European stock markets are seeing green on Tuesday, and the DAX and CAC have both posted strong gains. Currently, the DAX is trading at 12,097.08, up 0.10% since the Tuesday close. On the release front, Eurozone Revised GDP posted a gain of 0.6% for a fourth straight quarter. This matched the forecast. On Thursday, the ECB sets its benchmark rate, and the US will publish unemployment claims.

The ECB will be in focus on Thursday, as policymakers set the monthly benchmark rate. This will be followed by a press conference with Mario Draghi. The interest rate has been pegged at a flat 0.0% for the past two years, and no change is expected. The markets will be keeping a close eye on the language of the rate statement; in particular, whether the easing bias stance will be removed. If so, this would likely be interpreted as a plan to eventually tighten policy and would be bullish for the euro. Inflation remains weak, so there is little pressure on the ECB to tighten policy anytime soon. Recent indicators show that inflation in the eurozone is steady, but remains well below the ECB target of around 2 percent.

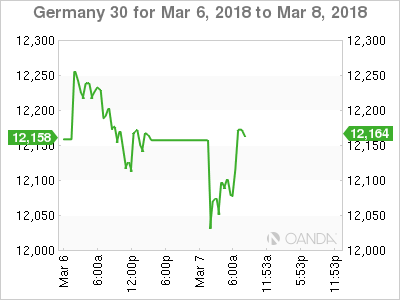

European stock markets have been turbulent since US President Trump stunned investors last week when he proposed stiff tariffs on steel imports, much to the consternation of the European Union and other US trading partners. Fears of a trade war sent the DAX sharply lower last week, with losses of 5.2%. The DAX has clawed back some of the losses this week, as Republican lawmakers, including House Speaker Paul Ryan, have come out strongly against the move. This has raised hopes that Trump will back down. However, the unpredictable president could barrel ahead and impose the tariffs, which would likely send global stock markets lower.

Economic Calendar

Wednesday (March 7)

- 5:00 Eurozone Revised GDP. Estimate 0.6%. Actual 0.6%

Thursday (March 8)

- 2:00 German Factory Orders. Estimate -1.9%

- 7:45 ECB Minimum Bid Rate. Estimate 0.00%

- 8:30 ECB Press Conference

*All release times are EST

*Key events are in bold

DAX, Wednesday, March 7 at 7:00 EDT

Prev. Close: 12,113.87 Open: 12,058.00 High: 12,117.50 Low: 12,019.92 Close: 12,097.08