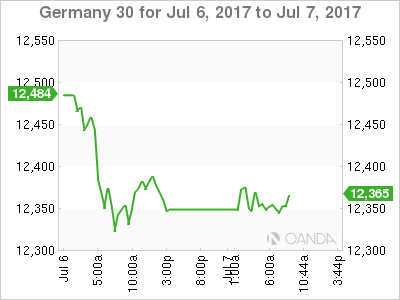

The DAX index has inched lower in the Friday session, as the index is down 0.22%. Currently, the DAX is at 12,355.50. On the release front, German Industrial Production gained 1.2%, easily beating the estimate of 0.2%. Later in the day, the US releases Nonfarm Payrolls, which traders should treat as a market-mover. The indicator is expected to jump to 175 thousand. As well, the Federal Reserve will release its semi-annual Monetary Policy Report.

All eyes are on US nonfarm payrolls, considered the most important US employment indicator. The indicator was dismal last month, plunging to 138 thousand, compared to an estimate of 181 thousand. The markets are expecting better news this time around, with an estimate of 175 thousand. On Thursday, the Fed minutes were a non-event, as the failed to provide any clarity about the Fed’s plans. The minutes pointed to a divided Fed over the key issues of inflation and the Fed’s bloated balance sheet. Some members expressed unease at the Fed’s current forecast of rate hikes, given the persistently low levels of inflation.

According to the current “dot plot”, the Fed expects to raise rates in December, and three times in 2018. There was also division over the timing of reducing the $4.2 trillion balance sheet – some policymakers were in favor of starting in September, while others preferred later in the year. At the June meeting, the Fed stated that it would begin reducing the balance sheet this year, but provided no details. Analysts expect the Fed to start winding down the balance sheet in September, prior to a rate hike in December. The markets are lukewarm about a rate hike in December, with the odds at just 50%, according to the CME Group.

The German economy continues to perform well, with healthy growth and a strong labor market. The manufacturing sector continues to expand, as stronger global demand for German products has boosted the manufacturing and exports sector. This week’s manufacturing releases all pointed to expansion. Industrial Production gained 1.2%, marking a 3-month high. Earlier in the week, German Manufacturing PMI came in at 59.6, and Factory Orders were up 1.0% in May, rebounding after a sharp decline of 2.1% in April.

The DAX lost ground on Thursday, responding to the release of the ECB minutes from the June policy meeting, which showed the bank mulling adjustments to monetary policy. Policymakers discussed removing its “easing bias” at the June meeting, but ultimately decided not to make a move, since stronger economic conditions had not resulted in higher inflation. At the same time, minutes were cautious in tone, noting that “it was necessary to avoid signals that could trigger a premature tightening of financial conditions”. The minutes come after comments from ECB President Mario Draghi last week, who said that the eurozone growth was broadly distributed and that factors keeping inflation down were temporary. The markets jumped on his remarks, as speculation rose that the ECB was preparing to taper its stimulus program.

Draghi’s message did not seem to veer away from ECB policy, but the markets clearly thought otherwise. As well, ECB chief economist Peter Praet reiterated the bank’s stance at a conference in Paris. Praet noted that eurozone economic growth is accelerating, but said that the ECB still needs to provide a “steady hand” in order to spur stubbornly low inflation levels. Next stop for the ECB is the July policy meeting. In June, the bank removed an easing bias towards lowering interest rates. However, policymakers may now be wary about sending more signals of tightening policy, so as to avoid another run on the euro. The ECB doesn’t want the rate statement to shake up markets, so we could see a bland statement, to the effect that the economy is headed in the right direction, but QE will remain in place until inflation levels move higher.

Economic Calendar

Friday (July 7)

- 2:00 German Industrial Production. Estimate 0.2%. Actual 1.2%

- 8:30 US Non-Farm Employment Change. Estimate 175K

- 10:30 US Natural Gas Storage. Estimate 61B

- 11:00 US Fed Monetary Policy Report

*All release times are EDT

*Key events are in bold

DAX, Friday, July 7 at 7:45 EDT

Open: 12,377.50 High: 12,387.50 Low: 12,337.50 Close: 12,355.50