The DAX index has ticked lower in the Tuesday session, as the index is down 0.21%. Currently, the DAX is at 12,449.50. On the release front, it’s a very quiet day. There are no US events, as the markets are closed for Independence Day. The sole eurozone indicator was Eurozone PPI, which declined 0.4%, weaker than the forecast of -0.2%. On Wednesday, the Federal Reserve will publish the minutes of its June policy meeting.

The German consumer is spending more, which is good news for the German and eurozone economies. German retail sales posted a solid gain of 0.5%, in May, the strongest since February. Preliminary CPI posted a gain of 0.2% in June, beating the estimate of 0.0%. This reading was an improvement from May, which showed a decline of 0.2%. The German manufacturing sector is in good shape, boosted by a stronger demand for German exports. On Monday, German Manufacturing PMI came in at 59.6, pointing to expansion. We’ll get a look at additional manufacturing data later in the week, with the release of Factory Orders and Industrial Production.

The annual European forum of central bankers is generally a non-event for the markets, but last week’s gathering was a significant market-mover. Both the euro and the pound recorded sharp gains, following hawkish remarks from ECB President Mario Draghi and BoE Governor Mark Carney. The euro jumped 2.0% last week, catching ECB policymakers by surprise. The bank tried to dampen market speculation about any imminent moves to withdraw stimulus, but the euro remains at high levels. Last week’s stampede to snap up euros has forced ECB policymakers to reassess whether what moves, if any, the bank will announce at the July 20 policy meeting.

In June, the ECB removed an easing bias regarding interest rates, effectively closing the door to further rate cuts. However, after the Draghi rally last week, policymakers may be wary about removing a second easing bias regarding the asset-purchase program, to avoid another run on the euro. The ECB has repeated loud and clear that it will not remove QE until inflation levels are closer to the bank’s target of 2.0%, but Draghi may have learned the hard way at the ECB forum that the market is picking up a different message than what the ECB thinks it is sending. This could result in the ECB playing it safe and avoiding any meaningful discussion about QE at the July meeting, especially if the euro remains at high levels.

The Federal Reserve has given broad hints that it plans to raise interest rates three times in 2017, but the markets are becoming more skeptical. The odds of a rate hike in December have fallen to 47%, down from 53% last week, according to the CME Group. With the US economy giving a mediocre performance in the first quarter, and inflation levels remains low, there are Fed policymakers who are currently lukewarm to the idea of raising rates again this year. Key economic indicators have not looked particularly sharp in the second quarter, notably housing and consumer spending numbers. If inflation numbers do not improve and GDP reports for Q2 remain soft, the odds of a December hike will drop even further, which could translate into broad losses for the US dollar.

Economic Calendar

Tuesday (July 4)

- 5:00 Eurozone PPI. Estimate -0.2%. Actual -0.4%

Wednesday (July 5)

- 4:00 Eurozone Final Services PMI. Estimate 54.7

- 5:00 Eurozone Retail Sales. Estimate 0.4%

- 14:00 US FOMC Meeting Minutes

*All release times are EDT

*Key events are in bold

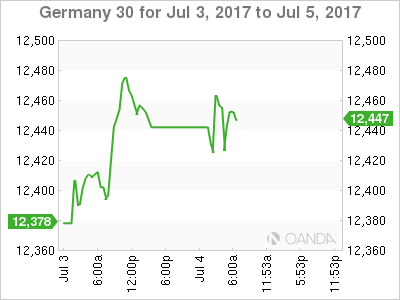

DAX, Tuesday, July 4 at 5:55 EDT

Open: 12,422.75 High: 12,480.50 Low: 12,414.50 Close: 12,449.50