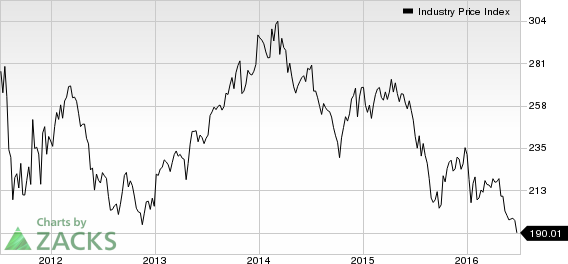

The rally in the broader markets continued after the rebound from the Brexit-induced fall, with the major indexes trading in the green. This had a positive impact on the defense stocks over the last five trading sessions. The S&P 500 Aerospace & Defense (Industry) index and Dow Jones U.S. Aerospace & Defense Index climbed 4.54% and 4.64%, respectively, in the last five trading sessions.

`

This apart, the spotlight was on Lockheed Martin (NYSE:LMT) LMT that maintained its supremacy by securing high-value contacts.

Again, the long-anticipated award of two new major U.S. Navy shipbuilding contracts turned out as expected last week, with long-time amphibious shipbuilder Ingalls Shipbuilding getting a new assault ship contract and the veteran support ship builder NASSCO set to build the first six of a new class of fleet oilers.

(Read Defense Stock Roundup for Jun 28, 2016 here.)

Recap of the Week’s Most Important Stories

1. The Defense Logistics Agency has awarded Lockheed Martin a potential $1.75 billion contract to provide consumable and depot-level repairable components for various weapon systems of the U.S. military. The Pentagon’s prime contractor will provide the weapon components to the U.S. Army, Navy, Air Force and Marine Corps.

Lockheed Martin has won another contract worth $323 million from the Navy last week to provide a laboratory for the F-35 Lightening II. The laboratory would contain a hardware in-the-loop (“HITL’)-based system to test and examine mission data file (“MDF”) performance in an operationally representative environment; a set of tools to manufacture, alter, manage, analyze and issue MDFs and MDF sets, and build and load mission data loads in the HITL, with limited product support elements.

Lockheed Martin has also been awarded a task order for Terminal High Altitude Area Defense (“THAAD”) system development, support and integration under a previously awarded sole-source, indefinite-delivery/indefinite-quantity (“IDIQ”) contract. With this modification, the order value of the contract has been increased by $205 million, resulting in a total contract value of $995.2 million.

2. A United Technologies Corp. (NYSE:UTX) unit, Pratt and Whitney, secured an $873.2 million cost-plus-incentive-fee contract from the U.S. Air Force to design, manufacture, integrate and test turbofan adaptive aircraft engines.

As a part of the Adaptive Engine Transition Program (AETP), Pratt & Whitney will design, develop, fabricate, and test complete adaptive engines in the 45,000lb thrust-class, continuing the advancement and maturation of the next generation of military fighter engine technology.

AETP is mainly aimed at maturing a three-stream architecture and other advanced propulsion technologies that are essential for high-speed and long-endurance performance requirements.

The company will carry out the work at Hartford, CT, West Palm Beach, FL, and Arnold Engineering and Development Complex, TN. and the work is slated for completion by Sep 30, 2021.

3. General Dynamics Corp.’s (NYSE:GD) National Steel and Shipbuilding Co. (“NASSCO”) received a contract from the U.S. Navy for the design and development of six oilers, the TAO-205 Class Fleet Replenishment Oilers, having a cumulative capacity to transport 156,000 barrels of oil.

The contract is valued at $3.2 billion, on the potential exercise of all options. The base value of the contract stands at $640 million for the construction of the first oiler and is expected to be followed by one ship per year from fiscal 2018 to fiscal 2022 as and when funds are allocated.

Again, Electric Boat Corp, another unit of General Dynamics, has secured a follow-up contract from the U.S. Navy worth $116.2 million for the production of Virginia Payload Module and South Dakota Insertion sample materials to be used in Virginia Class Submarines.

4. Raytheon (NYSE:RTN) and Thales have announced that they are modifying the structure of their ThalesRaytheonSystems (TRS) joint venture. The equally owned joint venture - which was established in 2001 - currently specializes in air operation command-and-control (C2) systems, surveillance radars, and ground-based weapon-locating radars.

Under an agreement announced on Jun 30, the joint venture will now focus solely on C2 operations for air and missile defense under the NATO Air Command and Control System (ACCS), of which TRS is the prime contractor.

The ground-based radars and non-ACCS-related air command and control systems currently within the joint venture portfolio will return to their parent companies. The former TRS LLC – US Operations is now a wholly owned subsidiary of Raytheon, Raytheon Command and Control Solutions. The former TRS SAS – French Operations is now a wholly owned subsidiary of Thales.

Raytheon made a cash payment of $90 million to Thales as a part of the transaction. A tax free gain of around $150 million will be reflected in the company’s second-quarter financial results.

Meanwhile, the missile maker clinched a modification contract worth $291.8 million for the procurement of AIM-9X Block II Missiles. Per the contract, Raytheon will deliver 660 AIM-9X Block II All Up Round tactical full rate production Lot 16 Missiles to the U.S. Navy, Air Force, Army and the governments of Japan, Norway and Taiwan.

5. Huntington Ingalls Industries, Inc. (NYSE:HII) won an initial $272.5 million fixed-price-incentive firm target contract from the U.S. Navy for the planning, advanced engineering, and procurement of long lead time material for the LHA 8 ship, with full funding to follow.

The assault ship, designated LHA 8, will be built at the Huntington Ingalls Industries Ingalls Shipbuilding yard in Pascagoula, MS, which has produced all previous assault ships for the Navy.

The contract is valued at $3.13 billion, on the potential exercise of all options and is slated for completion by Jun 2017.

Performance

Defense stocks regained their spot after consecutive sessions of volatility. In the last five trading sessions, almost all the major stocks in the sector appreciated by a decent percentage. General Dynamics surged the most followed by Textron Inc. (NYSE:TXT) .

The six-month picture shows a mix of gains and losses. L-3 Communications Holdings (NYSE:LLL) was in the leading position while Textron was the biggest laggard.

The following table shows the price movement of the major defense players over the past five trading days and during the last six months.

Company | Last Week | Last 6 months |

LMT | 4.20% | 15.90% |

BA | 5.70% | -6.46% |

GD | 6.83% | 5.19% |

RTN | 0.56% | 8.38% |

NOC | 3.57% | 16.27% |

COL | 3.99% | -8.17% |

TXT | 6.00% | -12.44% |

LLL | 4.74% | 24.07% |

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

GENL DYNAMICS (GD): Free Stock Analysis Report

TEXTRON INC (TXT): Free Stock Analysis Report

UTD TECHS CORP (UTX): Free Stock Analysis Report

RAYTHEON CO (RTN): Free Stock Analysis Report

L-3 COMM HLDGS (LLL): Free Stock Analysis Report

HUNTINGTON INGL (HII): Free Stock Analysis Report

Original post

Zacks Investment Research