The DAX index has posted small gains in the Tuesday session. Currently, the DAX is at 11,954, down 0.07% on the day. In economic news, there are no German or eurozone events on the schedule. On Wednesday, the ECB will set its monthly interest rate and release a policy statement.

European stock markets enjoyed sharp gains last week, and this was reflected in German and French blue-chip indices. The DAX soared 3.9%, while the French CAC climbed 2.3%. Growing optimism over the trade talks between China and the U.S. has bolstered risk appetite, as investors weary of the bruising trade war are confident that the sides will reach a deal.

With a light release calendar on Tuesday, investors are looking ahead to the ECB meeing on Wednesday. The bank is expected to maintain interest rates at a flat 0.00%, where they have been pegged since March of 2016. Investors will be more interested in the rate statement, as a dovish message to the markets could push the euro lower. ECB policymakers have acknowledged the slowdown which has gripped Germany and the eurozone. The manufacturing sector has been particularly hard hit, as a slump in global demand has hurt exports, such as German cars and auto parts. Last week, the ECB minutes from the March meeting were pessimistic, as policymakers acknowledged that the economic outlook remained bleak. If the rate statement is a repeat performance, the euro is likely to point downward.

Economic Calendar

Monday (April 8)

- 2:00 German Trade Balance. Estimate 19.0B. Actual 18.7B

- 4:30 Eurozone Sentix Investor Confidence. Estimate -1.7. Actual -0.3

*All release times are DST

*Key events are in bold

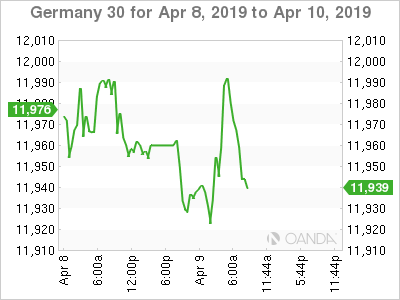

DAX, Tuesday, April 9 at 7:20 EST

Previous Close: 11,963 Open: 11,927 Low: 11,924 High: 11,988 Close: 11,954