It's decision time in the eurozone, at a whole host of levels. From a technical viewpoint, the Euro STOXX 50 is forming a wedge and I am watching for the direction of the breakout.

ECJ decision

The ECJ will render a decision today on the ECB`s OMT program, which could have an impact on the proposed QE program likely to be announced next week. This Bloomberg report puts the decision in context:

European Central Bank President Mario Draghi will get a legal readout tomorrow on a predecessor to the quantitative easing plan that he’s set to reveal later this month.

An adviser to the EU Court of Justice will say whether the European Central Bank’s Outright Monetary Transactions program overstepped the law in a non-binding opinion that may signal whether QE must also be reined in.

A negative opinion “would make the ECB’s life much tougher,” Carsten Brzeski, chief economist at ING-DiBa in Frankfurt, wrote in a note to clients yesterday. “It would be welcome grist to the mills of Germans’ opposition against QE. In our view, given the political and economic sensitivity of the Court’s verdict, an outright condemnation of the legality of OMT is highly unlikely.”

To QE or not QE?

As well, we have the ECB Governing Council meeting next week on January 22, where they are expected to announce some form of QE-lite (via CNBC):

The European Central Bank (ECB) could be ready to announce a quantitative easing (QE) program based on the contributions made from national central banks, a source close to the central bank has told CNBC.

The source said that the central bank is planning to design a sovereign debt purchase program based on the paid-in capital contributions made by euro zone central banks.

Every national central bank pays a certain amount of capital into the ECB. For example Germany pays in 17.9 percent of the total contributions, while France contributes 14.2 percent. Cyrpus, meanwhile, pays the least with 0.15 percent of the total.

Greece is the word

Shortly after the ECB meeting, Greece will hold its election on January 25. While Syriza is still leading in the polls, it is unclear whether they will be able to form a government, according to Marc Chandler. Needless to say, such a development would be hugely market bullish:

In Greece, the latest polls continue to show Syriza winning a plurality of votes at the January 25 election. Prime Minister Samaras’ New Democracy has not been able to close the 2-3 percentage point lead. Even with the 50 bonus seats given to the party that gets the most votes, it appears Syriza may not secure a majority in parliament. If it fails to do so after three days, the party with the second highest vote count will get a chance. New Democracy may be able to do so, avoiding another election.

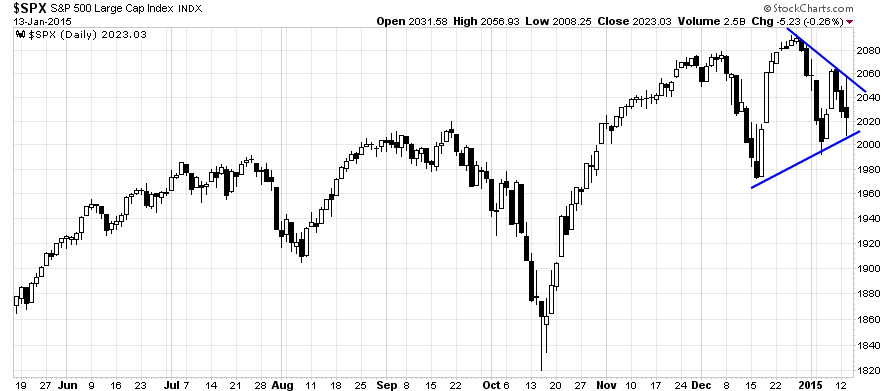

I would note that the SPX is already forming a wedge formation similar to the Euro STOXX 50. Given the kinds of deflationary winds emanating from Europe, it may be eurozone developments that drive the next direction in the stock market, rather than Earnings Season in the US.

So instead of just watching US stocks, savvy investors and traders might be better served by watching Europe.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.