We are on the threshold of another earnings season, this time the second quarter of 2016. The outlook for the aerospace and defense sector is not so bad when compared with the overall Q2 forecast. Total earnings are likely to be down 6.2% on 0.6% lower revenues, with growth in the negative territory for 9 of the 16 Zacks sectors.

In contrast, the aerospace and defense sector is expected to register a 3.1% increase in earnings despite a 0.3% revenue decline.

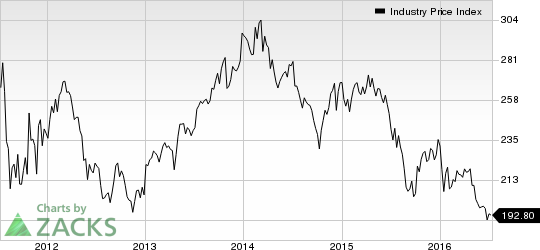

Meanwhile, the rally in the broader markets has continued last week, with the major indexes trading in the green. This has helped the defense stocks over the last five trading sessions as well. The S&P 500 Aerospace & Defense (Industry) index and Dow Jones U.S. Aerospace & Defense Index climbed 1.57% and 1.52%, respectively, in the last five trading sessions.

Boeing (NYSE:BA) came up with a mixed second-quarter delivery report. United Technologies Corp. (NYSE:UTX) on the other hand clinched a $1.5 billion defense contract.

(Read Defense Stock Roundup for Jul 5, 2016 here.)

Recap of the Week’s Most Important Stories

1. The Boeing Company reported second-quarter 2016 deliveries wherein commercial deliveries were up 1% whereas defense shipments were down 19.6% year over year. Boeing’s second-quarter 2016 commercial deliveries of 199 airplanes were driven by higher demand for its 777 and 787 Dreamliners. Sequentially, deliveries showed a 13.1% improvement. Boeing’s total deliveries were 244 units in the quarter compared with 253 a year ago.

The first half numbers were rather disappointing for this aerospace and defense major. In the first half of the year, Boeing’s total shipments were 470 units compared with 479 in the corresponding year-ago period. Of the total, commercial deliveries were 375 (down from 381 in 1H15) and defense deliveries were 95 units (down from 98 in 1H15).

On a more positive note, the U.K. Ministry of Defense announced yesterday a $2.3 billion deal to buy 50 AH-64E Apache (NYSE:APA) helicopters from Boeing for the army. The new Apaches are being purchased through the U.S. Foreign Military Sales (FMS) program at the ongoing Farnborough air show.

The United Kingdom also has officially confirmed a plan to secure nine P-8A maritime surveillance aircraft, worth around $3.8 billion or 3 billion pounds.

2. United Technologies Corp.’s operating segment, Pratt & Whitney, received a contract worth $1.5 billion from the U.S. Department of Defense (DoD) to manufacture F135 propulsion systems to power all three variants of the F-35 Lightning II aircraft. The deal encompasses 99 engines in aggregate, along with program management, engineering support, spare modules and related spare parts.

F-35 Lightning II is a highly advanced fighter jet manufactured by Lockheed Martin Corporation (NYSE:LMT) and is widely regarded for its superior combination of stealth with speed and agility.

3. Pentagon’s prime contractor Lockheed Martin Corp. secured a $559.5 million contract to provide infrastructure investments for 94 F-35s, according to an announcement by the Pentagon last week. Per the contract, Lockheed Martin will be provided funds for spare parts, support equipment and items specific to the so-called "autonomic logistics information system” or ALIS on 94 F-35 aircraft.

ALIS is regarded as a system of systems that tracks maintenance data for individual aircraft as well as the larger global fleet.

Meanwhile, Lockheed Martin has announced that the exchange offer for the separation of its Information Systems & Global Solutions (IS&GS) segment is underway, one more step in the proposed tax-efficient Reverse Morris Trust transaction. Per the proposed transaction, Abacus Innovations Corporation (Abacus), a subsidiary of Lockheed Martin created to facilitate the transaction, will merge with a subsidiary of Leidos and become a wholly owned subsidiary of Leidos. This is the first time that Lockheed Martin revealed how the exchange offer would work.

Lockheed Martin shareholders can receive a 10% discount on new shares in Leidos Holdings Inc. (LDOS) when it merges with Lockheed’s $5.6 billion government IT division in the coming months, according to filings with the U.S. Securities and Exchange Commission.

4. Triumph Group, Inc. (NYSE:TGI) has signed long-term agreements with Lockheed Martin for supplying key engine and structures components for the F-35 Lightning II aircraft.

Per the agreement, Triumph will supply engine mounts, bulkheads, longerons and wing ribs for Lockheed Martin’s F-35. The supply agreement will run through 2021. The latest agreements are expected to drive organic growth at the company.

5. The U.S. Army Contracting Command, Redstone Arsenal, Alabama, has awarded General Dynamics' (NYSE:GD) Ordnance and Tactical Systems a modification contract valued at $169.7 million for Hydra rockets. This contact falls under the FMS program for the allied nations of Colombia, Afghanistan, Iraq, Qatar, United Arab Emirates, India and Belgium. The contract will run through Jan 31, 2019.

6. Northrop Grumman Corp. (NYSE:NOC) has received a U.S. Navy contract to continue its counter improvised explosive device support for the Navy. This is a modification contract valued at $103.4 million.

Per the contract, Northrop Grumman will start low-rate initial production of the U.S. Navy’s Joint Counter Radio-Controlled Improvised Explosive Device or RCIED Electronic Warfare Joint Crew (JCREW) Increment One Build One system. The company will provide counter radio-controlled-IED systems, which protect combat troops against IEDs.

Performance

Defense stocks remained in the green last week amid sessions of volatility. In the last five trading sessions, almost all the major stocks in the sector appreciated by a decent percentage. Textron Inc. (NYSE:TXT) surged the most followed by Boeing.

The six-month picture shows more of gains than losses. L-3 Communications Holdings (NYSE:LLL) was in the leading position with over 28% share price appreciation while Rockwell Collins Inc. (NYSE:COL) was the biggest laggard with a 3.59% share price drop.

The following table shows the price movement of the major defense players over the past five trading days and during the last six months.

Company | Last Week | Last 6 months |

LMT | 1.96% | 18.40% |

BA | 3.99% | 1.84% |

GD | 2.01% | 8.37% |

RTN | 1.82% | 12.71% |

NOC | 0.19% | 18.49% |

COL | 2.89% | -3.59% |

TXT | 7.05% | -2.05% |

LLL | 1.22% | 28.86% |

What’s Next in the Defense World?

Lockheed Martin will report its second-quarter 2016 results on Jul 19 before the opening bell.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

NORTHROP GRUMMN (NOC): Free Stock Analysis Report

BOEING CO (BA): Free Stock Analysis Report

ROCKWELL COLLIN (COL): Free Stock Analysis Report

TRIUMPH GRP INC (TGI): Free Stock Analysis Report

TEXTRON INC (TXT): Free Stock Analysis Report

UTD TECHS CORP (UTX): Free Stock Analysis Report

L-3 COMM HLDGS (LLL): Free Stock Analysis Report

Original post

Zacks Investment Research