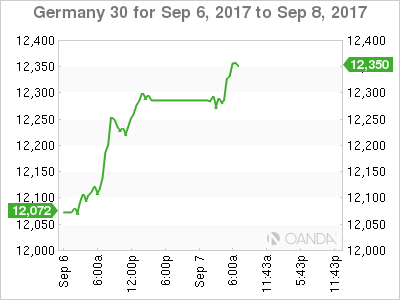

The DAX index has posted considerable gains in the Thursday session. Currently, the DAX is currently trading at 12,330.00, up 0.95% on the day. On the release front, German Industrial Production came in at a flat 0.0%, short of the estimate of 0.5%. Later in the day, the ECB releases its monthly statement, followed by a press conference with ECB President Mario Draghi.

All eyes are on the ECB, which will release a rate statement later in the day. No change is expected in the interest rate level of 0.00%, and the markets will be looking for any clues regarding the ECB’s quantitative easing (QE) program, in which the ECB makes monthly asset purchases of EUR 60 billion/month.

The QE scheme is scheduled to terminate in December, and the ECB is yet to determine what happens next. Will the ECB terminate or taper its asset purchases? Policymakers must weigh competing interests, Germany would like nothing more than the ECB to simply exit the program, which was brought in as an emergency measure to begin with. However, other eurozone members, which are not enjoying German-style growth, favor a gradual tapering of the program, perhaps lowering monthly asset purchases from EUR 60 billion to EUR 45 billion.

Analysts are not expecting any announcements regarding QE at the Thursday meeting, although Mario Draghi has surprised the markets in his press conferences more than once. The exchange rate has also become a factor, as a stronger euro is equivalent to a raise in interest rates and has resulted in monetary tightening even without the ECB taking any action. In determining what course of action to take, ECB policymakers must wrestle with a dilemma which the Federal Reserve and other central banks are also struggling with – is tighter monetary policy warranted when the economy has improved, but inflation is mired at low levels? The markets will be dissecting the rate statement and Draghi’s follow-up comments, and any hints about a change in policy could trigger significant movement from the euro.

The markets have grown used to solid German numbers, so this week’s industrial numbers have been a disappointment. Earlier this week, Factory Orders declined 0.7%, well off the forecast of a 0.2% gain. This marked a 3-month low. On Thursday, German Industrial Production followed suit, as the reading of 0.0% missed the estimate of 0.5%. The unexpectedly weak readings come as a surprise, as the German economy has looked strong in 2017, and has been an important factor in the improvement in the eurozone economy.

Global demand, which had been very strong in the first half of 2017, is showing signs of softening, and this could have a negative impact on the manufacturing sectors in Germany and throughout the eurozone. Germany releases Trade Balance on Friday, with the markets braced for a drop in the surplus for July.

German business leaders are closely following developments at the ECB, as the current quantitative easing (QE) scheme winds down in December. On Wednesday, Deutsche Bank (DE:DBKGn) chief executive John Cryan weighed in on the matter, calling on the ECB to alter course and stop providing “cheap money” to the markets. Cryan warned that the ECB’s monetary stance threatened to cause bubbles in the capital markets, including property, stocks and bonds. Cryan added that the stronger euro should not serve as an excuse for the ECB to continue its QE program.

Turning to Brexit, Cryan argued that Frankfurt is ideally suited to take over from London as the financial hub for European banks. There is fierce jockeying in Europe as to who will take over from London, with Paris, Dublin and Amsterdam all hoping to pick up the spoils after Britain leaves the European Union and large financial companies bid adieu to London.

Economic Calendar

- 2:00 German Industrial Production. Estimate 0.5%. Actual 0.0%

- 2:45 French Trade Balance. Estimate -4.5B. Actual -6.0B

- 5:00 Eurozone Revised GDP. Estimate 0.6%

- Tentative – Spanish 10-y Bond Auction

- Tentative – French 10-y Bond Auction

- 7:45 ECB Minimum Bid Rate. Estimate 0.00%

- 8:30 ECB Press Conference

*All release times are EDT

*Key events are in bold

DAX, Thursday, September 7 at 5:20 EDT

Open: 12,291.00 High: 12,330.00 Low: 12,268.75 Close: 12,330.00