Preliminary estimates of the U.S. election results support a positive mood on the world markets, reducing the demand for protective assets and causing some dollar weakening.

It should be noted that market movements are very moderate. The dollar index sank by 0.2%. Futures for S&P 500 has added about the same amount.

The Democrats got control over the House of Representatives, but the Senate remained under control of the Republicans. This is the most expected result, and it is welcomed by markets, as the control of the Senate eliminates the risk that rigid regulation of the financial sector can be restored. After many surprises during the Votes in recent years, the most probable outcome looks somewhat unusual.

Often after the elections, even if their results meet expectations, there is some upswing in the markets, following the reduction of the uncertainty.

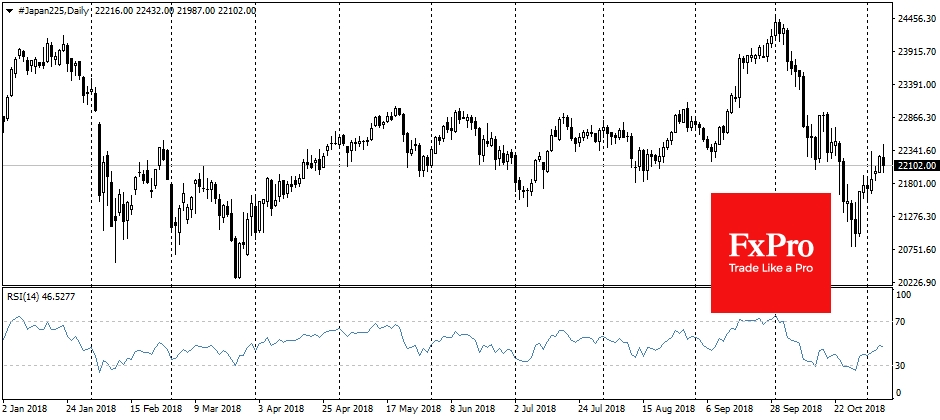

Now the focus of the market returns to other macrotrends. At the time of writing, Chinese indices and Japanese Nikkei 225 have returned the increase since the beginning of the day and have entered the red zone to preserve fears before the trade wars.

The dollar has been losing ground since the beginning of the month, following the recovery of the demand on the U.S. stock markets and the return of demand for the pound and the euro. The British currency is adding on the progress around the Brexit negotiations. Expectations of a breakthrough allowed GBP/USD to add more than 3% from the end of October and return above 1.31. At the same time, one should stay very cautious about such expectations, as there have been many unfulfilled hopes for a breakthrough in recent months on this topic.

At the same time, the recovery from the October dip continues in the American markets. Futures on S&P 500 Returned to the mark of 200-day average. Further growth above this line can be a positive signal, additionally supporting the demand for shares.