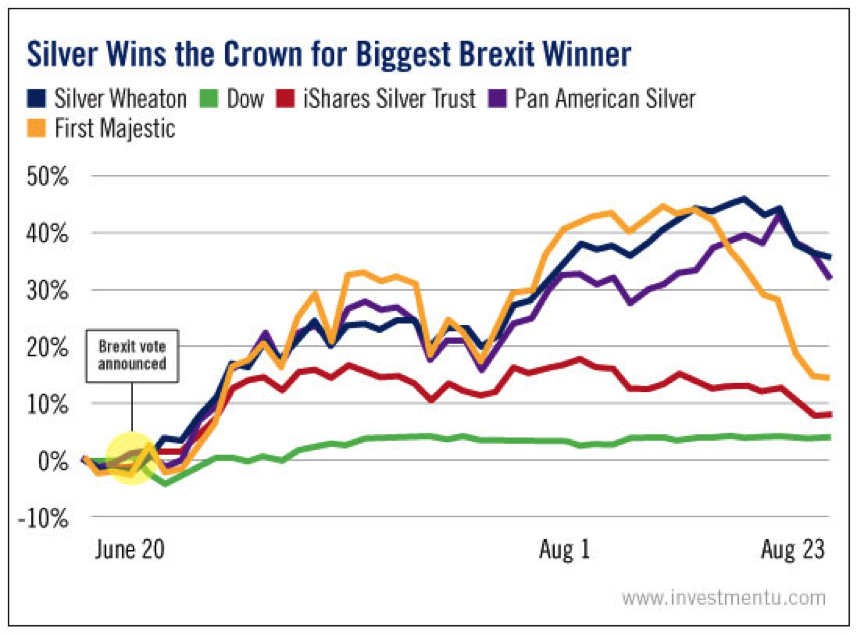

Silver gets the crown for biggest Brexit winner. The price of silver gained nearly 13% in the week following the U.K. referendum results. And producers, like Silver Wheaton (NYSE:SLW), churned out even better performances...

Silver Wheaton shares quickly jumped 13.6% in the wake of Brexit. Since then, they’ve climbed more than 35%. At the same time, the iShares Silver Trust (NYSE:SLV) has gained 32%. And miners First Majestic (NYSE:AG) and Pan American Silver (NASDAQ:PAAS) are up an average of 10%, doubling the performance of the Dow.

So far in 2016, silver has been the best-performing metal, gaining more than 36%. That also makes it the best-performing commodity, outperforming both sugar and gold.

Historically, silver has been a "Buy" when the gold-silver ratio hits 80 (when it takes 80 ounces of silver to buy one ounce of gold).

Back in March, this ratio hit 80.57.

Now, we can see from the chart that every time the gold-silver ratio hits this 80 level, it bounces lower. That occurs when silver's price outperforms gold's. As long as this is the case, the ratio will continue to decrease until it drops below 50.

From July 2011 to March of this year, the gold-silver ratio tromped steadily higher, from 40 into the low 80s. But it has started to walk back down and currently sits at 70.4. That's thanks to silver's outperformance of gold.

This is exactly the trend that you want to see as a resource investor. The price of gold has gained 26.5%, or roughly $282 per ounce this year. At the same time, the price of silver has gone up 36%, or $5.18 per ounce.

I'm not going to tell you that silver is going to rise to $100 per ounce or that gold is going to go to something ridiculous. But as a trend trader following a clearly defined pattern, I will tell you the move in silver is far from over.

For the gold-silver ratio to return to its historic sell level of 50, and for the price of gold to stay at its current level, silver would need to rise to $26.76 per ounce.

That's a 36.9% increase from current prices.

So, even if you didn't believe us in March when we told you the gold-silver ratio signaled a buying opportunity -- silver was $15.89 per ounce then - you still have an opportunity for gains.

The historic three-month average gain for silver following a gold-silver ratio peak is 19.29%. Since March 21, the price of silver has gone up 20% -- right in line with that average.

The historic average gain in silver six months after a gold-silver ratio peak is 49.3%. So even over the next few months, there's plenty of upside.

It gives us a price target of somewhere around $23.75 by October.

Good investing,