The DAX index is unchanged in the Monday session. Currently, the DAX is at 13,157.00, up 0.03% on the day. On the release front, there are no Eurozone or German indicators. On Tuesday, we’ll get a look at ZEW Economic Sentiment reports out of Germany and the eurozone, and ECB President Mario Draghi will speak at an event in Frankfurt.

Brexit is back in the headlines, and this could have an effect on European stock markets. There was a major breakthrough on Friday, as EU Commissioner Jean-Claude Juncker announced that sufficient progress had been made on non-trade issues in the Brexit talks. The announcement came as May was able to get both the Irish government and the DUP party on board, after she promised both that Northern Ireland would not have any hard borders after Brexit. This breakthrough means that Britain and Europe can now move to Phase II and discuss trade relations. With Britain scheduled to leave the EU in March 2019, time is of the essence. What will a new trade relationship look like? On Sunday, Brexit minister David Davis said he envisions a comprehensive trade deal with Europe, which would be signed just after Britain leaves the bloc. The EU recently signed a free-trade treaty with Canada, and Davis said that he wants an agreement “Canada plus plus plus”, meaning that the deep trading ties between the sides and access to European markets would remain intact.

US job numbers were a mixed bag on Friday. Nonfarm Employment Change softened in November, but the reading of 228 thousand easily beat the estimate of 198 thousand. However, wage growth missed the forecast and remains a major source of concern. Average Hourly Earnings, which measures wage growth, came in at 0.2%, shy of the estimate of 0.3%. Analysts remain stumped as to why wages remain stubbornly low, given a red-hot labor market which is running at full capacity. On an annual basis, wages rose 2.5%, short of the forecast of 2.7%. The Fed is also concerned with the lack of wage growth, and this could have a significant effect on monetary policy – if wage growth and inflation shows improvement in 2018, the Fed could raise rates up to three times in 2018.

Economic Calendar

Monday (December 11)

- There are no Eurozone or German events

Tuesday (December 12)

- 5:00 German ZEW Economic Sentiment. Estimate 17.9

- 5:00 Eurozone ZEW Economic Sentiment. Estimate 30.2

- 14:00 ECB President Mario Draghi Speaks

*All release times are GMT

*Key events are in bold

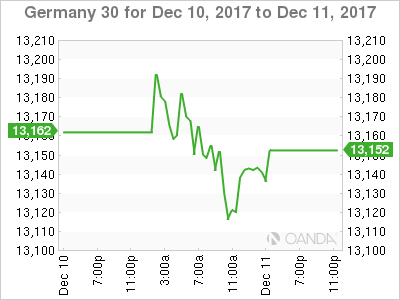

DAX, Monday, December 11 at 8:50 EDT

Open: 13,182.50 High: 13,191.50 Low: 13,133.25 Close: 13,153.50