The DAX index has started the week with losses. In the North American session, DAX is trading at 12,249.25, down 0.40% on the day. On the release front, German Industrial Orders disappointed with a decline of 1.1%, compared to the estimate of +0.2%. The Eurozone Sentix Investor Confidence slowed to 27.7, just shy of the forecast of 27.8 points.

Recent German numbers have been solid, so July’s Industrial Production was a nasty surprise, posting a sharp decline of 1.1%. This marked the weakest reading this year. Still, German indicators continue to point to an expanding German economy. Retail Sales jumped 1.1%, its second-highest gain in 2017. Factory Orders gained 1.0%, while unemployment claims dropped 9 thousand – the employment indicator has declined every month in 2017, except one. Although manufacturing and services PMIs dipped in July, both are well over the 50-level, indicative of expansion. Are the strong German numbers too much of a good thing? Some analysts think so, and are cautioning that the German economy is in danger of overheating. The eurozone economy has also benefited from the robust German economy. Eurozone GDP gained 0.6% in the second quarter, up from 0.5% in the previous quarter. As well, Eurozone Retail Sales gained 0.5%, marking a 4-month high.

Last week’s strong US payrolls report boosted the US dollar and raised the odds of a December rate hike, which are currently at 47%, up from 43% one week ago. With the Federal Reserve unlikely to raise rates before December, investor attention has shifted to the Fed’s balance sheet, which stands at $4.2 trillion. Fed policymakers have broadly hinted at reducing purchases of bonds and securities starting in September, but San Francisco Fed President John Williams was more forthcoming about the Fed’s plans, likely aimed at giving notice to the markets. In a speech on Wednesday, Williams said that the economy had “fully recovered” from the 2008 financial crisis and called on the Fed to start trimming the balance sheet “this fall”. Williams added that the process would be gradual and would take four years to reduce the balance sheet to a “reasonable size”. Other FOMC members have also come out in favor of the Fed starting to wind up its portfolio this fall.

Economic Calendar

Monday (August 7)

- 2:00 German Industrial Production. Estimate 0.2%. Actual -1.1%

- 4:30 Eurozone Sentix Investor Confidence. Estimate 27.8. Actual 27.7

Tuesday (August 8)

- 2:00 German Trade Balance. Estimate 22.3B

*All release times are EDT

*Key events are in bold

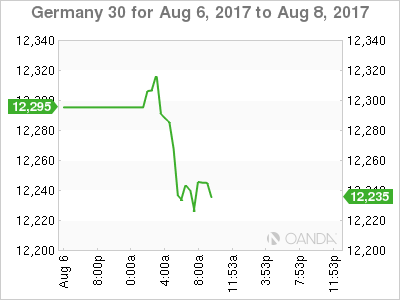

DAX, Monday, August 7 at 9:05 EDT

Open: 12,304.25 High: 12,337.50 Low: 12,226.00 Close: 12,249.25