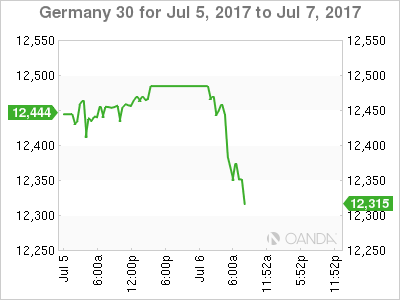

The DAX index has dropped in the Thursday session, as the index is down 0.74%. Currently, the DAX is at 12,361.50. On the release front, German Factory Orders gained 1.0%, well short of the forecast of 1.9%. Eurozone Retail PMI improved to 53.2, up from 52.0. Today’s highlight is the minutes from the ECB’s policy meeting in June.

The German manufacturing sector continues to expand, as stronger global demand for German products has boosted the manufacturing and exports sector. Earlier in the week, German Manufacturing PMI came in at 59.6, pointing to expansion. Factory Orders were up 1.0% in May, rebounding after a sharp decline of 2.1% in April. We’ll get a look at Industrial Production on Friday, which is expected to show a weak gain of o.2%.

All eyes will be on the ECB later on Thursday, with the release of the minutes from the July policy meeting. Investors will be monitoring closely, looking for hints that the ECB is moving close to exiting the QE scheme. There was plenty of excitement last week, as the “Draghi rally” saw the euro soar by 2.0%. Draghi spoke at the ECB forum, a gathering of central bankers. His upbeat comments about growth and inflation in the eurozone economy triggered a rush to buy euros, much to the surprise of the ECB. In June, the bank removed an easing bias regarding interest rates, effectively closing the door to further rate cuts. However, policymakers may now be wary about any more signals of tightening policy, to avoid another run on the euro. The ECB meets for a policy meeting on July 20, and we could see a bland rate statement, to the effect that the economy is headed in the right direction, but QE will remain in place until inflation levels move higher. However, Draghi has surprised the markets before, so the meeting could prove to be a market-mover.

The dollar shrugged off the release of the Fed’s June policy meeting, which failed to shed much light on the Fed’s plans. The minutes revealed a divided Fed over the key issues of inflation and the Fed’s bloated balance sheet. Some members expressed unease at the Fed’s current forecast of rate hikes, given the persistently low levels of inflation. According to the current “dot plot”, the Fed expects to raise rates in December, and three times in 2018. There was also division over the timing of reducing the $4.2 trillion balance sheet – some policymakers were in favor of starting in September, while others preferred later in the year. At the June meeting, the Fed stated that it would begin reducing the balance sheet this year, but provided no details. Analysts expect the Fed to start winding down the balance sheet in September, prior to a rate hike in December. The markets are lukewarm about a rate hike in December, with the odds at just 50%, according to the CME Group.

Economic Calendar

Thursday (July 6)

- 2:00 German Factory Orders. Estimate 1.9%. Actual 1.0%

- 4:10 Eurozone Retail PMI. Actual 53.2

- 7:30 ECB Monetary Policy Meeting Accounts

Friday (July 7)

- 2:00 German Industrial Production. Estimate 0.2%

- 8:30 US Non-Farm Employment Change. Estimate 175K

*All release times are EDT

*Key events are in bold

DAX, Thursday, July 6 at 7:00 EDT

Open: 12,472.00 High: 12,491.00 Low: 12,356.50 Close: 12,361.50